Note

Shut Out: Data Security and Cybersecurity Converge in Next Wave of US Tech Controls

New US tech controls will force a mindset shift for a wide range of industries on how their products could be national security risks.

We take a fresh look at the data on the expanding capacity of China’s legacy chip production after two big waves of US-led chip controls and review how the US aims to target these foundational chips.

China-sourced legacy chips are under the regulatory spotlight as the US continues to patch up existing controls around semiconductors built on advanced nodes. In the mounting case against Chinese chipmakers, economic complaints of an uneven playing field are blending with national security concerns as policymakers grow alarmed by the rapid pace China is building out production capacity for foundational semiconductors. This report takes a fresh look at the data on China’s legacy chip production capacity expansion after two big waves of US-led chip controls. We then distill the theories of harm circulating in the US to outline the most likely policy pathways for the US to target China-sourced legacy chips and evaluate potential gaps between the US and G7 partners in shaping a response.

Over the past year and a half, the US has been honing measures designed to deny China access to high-performance computing chips and the manufacturing tools to develop advanced semiconductors. This is an evolving process as US regulators identify holes to fill after seeing what Chinese foundries like Semiconductor Manufacturing International Corporation (SMIC) can pull off with existing manufacturing equipment. For example, Huawei’s recent launch of another 7nm mobile processor using deep ultraviolet (DUV) lithography may well compel the US to tighten electronic restrictions on electronic design automation (EDA) software and extend long-arm measures affecting Dutch, Japanese, Korean, and German suppliers to hinder Chinese fabs trying to source spare parts and service machines.

Parallel to the export control patch-ups around advanced semiconductors, policy debates have been building over whether and how to combat potential threats from China’s capacity-building in semiconductors built on legacy process nodes (also commonly referred to as foundational, trailing edge, mature, essential, or mainstream chips). Legacy chips were defined in 2023 US Commerce CHIPS Act guardrails as semiconductors built on 28nm or larger process nodes—distinct from leading edge semiconductors, which the US defined in 2022 export controls as logic chips built on 16/14nm or below process nodes. A wide range of chips fall into the legacy bucket, from highly specialized 28nm microcontrollers to off-the-shelf 350nm power components. Cutting-edge server, graphics, laptop, and smartphone processors rely on extreme ultraviolet lithography to pack evermore transistors per square millimeter in (sub-5nm) process nodes in a highly complex manufacturing process. In contrast, the humbler legacy chip can be made on older-generation DUV lithography equipment and is less demanding in wafer production.

Legacy chips are pervasive and therefore essential. Virtually every electronic device—including cars, airplanes and fighter jets, medical devices, smartphones, computers, and agricultural and industrial equipment—is powered by mature node chips in conjunction with leading-edge processors. Pandemic-related restrictions drove home how the absence of a single chip could hold up entire manufacturing assembly lines, leaving consumers in disbelief that their new cars could be stripped of features normally taken for granted, like seats that heat up and adjust automatically. In hunting for capacity during the pandemic, companies obsessed far more over whether their chips would arrive than who was sourcing them. In today’s geopolitical climate, US regulators are forcing corporate decision-makers to grapple with the China sourcing question.

After the first wave of US semiconductor controls targeting China in October 2022, we examined how fast Chinese capacity was already building relative to the rest of the world and which semiconductor segments Chinese chipmakers would still be free to compete in (see our note “Running on Ice: China’s Chipmakers in a Post-October 7 World”). As we hypothesized last spring, Chinese semiconductor firms could still push the limits of DUV lithography in producing mobile processors for smartphones and artificial intelligence (AI) accelerators for the cloud. This prediction has been borne out with SMIC producing mobile processors on 7nm process nodes with DUV lithography for Huawei, the most heavily sanctioned Chinese tech firm. In addition to these flashier breakthroughs, we saw ample opportunity for China to expand production in the legacy space, in particular in power semiconductors, analog chips, and microcontrollers. In many of these market segments, China faces heavy competition from European, US, and Japanese incumbents, but, crucially, it has a home market advantage to grow market share with plenty of subsidized and chip-hungry OEMs worried about falling victim to the next round of US export controls and under political directives to source chips locally.

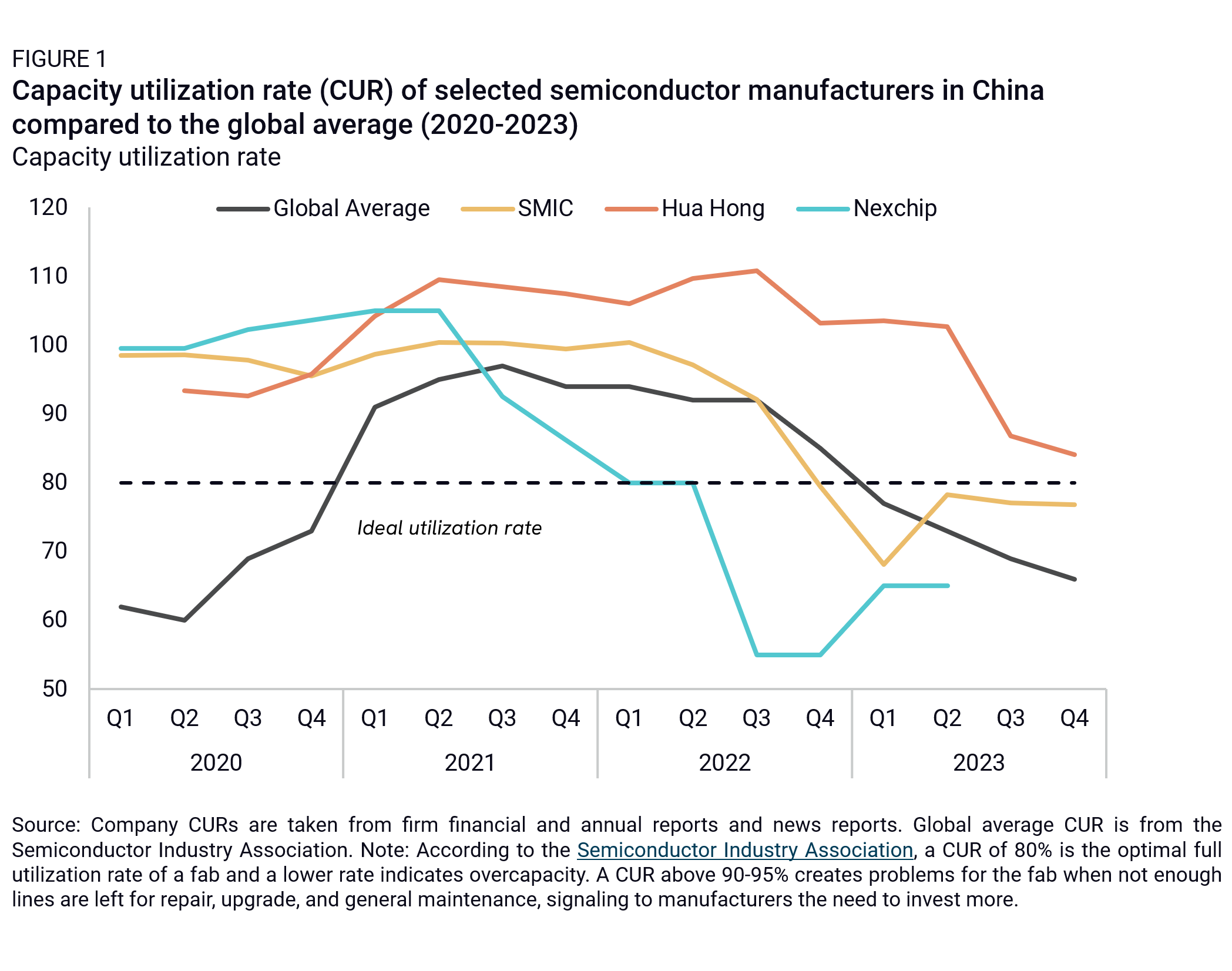

Policy concerns are growing that China’s rapid build-out of wafer capacity will lead to heavily under-utilized fabs (actual output relative to production capacity). This, in turn, would lead to price wars since foundries would be desperate to fill their fabs with customers at any price and IDMs may continue to produce chips even if they sit on the shelves. But an economist would look at the capacity utilization rate for China’s semiconductor firms and say the current data is inconclusive if policymakers are looking for a “smoking gun” of Chinese semiconductor overcapacity posing a threat to global markets. Overcapacity in this context is defined as firms producing well below the industry’s ideal utilization rate of around 80% through sustained state investment, portending structural distortions in the market. In fact, the firm-reported capacity utilization rates of China’s established chipmakers SMIC and Hua Hong, as well as rapidly growing newcomers like NexChip, are trending toward the global average as the industry as a whole adjusts to post-pandemic swings and cyclical shifts in electronics demand (Figure 1).

