This note is the third in a series of quarterly briefings comparing clean technology deployment and manufacturing trends in Europe and the United States as part of a collaboration between Bruegel and Rhodium Group.

The global electric vehicles (EVs) market is booming, and there are high stakes for economies—like the US and Europe—seeking to capitalize on the associated economic and political opportunities. The US and Europe are the largest markets for EVs and EV batteries behind China, which dominates deployment and manufacturing across the EV supply chain. In the US, battery investment has surged following the passage of the Inflation Reduction Act (IRA), while the European Union has pursued a more modest industrial policy. Although on similar footing today, the US is on track to overtake Europe in battery cell and module manufacturing if all facilities in the pipeline come online. As of the end of 2024, both regions had built out enough battery cell capacity to meet the majority of demand for that year. However, both markets remain reliant on foreign supply chains, prompting both the US and Europe to take increasing hard lines to protect their industries from competition from China. As trade tensions flare up and as US policy rapidly evolves, the battery market faces a lot of uncertainty.

To better understand and inform policymakers and investors navigating these dynamics, Rhodium Group and Bruegel have teamed up to track investment, deployment, and trade in low-carbon technologies. The Clean Investment Monitor, a joint project of Rhodium Group and MIT’s Center for Energy and Environmental Policy Research (CEEPR), tracks public and private investment in the manufacturing and deployment of clean technologies in the US, while Bruegel’s European Clean Tech Tracker provides an overview of the main clean technology manufacturing and deployment trends in Europe. These efforts are crucial to fill the gaps in objective public sector data. In this third note of our Transatlantic series, Bruegel and Rhodium combine these granular datasets to compare battery investment, manufacturing, and trade on both sides of the Atlantic and offer insights for policymakers.

