Taking Stock 2021: US Emissions Outlook Under Current Policy

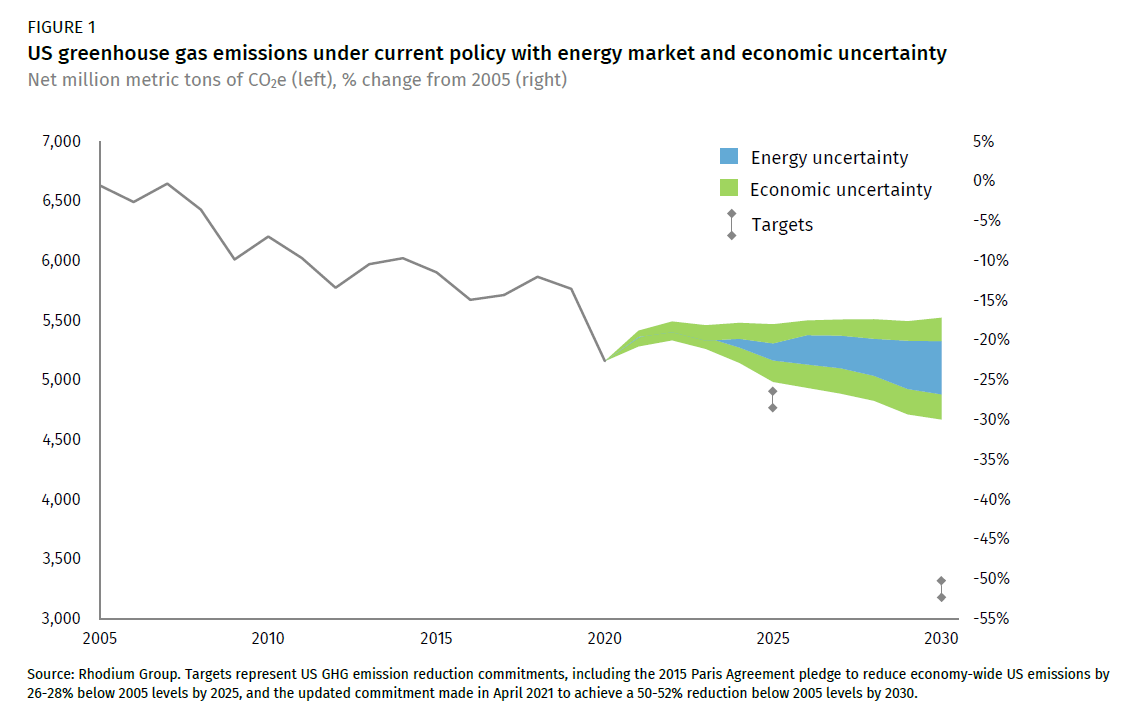

In Taking Stock 2021, we find that the US is on track to reduce emissions 20-22% below 2005 levels by 2025, and 20-26% below 2005 levels by 2030, absent additional action

For the past seven years, Rhodium Group has provided an independent annual outlook for US greenhouse gas (GHG) emissions under current federal and state policy. This current policy baseline provides a starting point for assessing where additional work—in the form of federal, state, or corporate action—is necessary to achieve mid- and long-term US GHG emission reduction goals.

Given the current state of federal and state policy (as of May 2021) and a range of potential energy market dynamics on the horizon, we find that the US is on track to reduce emissions 20% to 22% below 2005 levels by 2025. Looking ahead to 2030, the US is on track to achieve emission reductions anywhere from 20% to 26% below 2005 levels, absent additional action. Taking into account additional uncertainty in the direction and pace of US economic growth—and in particular, the pace of recovery from the economic disruption caused by the COVID-19 pandemic—we project 2030 emission reductions as small as 17% below 2005 levels, or as great as 30%.

This analysis only considers federal and state actions that are on the books today. It is clear that more policy action is needed if the US is going to achieve deeper emission reductions, including the Biden administration’s pledge to reduce US emissions 50-52% below 2005 levels by 2030. Later this fall, Rhodium Group will publish new research identifying the emissions impacts of a suite of federal and subnational actions that can help close the gap between the current US emissions trajectory and ambitious decarbonization goals.

Detailed national and 50-state results for all Taking Stock baseline scenarios—including GHG emissions and underlying sectoral data—are available in Rhodium’s ClimateDeck data platform.

Key trends by sector

In addition to the economy-wide outlook for US emissions under current federal and state policy, here are the key trends we see by sector under a range of potential energy technology and market uncertainties:

Power sector emissions increase modestly over the next few years as the US economy bounces back from the pandemic, but then continue their secular decline through 2025 due to a continued decline in coal-fired generation. After a temporary rebound in coal generation coming out of the pandemic, coal continues its downward spiral, due in large part to competitive pressure from low-cost natural gas. If natural gas prices fall below $3/MmBTU, more than 50% of the current coal fleet could shutter by 2030. By 2025, these trends help cut power sector emissions in half relative to 2005 across our scenarios.

Going forward, however, the trajectory of US power emissions isn’t defined by how much coal comes offline but rather the pace of natural gas expansion. In scenarios with the cheapest gas, power sector emissions begin to rise again after 2025. Low-cost natural gas, once the primary driver of emission reductions in the power sector, will begin to hamper the pace of decarbonization as it out-competes renewables and pushes out nuclear. Wind and solar capacity increase across our outlook, but cheap natural gas and a moderate reduction in clean energy technology costs could slash this clean build-out by almost 60% by 2030, compared to a future with more expensive natural gas and steeper technology cost declines. Low natural gas prices also put pressure on zero-emitting nuclear power, which could see more than a third of today’s capacity retire by 2030.

After a brief post-pandemic rebound, transportation emissions decline modestly through 2030, driven by fuel economy improvements in passenger vehicles and a shift toward electric vehicles (EVs). Assuming the most optimistic outlook for declining EV battery costs combined with high oil prices—which would increase the EV share of total new passenger vehicle sales to 35% by 2030—transportation emissions fall by 23% by that year. More moderate EV battery cost reductions coupled with low oil prices lead to EVs capturing only 9% of the market in 2030, and transportation emissions decline by 18% from 2005 levels. Across our projected range, steeper emission reductions are limited by consumer preference for larger, higher-emitting vehicles, and robust demand growth for freight and air travel.

Industrial emissions continue to rise and become the top-emitting sector in the mid-2020s. Industrial emissions grow across our scenarios, but climb almost three times as fast from current levels when natural gas is cheap compared to when it’s more costly. The oil and gas industry itself faces an uncertain future. If natural gas prices fall and global oil prices remain weak, emissions from upstream oil and gas activities could fall 12% by 2030 from today’s levels. Conversely, a stronger outlook for natural gas and oil prices could drive emissions up 25% from current levels by 2030.

Building efficiency improves but emissions from residential and commercial buildings remain effectively flat. Low-cost natural gas, increasing building square footage, and economic and population growth put upward pressure on building emissions, even while state policies make homes and businesses more efficient. Even in our highest scenario for natural gas prices, CO2 emissions from buildings fall only 2% below 2005 levels by 2025. By 2030, emissions fall modestly to 1-4% below 2005 levels.

For more information about our approach and methods, see the Taking Stock 2021 Technical Appendix.