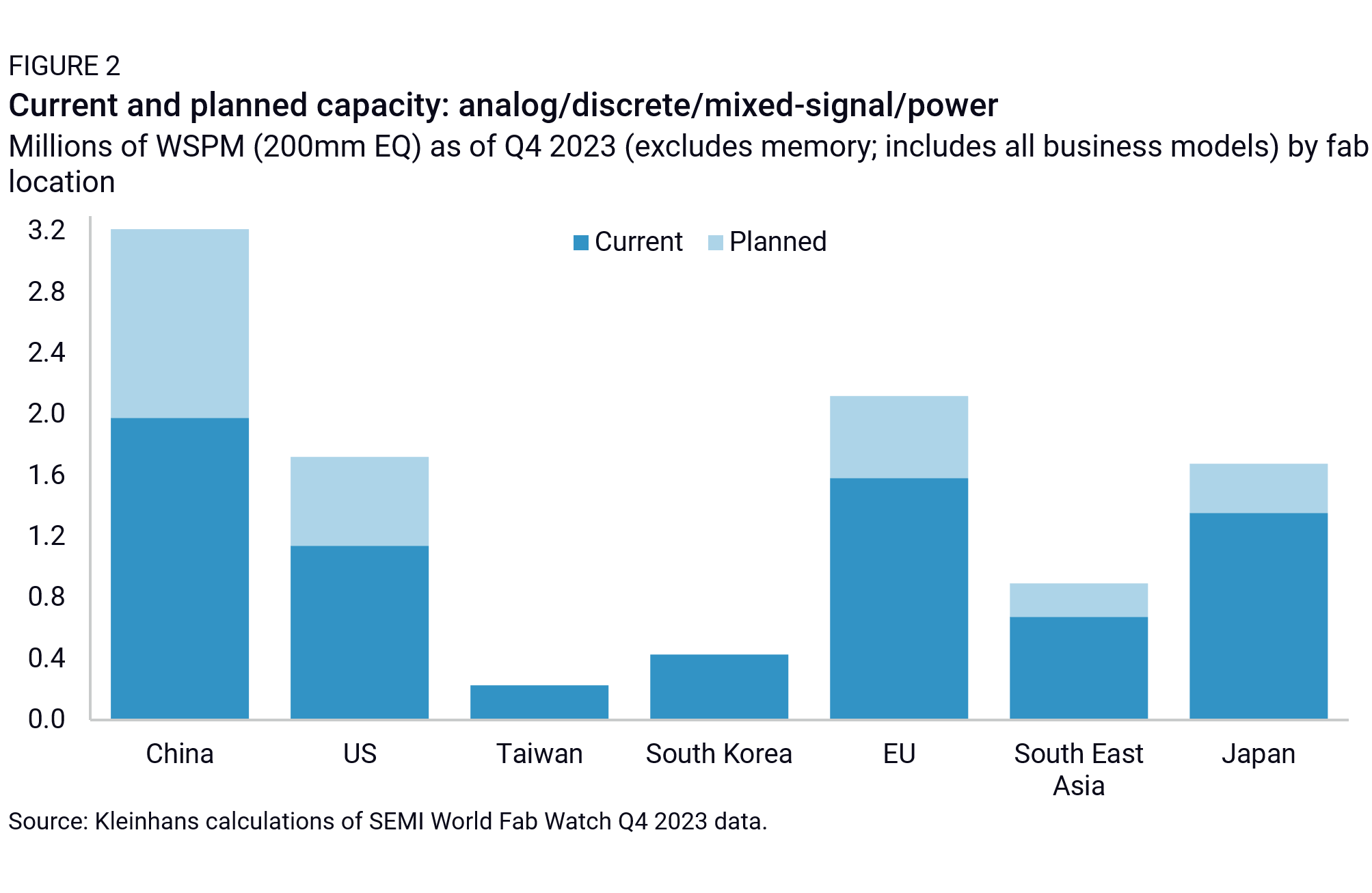

However, a policymaker would look at the industry data to show how China is unambiguously expanding legacy semiconductor manufacturing capacity at a rapid clip. China not only has more capacity in analog, discrete, mixed-signal, and power chips, but is also expanding capacity to produce these chips faster and at a much larger scale than any other country (Figure 2). China accounted for around 31% of global legacy chip production at the end of 2023, up from 17% in 2015, and is set to widen its lead with more planned fabs for mature node production. Projections from Taiwanese semiconductor research firm TrendForce find that China will account for 39% of global legacy capacity by 2027. China makes up 55% of planned production expansion in legacy chips at 4 million wafer starts per month (WSPM, 200mm equivalent) compared to around 3.3 million WSPM of planned capacity in the rest of the world.

Policymakers are watching this trend with alarm and trying to assess a future threat of injury to US and partner country semiconductor firms, their customers downstream, and risks for US national security more broadly.