Demand for batteries

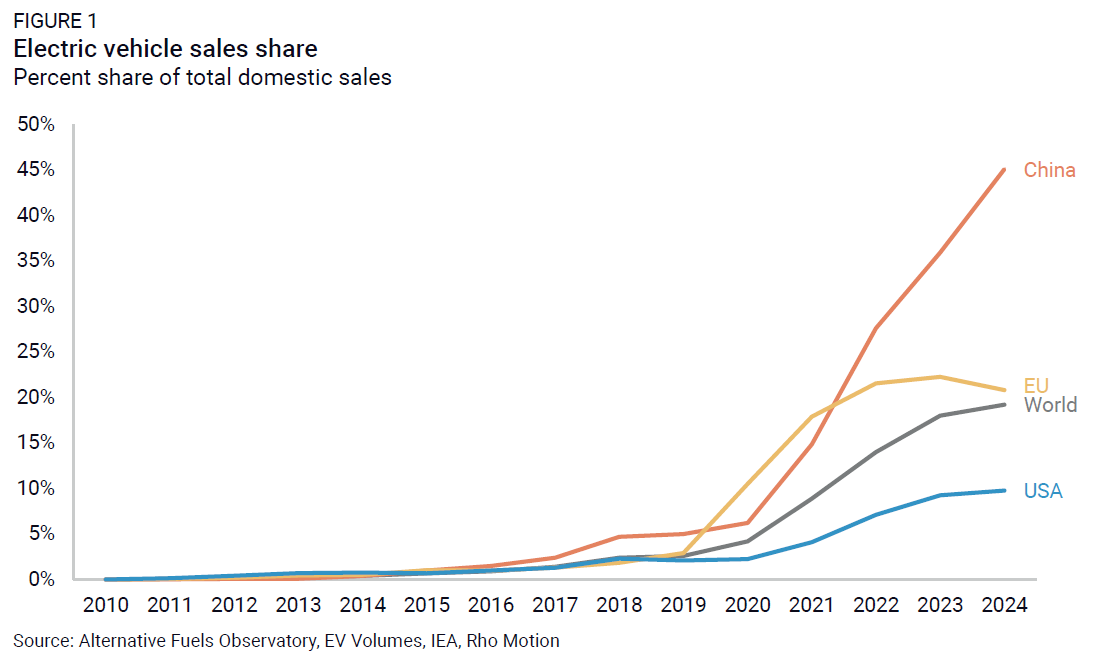

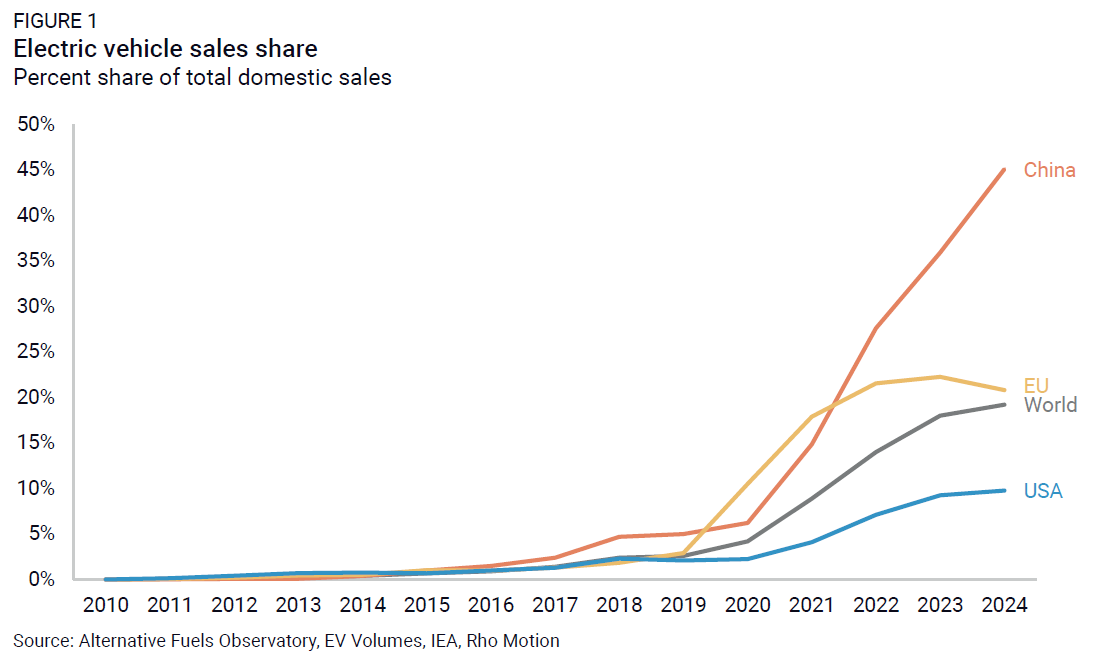

Battery technology is a crucial component of the global energy transition. Batteries are needed for electric vehicles as well as for providing stationary storage for electricity grids. The market for EV batteries significantly surpasses that for stationary storage, with EVs accounting for more than 80% of global demand for lithium-ion batteries. EVs have grown from a nascent industry to an important global market, accounting for 19% of automobile sales in 2024 worldwide (Figure 1). However, note that in 2024, EV sales growth in the EU market stalled as governments cut subsidies and companies postponed new models until 2025, due to impending stricter emissions regulations. The ongoing growth in EVs presents economic opportunities for companies and countries that can establish leadership in manufacturing requisite battery supply chains. Doing so requires competing with China, today’s leader in the space.

In recognition of this, both the US and European governments have designed policies to try to attract battery manufacturing investments. In the European Union, the first ever Important Project of Common European Interest was announced for the battery sector in 2019 with the intention to stimulate investment on the continent. European governments have subsequently made significant financial commitments to attract investments. In the US, the Inflation Reduction Act (IRA) passed in 2022 made available large subsidies for battery manufacturing, along with consumer EV subsidies paired with a domestic content requirement.

Consequently, both Europe and the US have developed significant battery manufacturing capacities, which are expanding further. These capacities predominantly focus on later stages of the value chain, whilst earlier critical inputs, such as lithium refining, are dominated by China.

This analysis of data from the Bruegel European Clean Tech Tracker and the Rhodium Group-MIT CEEPR Clean Investment Monitor explores the size of investments made into the battery manufacturing value chains and the resulting operational capacities, comparing this to domestic demand in both Europe and the US. We additionally consider trade data to understand the composition of imports. Combined, this comprehensive and granular data fills the gap in existing public data and offers insights into the impact of evolving policy and markets on a critical industry for the clean energy transition.

Manufacturing investments and capabilities

As the transition toward electric vehicles has progressed as well as the growing importance of stationary grid-connected batteries, so too have investments into battery manufacturing. While much of this investment has so far been in China, investments are notable and growing in both Europe and the US.

The value chain for manufacturing a battery is long and complex. The primary materials are chemical compounds formed from elements like lithium, nickel, and cobalt, which must first be extracted from the ground. Processing is then required to transform these compounds into ingredients that are suitable for battery production. Battery cell fabrication involves the complex assembly of these prepared materials and is by far the most capital-intensive stage. The final step is the assembly of series of battery cells into modules and packs.