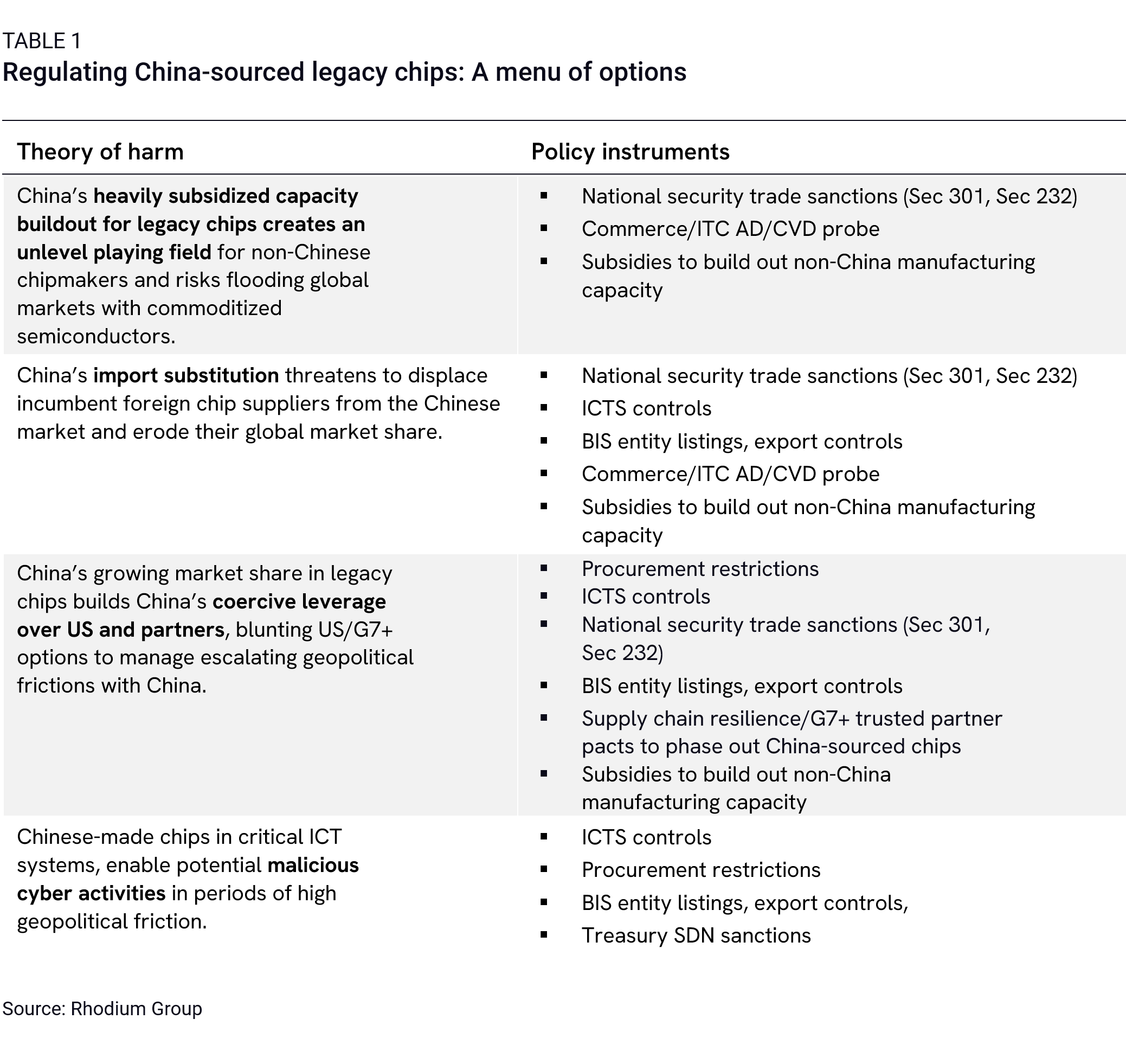

As US policymakers expand the scope for chip controls, they will also be compelled to layer tools to deter companies from sourcing chips from China. From import duties to cybersecurity restrictions and tightening export controls, there are multiple policy instruments that may be deployed in trying to address multiple theories of harm:

The US can also employ significant offensive measures. Subsidies to incentivize US and partner country-based manufacturing of legacy chips have already been deployed—though Commerce is already appealing for additional funds as it tries to balance demands for legacy chip production capacity with investments in leading-edge production.

More creative plurilateral arrangements may also emerge, especially if the Biden administration wins a second term. While there is deep consternation between the US and partner countries over the US’s paradigm-shifting chip controls, there is also growing convergence among G7 countries in recognizing harmful market distortions created by China’s economic system and national security risks from overreliance on China for critical inputs. Ongoing discussions among G7 countries on “supply chain resilience,” “trustworthiness criteria,” and upgrading digital and AI, climate, labor, IP, and human rights standards could encourage more G7 coordination in ways that increasingly restrict Chinese suppliers (including chipmakers) in advanced economies. Such restrictions can vary, from industrial policy coordination to phase-in quotas to outright bans.

For any restrictive measure, the US administration will have to assess the potential for supply chain disruptions in critical sectors, particularly when it comes to defense applications and medical devices. Measures are likely to be designed with an eye toward deterring companies from increasing their chip supply dependencies on China while actively reducing those dependencies over a particular period.

But policymakers will need to offer carrots alongside these sticks for de-risking plans to gain real traction. OEMs and fabless design firms currently sourcing chips from China are not necessarily wedded to Chinese chipmakers, but they are seeking the best price in the market and the manufacturing capacity to meet future demand for critical inputs. Companies trying to preserve market share in China will also be seeking flexibility to source chips in China for products sold in the China market. And even as non-Chinese foundries and integrated device manufacturers (IDMs) can benefit from restrictions carving out an exclusive market for non-Chinese chipmakers, they need to be able to ensure available capacity across a range of process nodes on a timeline that aligns with emerging restrictions.

China’s heavily subsidized capacity buildout for legacy chips creates an unlevel playing field for non-Chinese chipmakers and risks flooding global markets with below-cost semiconductors.

Not every legacy chip is prone to harmful market distortions. The more customized and software-defined the chip is, the less likely it is to be impacted by excess capacity and the less susceptible it will be to market flooding. For example, microcontrollers, which can be made on a range of process nodes, are programmed with proprietary software, and come in a variety of physical packaging. While it is possible to replace a foreign-made microcontroller with one from a Chinese supplier, the manufacturer would need a strong reason—such as political pressure by Chinese regulators to utilize homegrown technology—to go through the trouble of reconfiguring and integrating a new microcontroller into their technology platform. By contrast, analog, discrete, mixed-signal, and power semiconductors are generally not software-defined, making it in theory substantially easier to swap out suppliers.

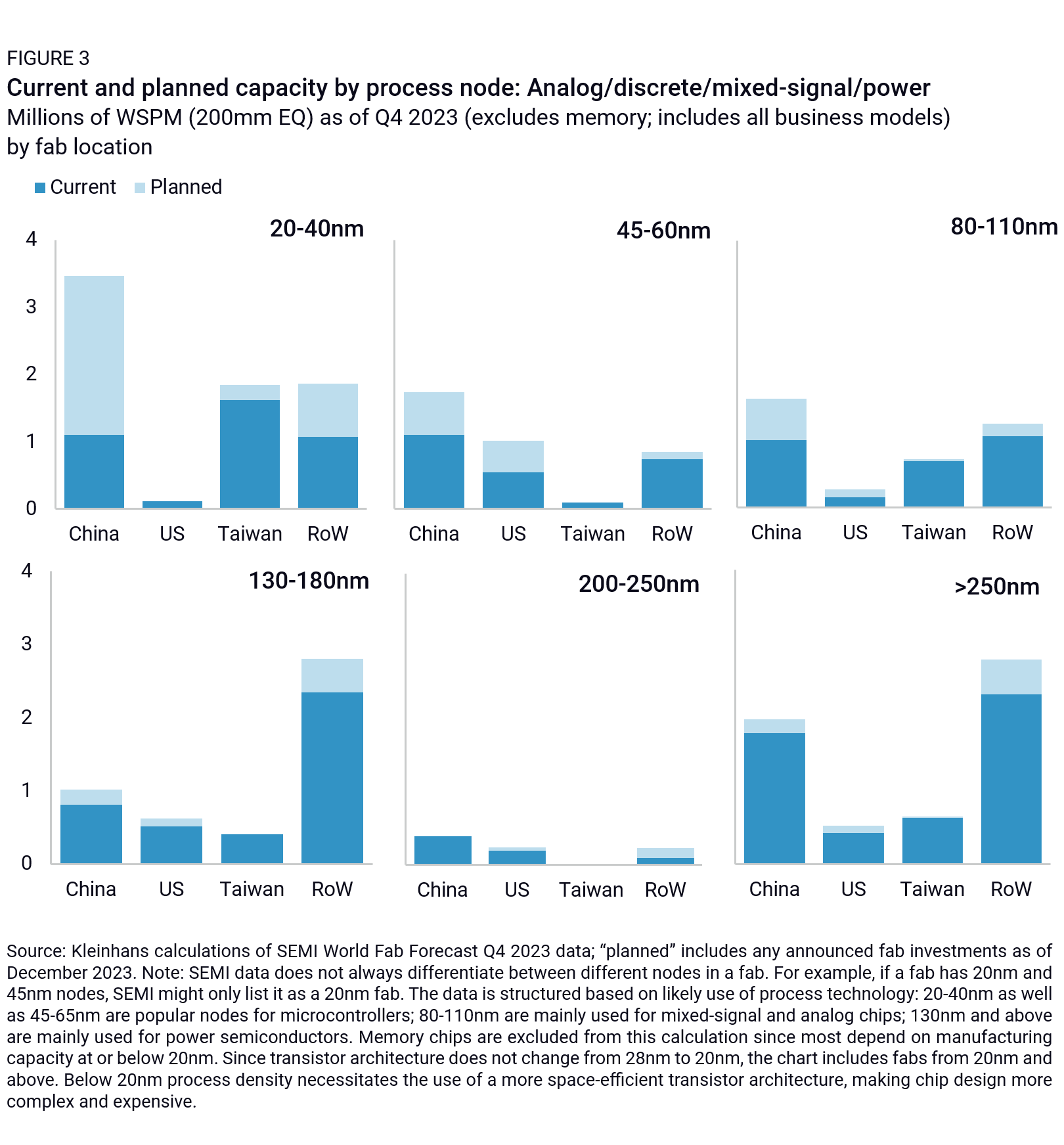

When we break down China’s current and planned capacity by process node for these more vulnerable legacy chip types, we can see that China’s production capacity is expanding most rapidly in semiconductors manufactured on 20-40nm process nodes (Figure 3). The rapid build-out of 20-40nm capacity is understandable since these are very popular nodes for microcontrollers and many low-power IoT chips. The 28nm node is often referred to as the “forever node” within the industry since it is extremely cost-effective and “good enough” for many automotive and industrial applications. China largely depends on foreign suppliers today for automotive microcontrollers in particular and is thus highly motivated to build self-sufficiency in these chips (see our note “Running on Ice: China’s Chipmakers in a Post-October 7 World“).