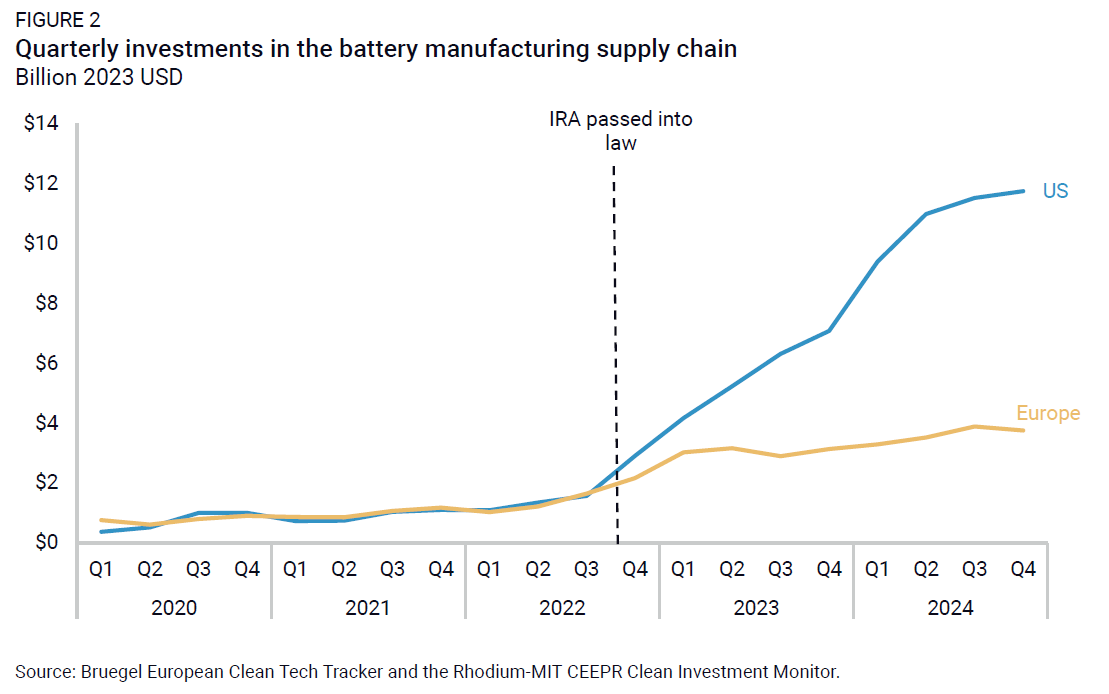

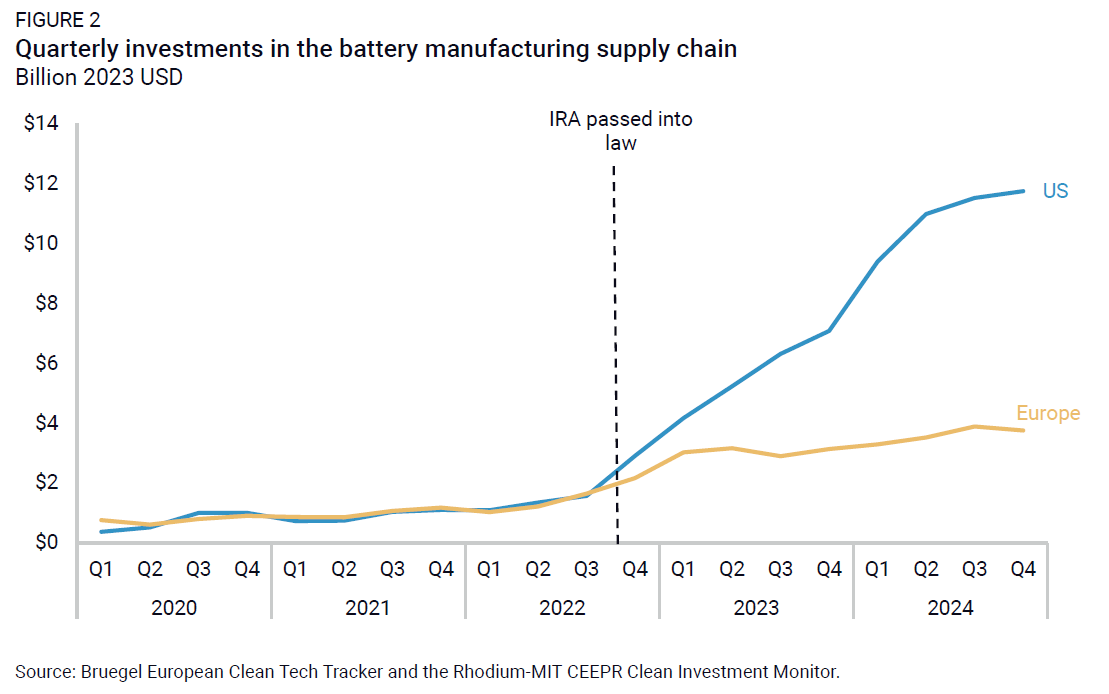

Most investment in battery manufacturing in the US and Europe has focused on battery cell and modules, while value chains remain highly reliant on inputs from China for the early stages of production. In 2020, investments in cell and module manufacturing were broadly consistent between Europe and the US at around $500 million to $1 billion per quarter (Figure 2). In Europe, investment volumes have grown steadily over time, reaching just over $3.5 billion by the last quarter of 2024. Meanwhile, the IRA drove a rapid expansion of investments in the US starting in 2022. Since then, investment in the US has diverged sharply from Europe, reaching a record investment of nearly $12 billion in the last quarter of 2024.

The IRA supercharged US activity in battery production, which accounted for more than 70% of clean manufacturing investment in every quarter of 2024. While still largely centered on cells and modules, a growing share of investments is in upstream steps, including critical minerals and electrodes.