Companies designing chips privately negotiate prices with foundries to fetch the most competitive cost per wafer, making public information on pricing for specific types of semiconductors scarce. This makes it difficult to make apples-to-apples price comparisons between Chinese foundries and IDMs and their foreign competitors for specific products. Industry reporting indicates that Chinese foundries headed off a price war with foreign producers in late 2023. The intent was to secure new demand for China’s surging planned capacity in mature node chip production following US-led controls on leading-edge chips. According to a January report by Ijiwei, Chinese chipmakers SMIC, Hua Hong, and Nexchip were winning customers away from GlobalFoundries, PSMC, and Samsung by promising lower prices. Foreign competitors reportedly responded with price cuts ranging from 10% to 30%. Some Taiwanese firms are reportedly withdrawing from certain chip segments under heavy price pressure from Chinese semiconductor design firms benefitting from lower wafer-start prices of Chinese foundries.

Chinese contract chipmakers like SMIC and Hua Hong are already operating under soft budget constraints and political urgency to advance China’s chip self-sufficiency goals. As a result, they do not face the same fiscal constraints as their foreign peers in deploying capital. For an industry marked by extremely high fixed costs—firms need to invest in expensive equipment, materials, and R&D to stay competitive—this can be a big variable in a company’s ability to compete on an inherently uneven playing field.

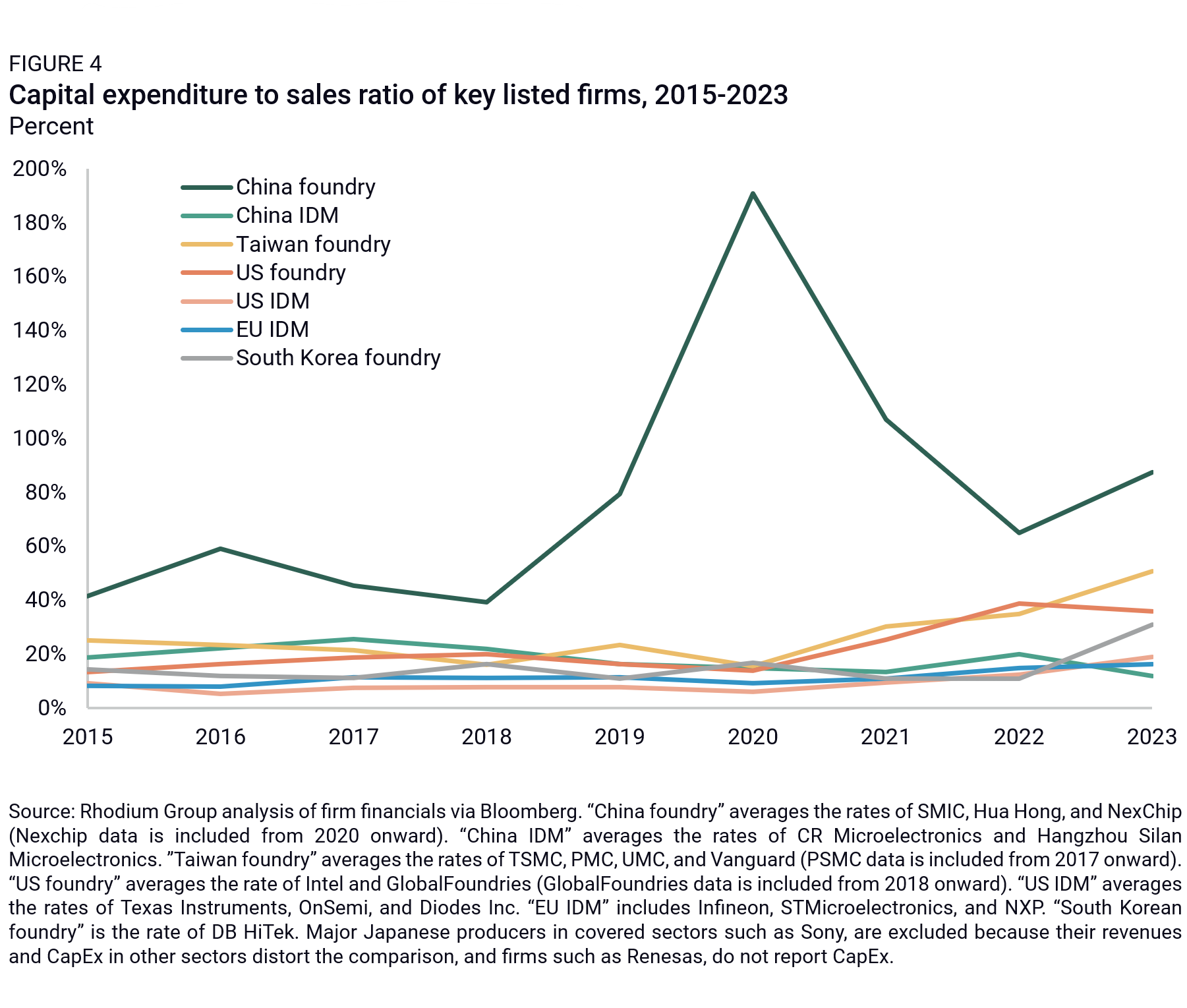

One lens we can use to examine this political dynamic is the capex-to-sales ratio between Chinese firms and other major producers in mature node chips. A company with a disproportionately high capex-to-sales ratio implies that it is investing heavily in expanding production capacity, in anticipation of future sales growth. Chinese foundries tower above their international competitors in measuring capex-to-sales ratios from 2015 to 2022 (Figure 4). Taiwanese firms maintained the closest ratios to Chinese firms over this period, but the gap widened significantly in 2020.

This dynamic is not entirely surprising. China’s semiconductor manufacturing industry only ramped up over the past decade with the central government’s rollout of the “Big Fund” in 2014 to funnel state-backed investment into the industry, followed by the launch of Made in China 2025 a year later, which set an ambitious goal for China to meet 70% chip self-sufficiency within the decade. More established players such as SMIC, Hua Hong, and CR Micro accelerated their capacity buildouts, while newer companies like Nexchip rapidly installed new capacity without meaningful sales. Given this dynamic and the considerable time it takes to build fabs, we would expect to see unsustainable capex/sales ratios for Chinese chipmakers in recent years.

Policy considerations

Although trade defense is the natural tool for level playing field and market distortion arguments, applying tariffs to legacy chips is complicated. In a traditional anti-dumping and countervailing duties investigation, Commerce would determine whether dumping or subsidization is happening and attempt to quantify those effects. The US International Trade Commission (ITC) would then determine whether US industry is harmed by Chinese dumping or subsidization, to include the threat of injury and whether dumped or subsidized imports impede establishment of an industry. Instead of nitpicking the lack of current evidence for dumping, a preemptive trade argument would focus on China’s capacity buildout and the more than $150 billion in subsidies that the state has pumped into chipmaking ambitions over the past decade, with another rumored $22 billion pending. ITC may also consider Chinese subsidies a threat to US industry if China’s below-cost production stifles efforts to revitalize chip manufacturing in the US via CHIPS Act funding.

Notably, Commerce recently finalized a rule that expands the scope for Commerce trade investigations to cover a country’s lack of IP, labor, human rights, and environmental protections. In arguing that the lack of these protections reduces the cost of compliance and thus the cost of production in ways that threaten US industry, Commerce has more ammunition to launch trade probes targeting China. Moreover, the Commerce rule permits probes over transnational subsidies, raising potential obstacles to Chinese chipmakers diversifying abroad to circumvent trade barriers. Still, this is a lengthy regulatory process that can take 12 to 18 months to complete. Even then, circumvention risk will remain high.

US policymakers are also debating the actual target of the tariff. Is it enough to apply tariffs on the chip alone, or should the component containing the China-sourced chip come under higher tariffs? Semiconductors imported from China already come under a 25% tariff under Section 301, List 2 Trump-era tariffs under the US Trade Representative’s authority. But since most chips are assembled into electronic components before being exported to the US, applying a direct tariff on the chip alone doesn’t move the needle if the political intent is to dissuade US firms from sourcing low-cost chips from China. Moreover, since legacy chips tend to be lower in value and higher in volume than advanced chips, tariff rates or quotas would need to be severe enough to make an appreciable impact on a company’s decision to eat the cost of the tariff or find an alternative source.

National security trade sanctions are more politically expedient and resistant to legal challenges. Using Section 232, Commerce could launch an investigation with recommendations that the president could then use to apply component tariffs—for example, a tariff on the imported good containing the chip—on national security grounds. Commerce action using Section 232 is a 270-day process and could result in tariffs or quotas without limits on duration. Since Commerce is already driving US policy on semiconductor controls, an ex-officio Section 232 case for China-sourced semiconductors may make sense from a regulatory consistency perspective. USTR also has a potent tool to impose component tariffs by self-initiating a Section 301 case. Section 301 cases take up to a year to implement and expire after four years unless USTR receives a request to continue the review. Section 301 cases are supposed to favor tariffs as trade remedies, but also include authorities to withdraw or suspend trade agreement concessions—an increasingly relevant policy option given growing calls to establish a China-specific tariff column or revoke China’s Permanent Normal Trade Relations status altogether to address China’s non-compliance with WTO rules.

Challenges remain, however. In addition to enforcement, the US administration would need to assess the competitiveness concerns of companies absorbing higher costs as well as the potential inflationary impact—and resulting political consequences—if manufacturers of chip-intensive goods like consumer electronics pass the costs of higher duties onto consumers.

Chinese import substitution policies, enabled by subsidized capacity buildouts, threaten to displace incumbent foreign chip suppliers from the Chinese market and erode their global market share.

China’s wafer capacity buildouts and import substitution is driven by several factors:

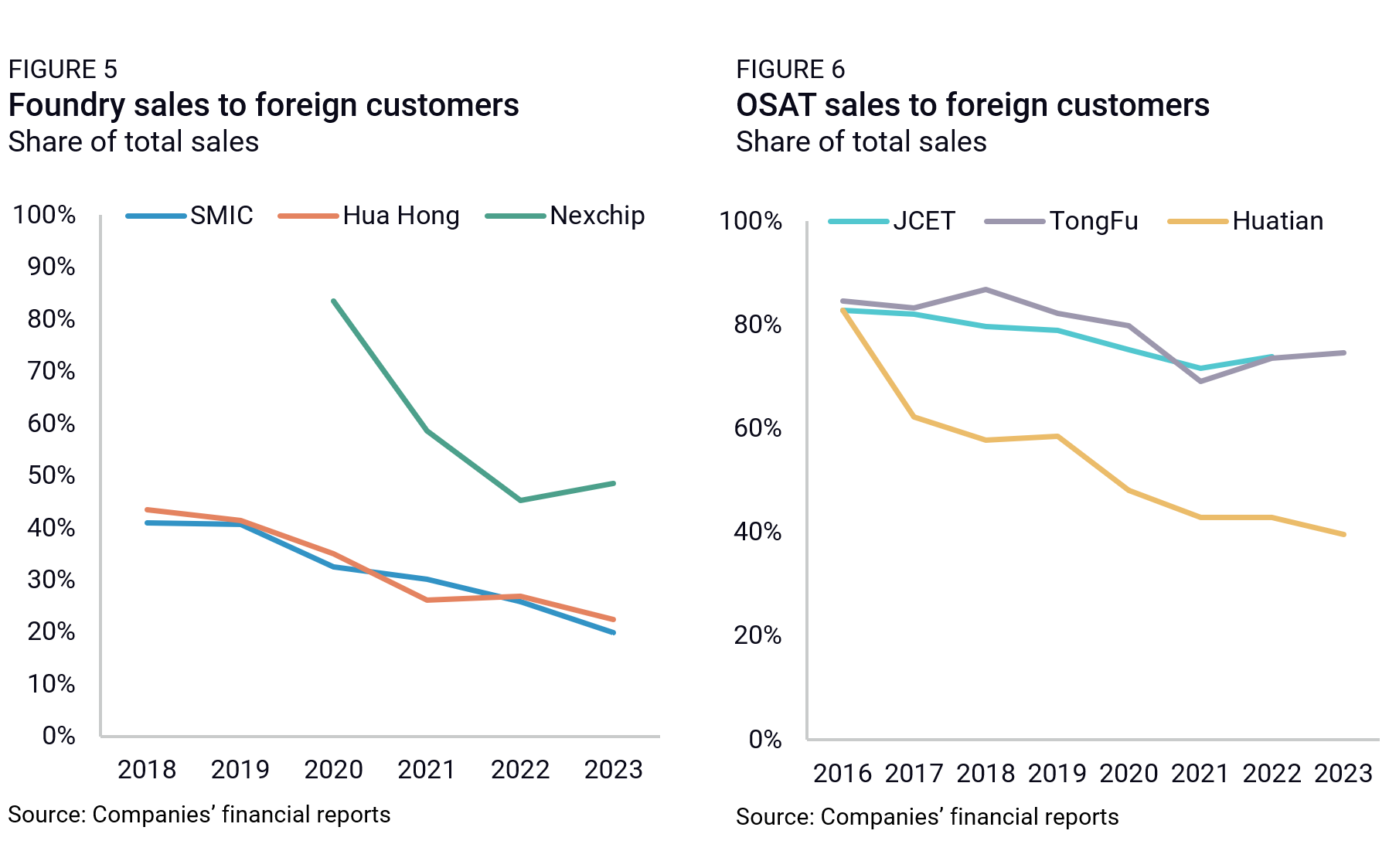

This dynamic explains how both Chinese foundries and outsourced semiconductor assembly and test (OSAT) firms are increasingly serving Chinese customers driven by increasing domestic demand (Figures 5 and 6).

The import substitution threat from China also raises the risk of abrupt supply disruptions for Western OEMs and Tier 1s if Chinese fabs are increasingly compelled to prioritize their Chinese customers over foreign customers. If China’s manufacturing capacity hits limits, Beijing’s self-reliance goals would take precedence over the needs of a Western firm sourcing cheaper Chinese chips. Besides, a Western firm may not be seen as a reliable customer if Chinese chipmakers see the writing on the wall from US restrictions making it difficult for firms to continue sourcing from China. Just as US and other foreign firms are being pressured to diversify, so too are Chinese firms in securing a more reliable customer base at home.

Non-Chinese foundries and IDMs eyeing China’s expanding production capacity are warily tracking China’s import substitution trend—Chinese chipmakers are likely to edge them out of some segments, but foreign chipmakers can maintain an edge in some niche areas by offering more reliability, specialized features, and ease of integration. The risk of Chinese legacy chipmakers taking over domestic and potentially international market share from foreign competitors will depend in part on China’s rate of import substitution in trying to insulate against US-led export controls.