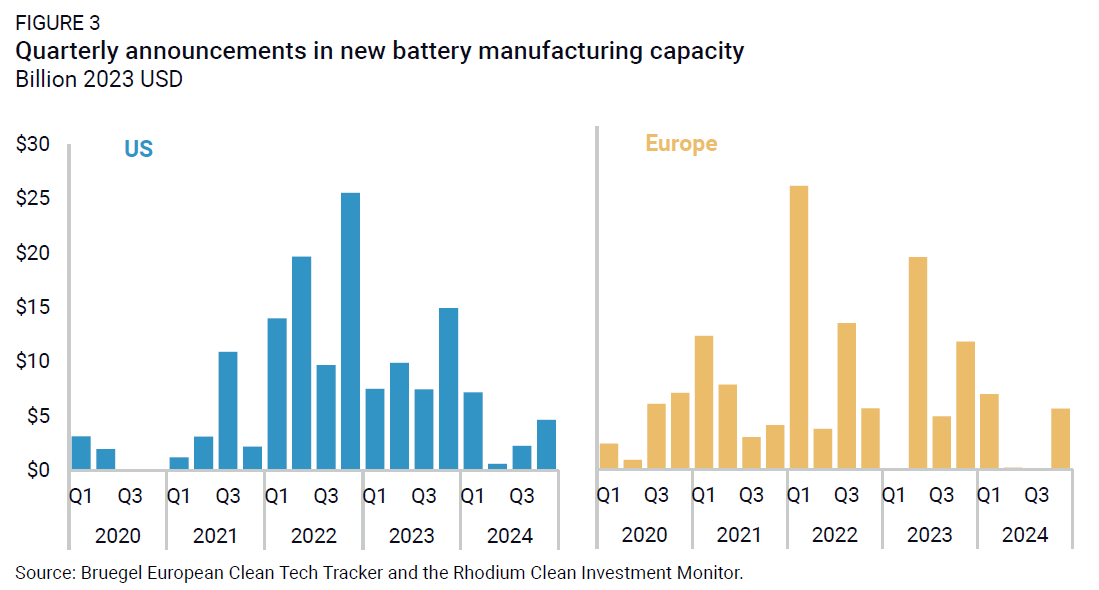

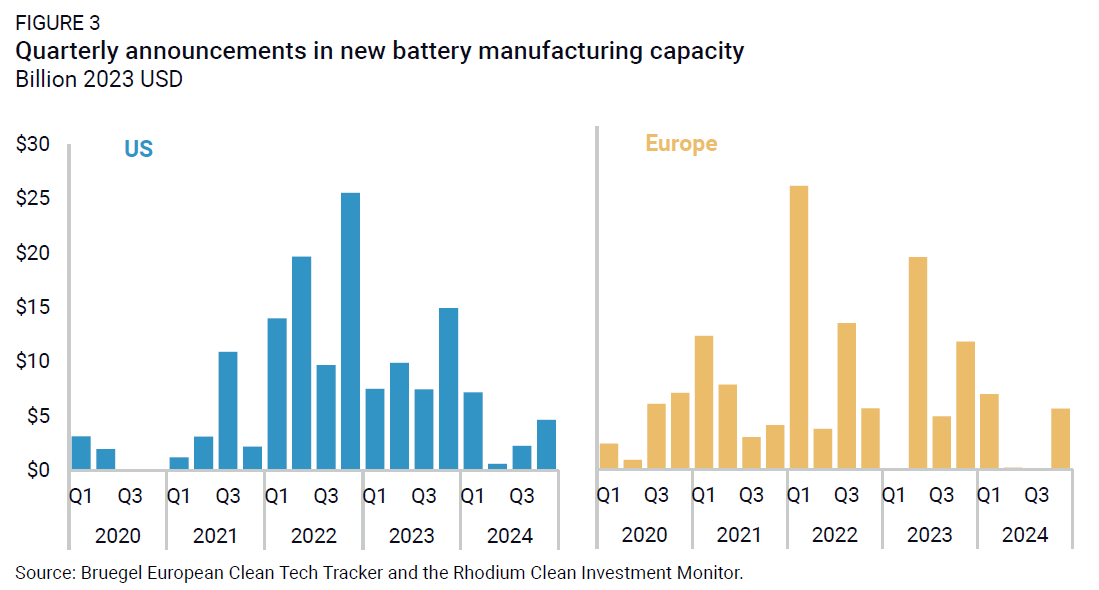

Announced projects, an indicator of the investment pipeline, peaked in 2022 for both the US and Europe (Figure 3). This came on the heels of the IRA in the US and in response to the energy crisis in Europe. For both regions, investment announcements have slowed in 2024 thanks to substantial previous investment, tempered EV demand growth, and competition from Chinese producers. There was a spike in the last quarter of 2024 for Europe from a joint venture announced between Stellantis and the Chinese battery cell manufacturer CATL for a project in Zaragoza, Spain.