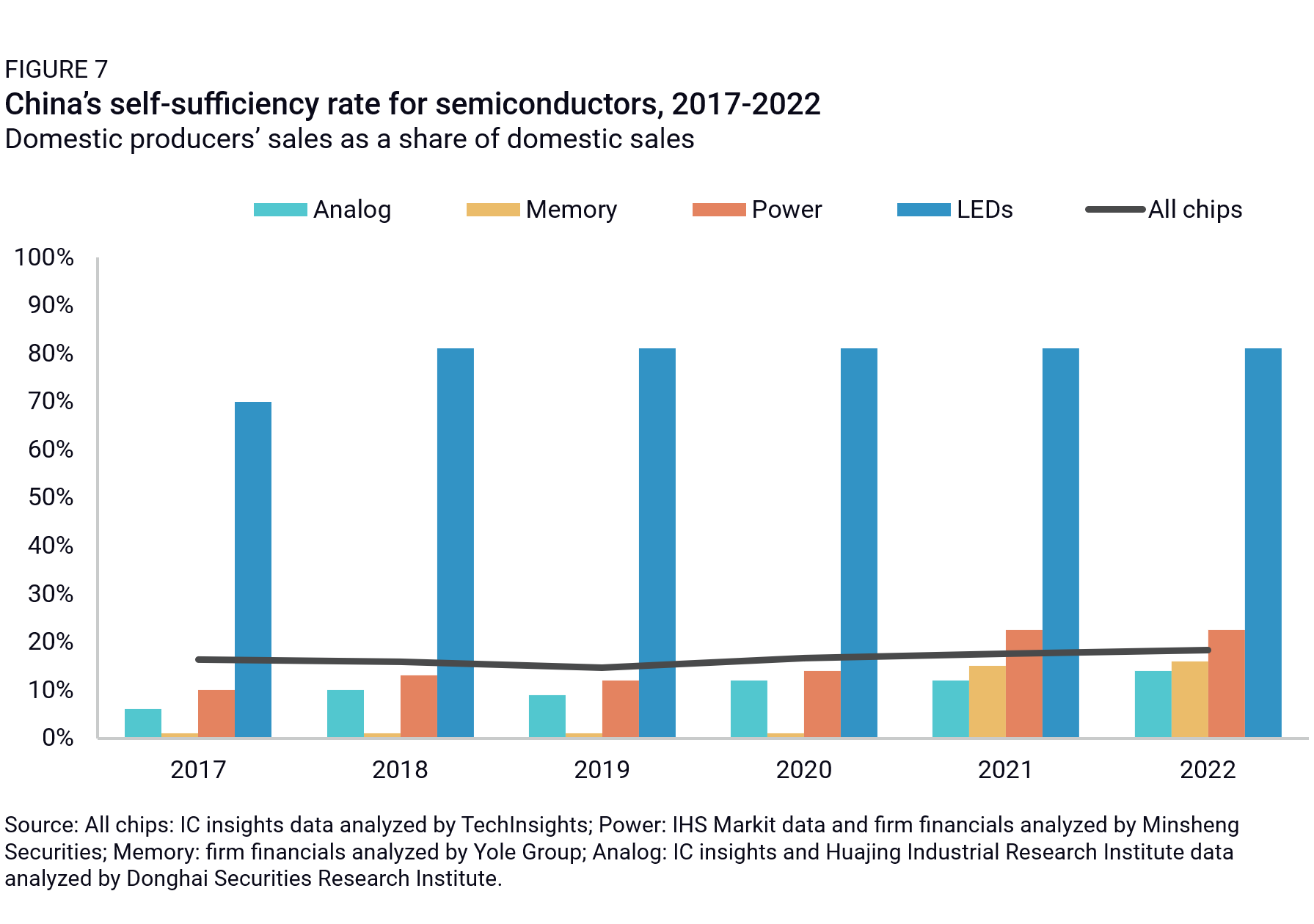

According to GACC data, in 2023 China imported 479.5 billion chips, a decrease of 10.8% by value and 15.4% by volume year-on-year. Some of this decline can be attributed to features of chip demand cycles and pandemic-related effects. However, China’s increasing self-sufficiency rate—a measure of domestic manufacturers’ share of domestic sales—in certain mature node chips (Figure 7) suggests that at least some of this import slowdown can be attributed to substitution favoring domestic suppliers.

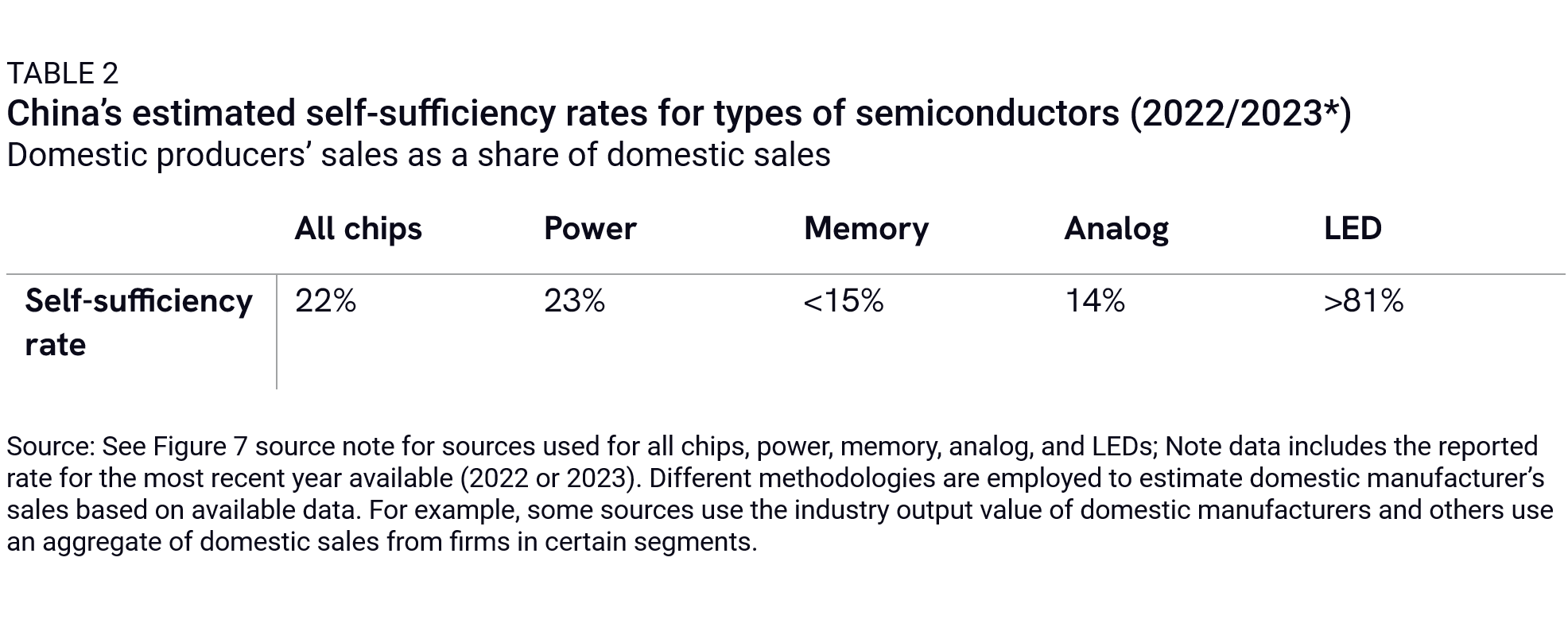

According to TechInsights, the self-sufficiency rate of China’s semiconductor industry in 2023 was only about 12%. This rises to 23% if both domestic and foreign chipmakers in China like TSMC, Samsung, and SK Hynix are included. On the one hand, China’s minimal production capacity and strong demand for more advanced chips likely suppresses the industry average. On the other hand, self-sufficiency rates of legacy chips have steadily increased, albeit from generally low levels (Table 2).

Chinese research firms report the self-sufficiency rate of power chips made by domestic firms rose from around 6% to 23% from 2015 to 2021 and the rate for analog chips increased from around 6% to 14% from 2016 to 2022. Nikkei reported in 2023 that the self-sufficiency rate for all automotive chips (which generally includes power chips as well as MCUs and sensors) was only 10% in 2023. Estimates place China’s self-sufficiency rate in memory chips made by domestic firms Yangtze Memory Technologies (YMTC) and ChangXin Memory Technologies (CXMT) at around 15% in 2022. In contrast, China can claim success with simpler chips like LEDs, where domestic producers have fulfilled above 80% of domestic demand since 2020, according to estimates.

Policy considerations

Foreign chip suppliers will advocate for industrial policy funding to keep pace with their emerging Chinese competition. At the same time, outbound investment screening measures and industrial policy guardrails may be used by policymakers to deter chip suppliers from expanding investments in China’s legacy chip manufacturing base for segments that foreign chipmakers have already conceded to lower-cost producers in China. Component tariffs, entity-based sanctions, and ICT-related restrictions can theoretically weaken Chinese chip companies and limit their growth in global market share. For example, by blacklisting OEMs like Huawei along with chipmakers like YMTC and SMIC, BIS can both restrict US-origin technology to these firms and turn them into economic pariahs overnight, raising obstacles to their ability to expand market share beyond China—all three are on the Commerce BIS entity list, but licensing can be tightened further; BIS export controls on SMIC are limited to sub-10nm production while Huawei is under heavier export restrictions under the foreign direct product rule. But a pariah abroad can also be a champion at home, as Huawei has demonstrated with its remarkable comeback and product diversification since getting pummeled with Trump-era sanctions in 2019.

BIS entity listings do not preclude sourcing from Chinese chipmakers, however. To deter US companies from sourcing chips from China, ICT and data security are more likely to come into play. For example, a Chinese ICT supplier in critical internet of things (IoT) applications could face much blunter restrictions if they are cast as a liability for critical supply chains on national security grounds.

The policy debate over restrictions could create a battle between lobbying groups, with the IDMs on one side and auto OEMs on the other. The former may be in favor of restrictions on their Chinese competitors, while the latter would argue that price wars ensuring low-cost chips are imperative to keep pace with fast-growing competition with Chinese companies in the EV market and that, until alternative supply can be provided elsewhere, policymakers should adopt a “do no harm” approach to industries on the edge of this competition.

China’s growing market share in legacy chips builds China’s coercive leverage over US and partners, posing a direct threat to US national security.

Amid heightened geopolitical tensions, or in a conflict scenario, China could leverage its supply dominance to coerce US and partner countries by holding critical supply chains hostage.

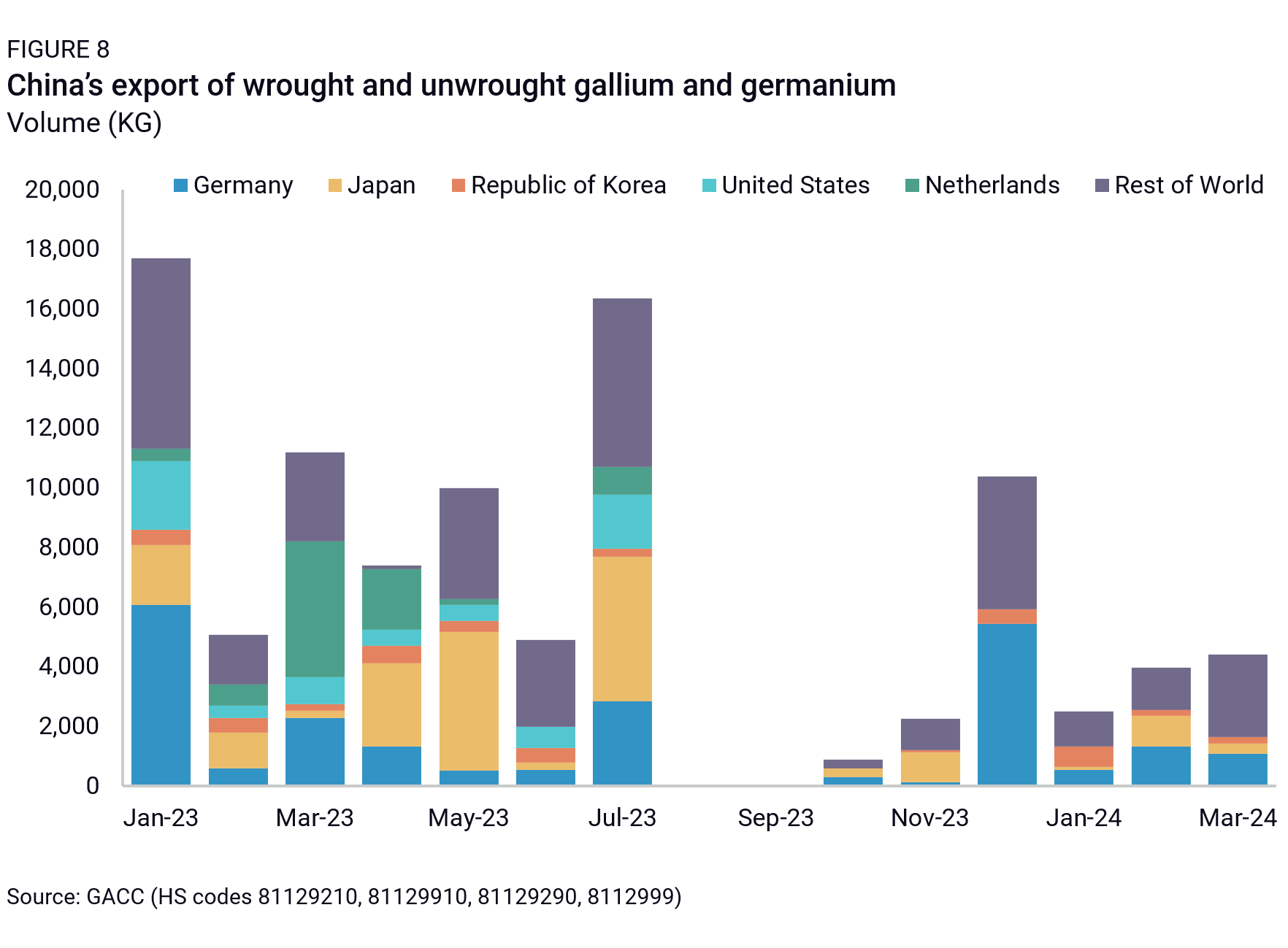

As US-China geopolitical frictions continue to escalate, so too does the risk that China leverages its turbo-charged growth in legacy chipmaking to coerce countries by threatening to cut off essential chips. China has already telegraphed its ability to withhold critical inputs to semiconductor manufacturing via export controls on gallium and germanium and related compounds. In fact, when we look at China’s exports of wrought and unwrought gallium and germanium since Beijing imposed restrictions in August, trade levels are recovering for most countries, while the US and Netherlands remain at zero while exports to Japan remain at lower levels. Not coincidentally, these are the three leaders in chip controls targeting China.

To address this issue, US policymakers are focused first and foremost on getting companies to avoid increasing their dependencies on China by, for example, contracting with Chinese fabs or even investing in Chinese legacy chip manufacturing. Second, they are pushing companies to actively decrease current dependencies on China for legacy chips.

This is easier said than done. Semiconductor manufacturing firms make money off the value of the chips produced on each wafer. Cutting-edge semiconductors manufactured on 2nm and 3nm process nodes can fetch $20,000-50,000 per wafer compared to a few hundred dollars per wafer for legacy chip nodes. As such, companies are loath to invest in legacy chip manufacturing when China is already plowing ahead in expanding capacity and when there is more money to be made in producing cutting-edge chips. Customers of those chips will at the same time resist diversifying away from China until they have assurances that alternative manufacturing capacity is coming online elsewhere.