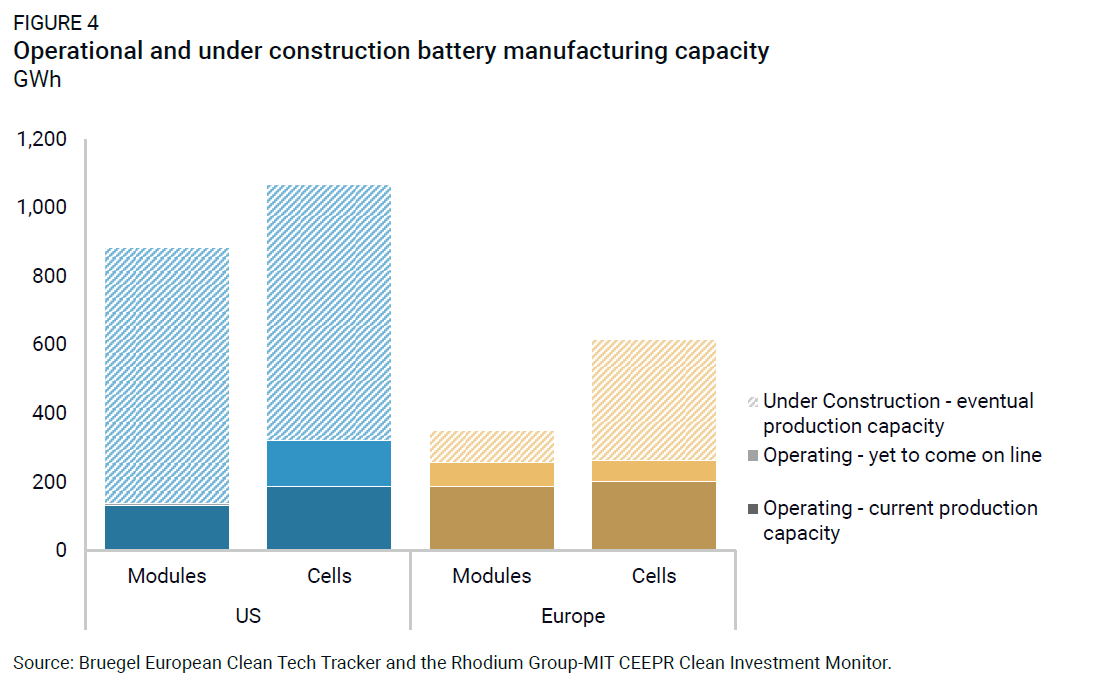

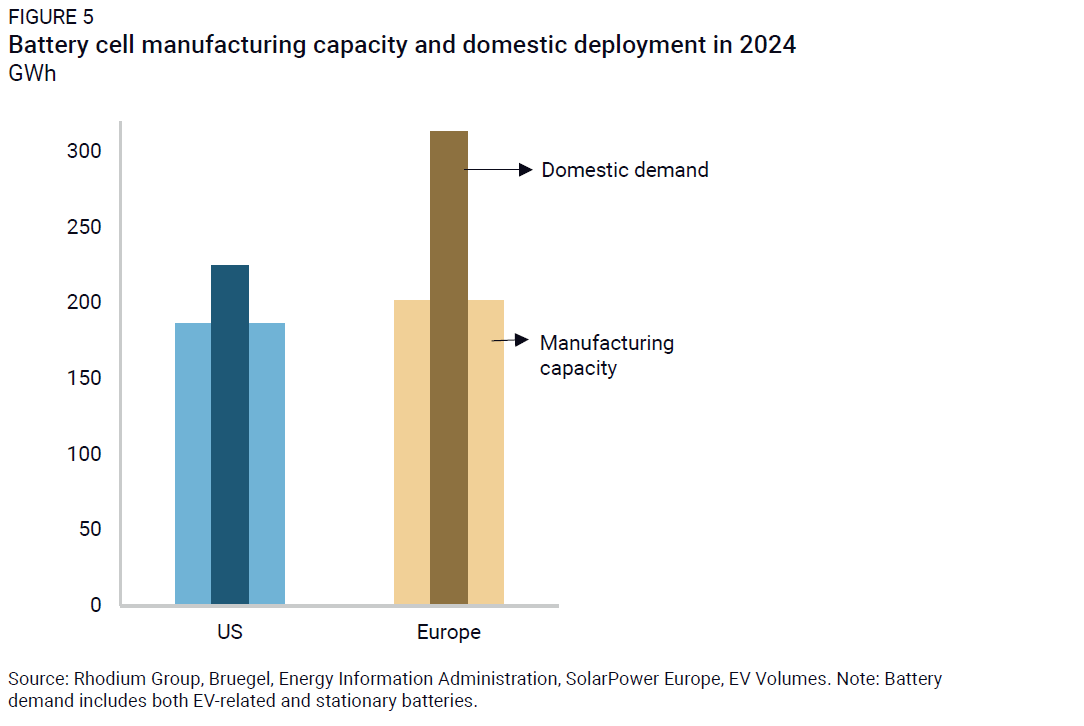

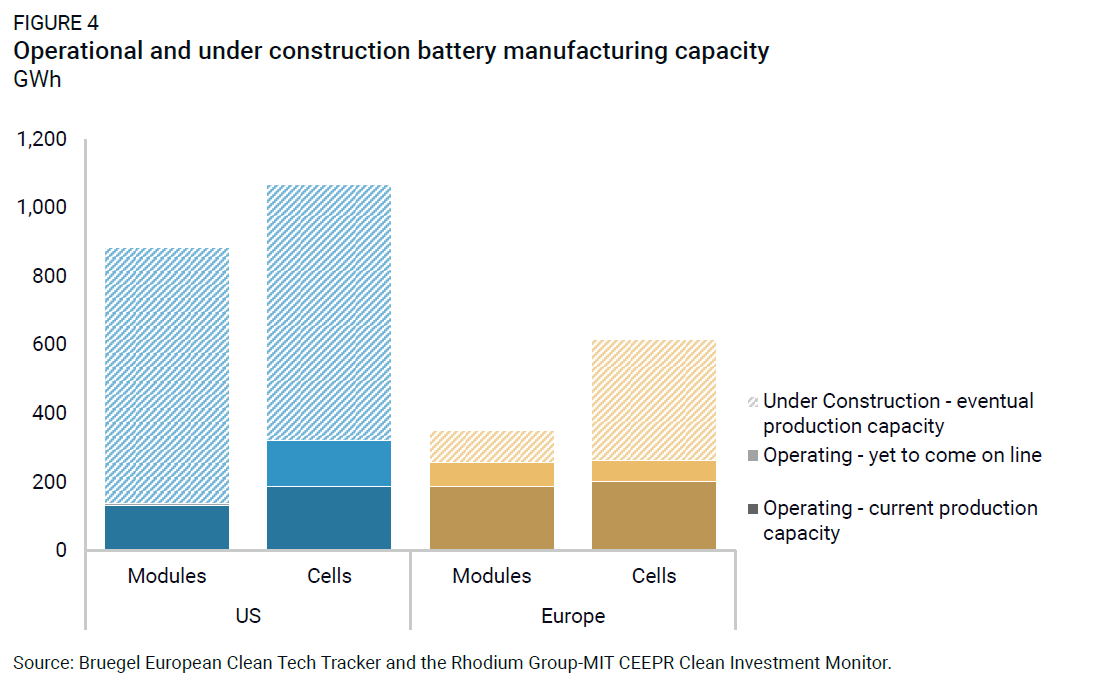

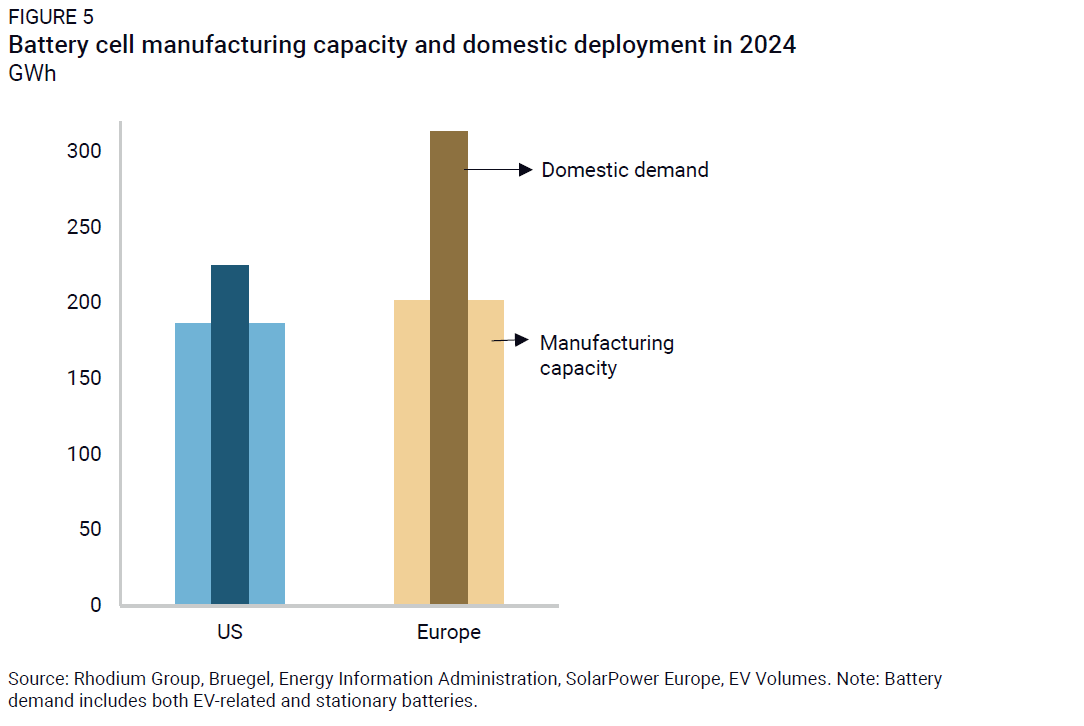

While investment volumes offer a market signal, it is the translation of these investments into operational manufacturing capacity that really matters. Today, the US and Europe have similar manufacturing capacities (Figure 4). Both have around 200 GWh of operational battery cell capacity, or roughly equivalent to 3.3 million electric vehicles. For module assembly, we estimate Europe has 190 GWh capacity while the US has 130 GWh.

As we look ahead, the US is poised to overtake Europe in both cell and module capacity as IRA-driven investments break ground. Considering new facilities under construction together with operational plants that are still ramping up production, US cell manufacturing is expected to exceed 1,000 GWh. Europe has fewer projects in the pipeline and is on track to reach over 600 GWh cell capacity by the same metric. However, the fate of new builds in both regions is not guaranteed. Evolving political priorities—in the US in particular—make ongoing monitoring of the sector critical.

Self-sufficiency and trade

Unable to compete with foreign-made traditional combustion vehicles, China’s advantage in the EV space was born out of a risky government program to build out a new industry. Now, battery manufacturing in the US and Europe is at a critical juncture as governments in both regions consider the opportunities of shoring up domestic supply chains, and the challenge of competing with China. Recent efforts have been reasonably successful in ramping up battery cell manufacturing to meet growing demand. As of 2024, domestic battery cell manufacturing in the US and, to a lesser extent, in Europe has sufficient capacity to meet the majority of domestic demand (Figure 5).