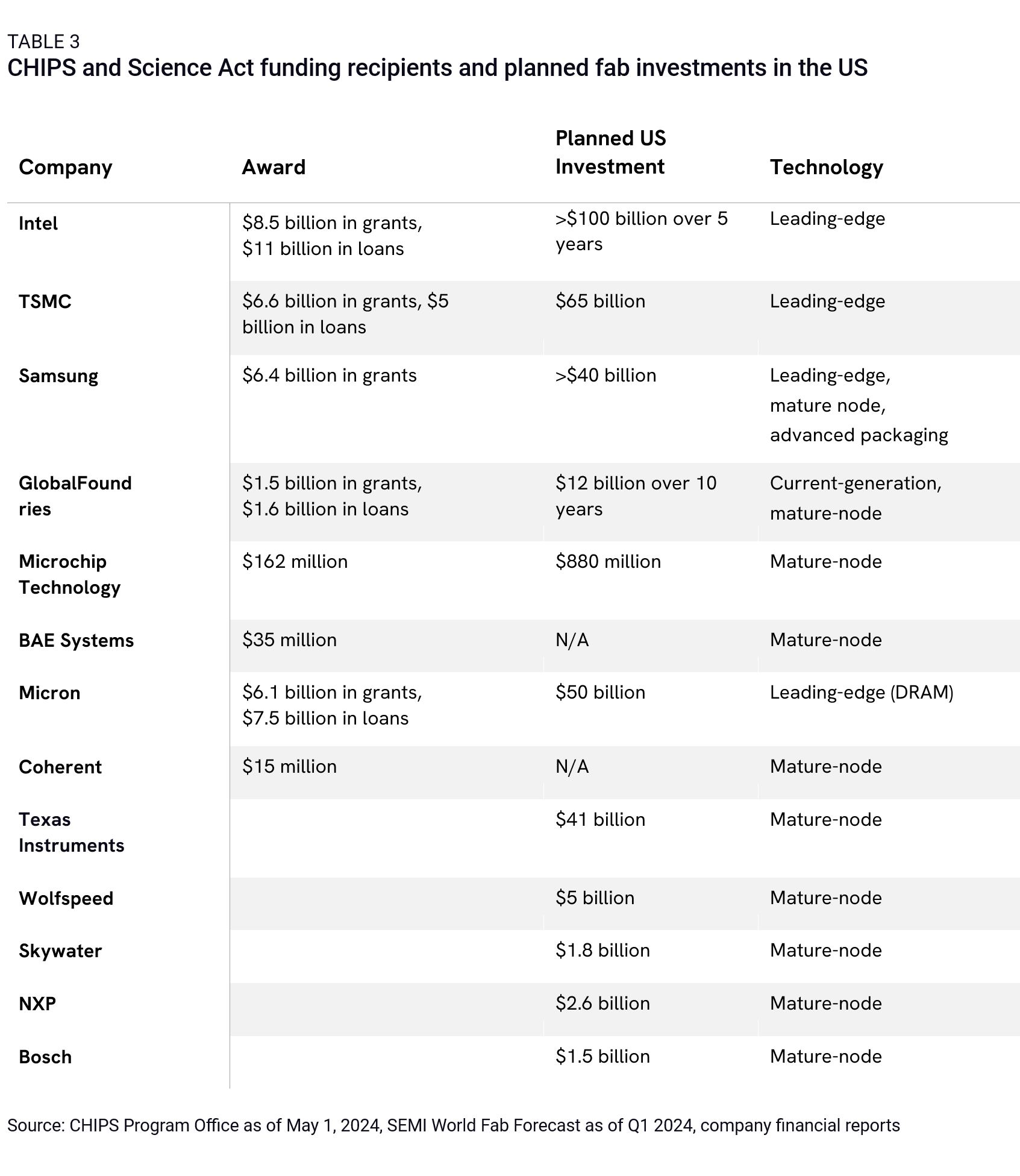

This dynamic places a significant burden on US policymakers to incentivize companies to absorb higher costs in restructuring supply chains and invest in lower-margin mature-node semiconductor manufacturing. A quarter of CHIPS and Science Act funding (up to $10 billion out of $39 billion) is earmarked for legacy chip manufacturing. This is not a big surprise given the core intent of the industrial policy is to build out state-of-the-art semiconductor manufacturing ecosystems. Nonetheless, it is a drop in the bucket when the political task at hand is to convince companies that would prefer to focus on higher-margin output to invest in legacy chips. But with industrial policy funds comes leverage. Negotiations over CHIPS and Science Act funding for leading-edge production can come with conditions attached to devote a certain amount of capacity to legacy chip manufacturing, especially for covering Department of Defense customers. So far, more than $1.7 billion in direct funding has been awarded to companies committed to semiconductor manufacturing of mature process nodes (see Table 3). Tax incentives for companies that diversify manufacturing and sourcing of chips away from China and build up a strategic stockpile of semiconductors may also come into play as the US government seeks additional ways to incentivize companies to follow its tune.

Procurement restrictions are already in play and could be tightened further. Section 5949 of the National Defense Authorization Act (NDAA) for Fiscal Year 2023 prohibits government agencies from engaging in transactions that “include” semiconductor products or services sourced from major Chinese chipmakers. It goes further to prohibit transactions with any entity that “uses” any parts that include semiconductor products or services for “critical systems” used by the federal government. These NDAA restrictions don’t go into effect until December 2027 to give government agencies and contractors time to adapt. But they could always be modified via newer measures, including future NDAA amendments, to move up the 2027 timeline or expand the ICT scope to capture any entities using China-sourced chips for government-related contracts.

Commerce has collected valuable information from an industrial base survey it released in late 2023 to understand just how dependent US companies are on China-sourced chips, especially for defense and medical supply. The EU Commission has kicked off a similar industry survey to get more transparency on company supply chains and their chip dependencies on China. Out of these efforts, we may see more creative proposals emerge centered on the theme of supply chain resilience. Similar to the design of the EU Critical Raw Materials Act, the intent would be to set specific percentage limits on how many chips can be sourced from China and countries of concern, with timelines for phase-outs. Depending on the viability of plurilateral forums like the Trade and Technology Council—and the outcome of the US presidential election—such arrangements could be coordinated among like-minded G7 partners and trusted tech allies.

Chinese firms’ design and manufacture of semiconductors pose a risk of hardware tampering during production, potentially facilitating adversarial cyber activities.

China can exploit vulnerabilities in ICT systems in a geopolitical conflict scenario, potentially enabling data collection or physical disruptions to critical infrastructure.

Revelations around Volt Typhoon, a Chinese state-sponsored hacking group, have jolted US government agencies into swifter and more serious deliberations over cyber-related restrictions. Using relatively simple entry points (such as stolen administrator credentials to gain initial access to routers, cameras, firewalls, and VPNs), Volt Typhoon was able to move laterally across an array of critical infrastructure systems, including power, water, ports, transportation, internet service providers, and telecom networks in a comprehensive stealth operation that in some cases lasted five years before detection. According to the US and Five Eyes intelligence partners, this vast operation was designed to give Beijing the ability to paralyze critical systems across the United States in the event of a geopolitical crisis, such as a standoff over Taiwan.

While most cyber scrutiny is focused on software-enabled vulnerabilities, cyber risks can be introduced across multiple stages of the semiconductor manufacturing process, from IP design to fabrication to assembly, packaging, and testing. More complex chip designs involving integrating and stacking chiplets are enabling chip design innovations to pack more compute and functionality into a single chip. But chiplets from multiple sources can also increase the number of design teams involved and thus expand the attack surface area for adversaries to penetrate safeguards of data and hardware. The growing popularity of chiplet-based architectures is also driving industry innovations to boost hardware security with on-chip safeguards for authentication and defense against tampering.

US semiconductor regulations have heavily focused on front-end manufacturing inputs for wafer production but are increasingly scrutinizing back-end processes and suppliers for packaging, assembly, and testing. In addition to its expanding role in front-end semiconductor manufacturing for mature node chips, China already plays a dominant role in contract back-end manufacturing, or outsourced semiconductor assembly and test (OSAT). According to SEMI data, China held 38% of the global OSAT market in 2020 with a growing number of those firms diversifying outside of China, particularly in southeast Asia. A portion of CHIPS Act funding is earmarked to boost domestic back-end manufacturing, but may be drawing from a dwindling pot dedicated for mature node production overall.

An ICT component, from a semiconductor to an internet module, does not need to be manufactured by a Chinese entity to make it vulnerable to a state-sponsored hacking operation. However, US security agencies are trying to build a layered cybersecurity defense to deny foreign adversaries backdoors to critical systems. So far, measures have entailed restricting the usage of Chinese-sourced ICT components in critical supply chains, from existing targets like 5G networks and port infrastructure to emerging areas like connected vehicles and medical devices. Commerce has recently activated a potent regulatory tool in its ICTS investigation into connected vehicles, which encompasses hardware such as the semiconductors and sensors used in automobile manufacturing. The FCC could also expand its Covered List of critical infrastructure and blacklisted suppliers to restrict Chinese chip providers.

Policymakers wrangling with complex trade arguments and market dynamics over the future threat of injury from China’s expansion in production capacity may be tempted to reach for cybersecurity measures as a regulatory shortcut to restricting mature node chips from China on national security grounds.

When geopolitics drives production capacity expansion and restrictions in a highly capital-intensive industry, market distortions are bound to occur. The degree of impact will depend in part on just how well the state and industry read the market, the geopolitical climate, and each other’s assumptions:

Note

New US tech controls will force a mindset shift for a wide range of industries on how their products could be national security risks.

Note

US policymakers are wagering that industry and partners will align with US controls and that time and innovation are on Washington's side.

Note

The proposed approach targets a smaller set of technology categories, but uncertainties in the regulatory draft language raise questions about its ultimate scope.

Note

A deep look at where Chinese chipmakers and their state backers are likely to focus their resources after the export controls imposed by the US on October 7, 2022