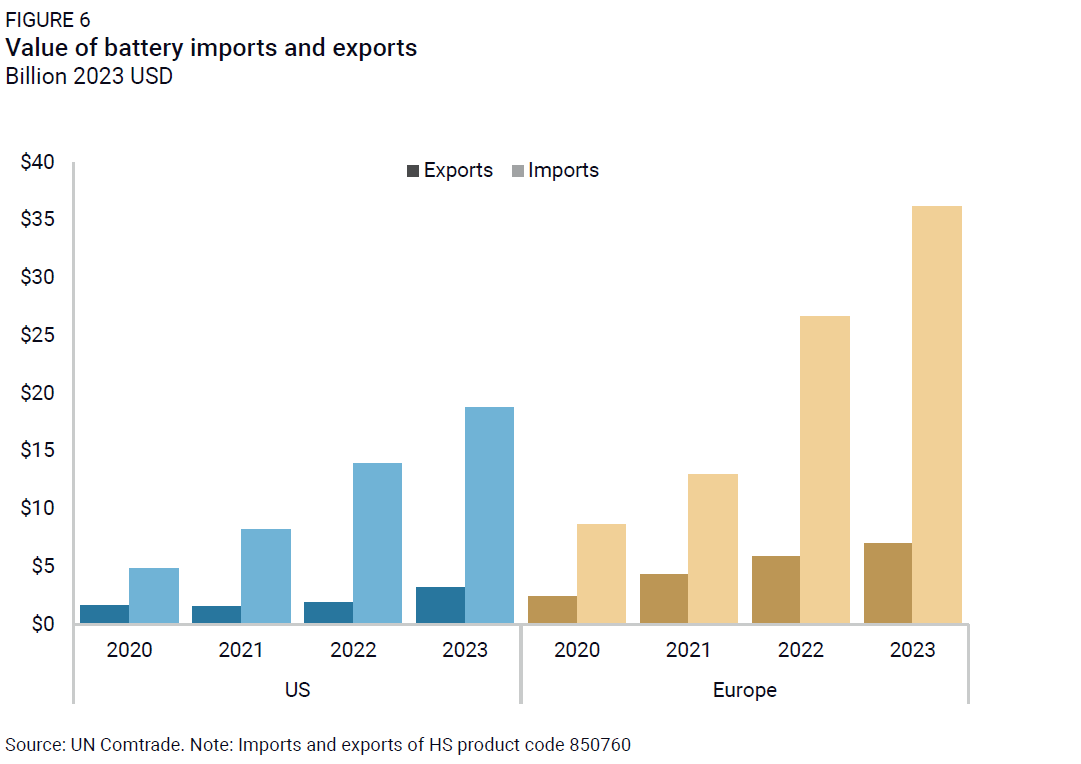

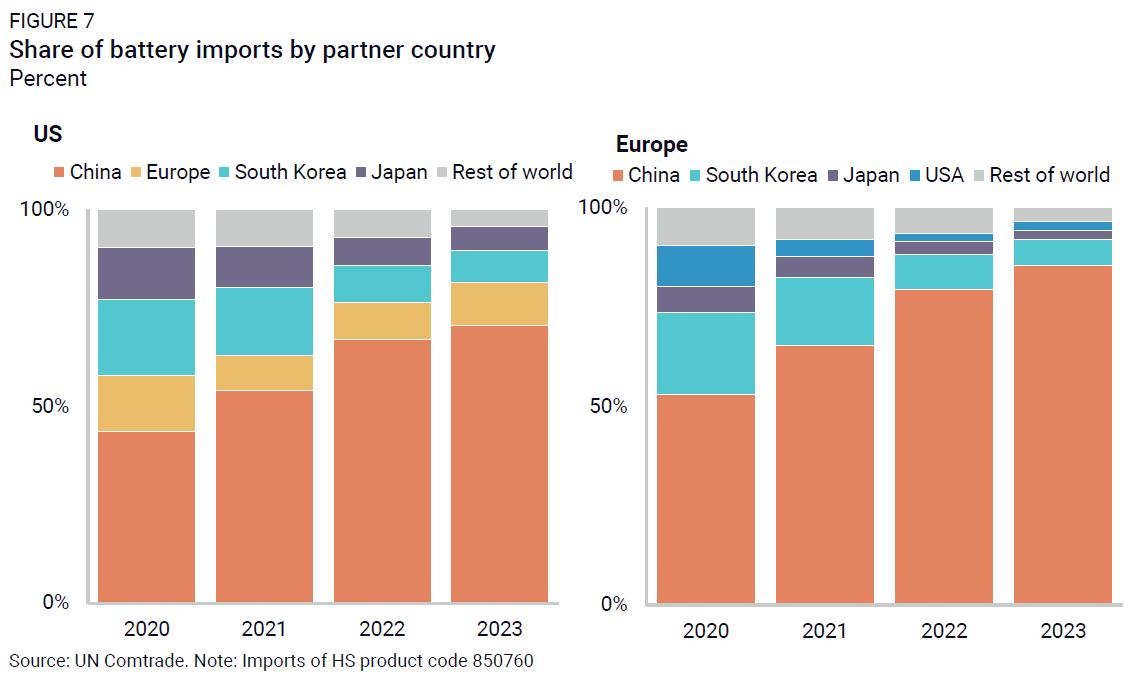

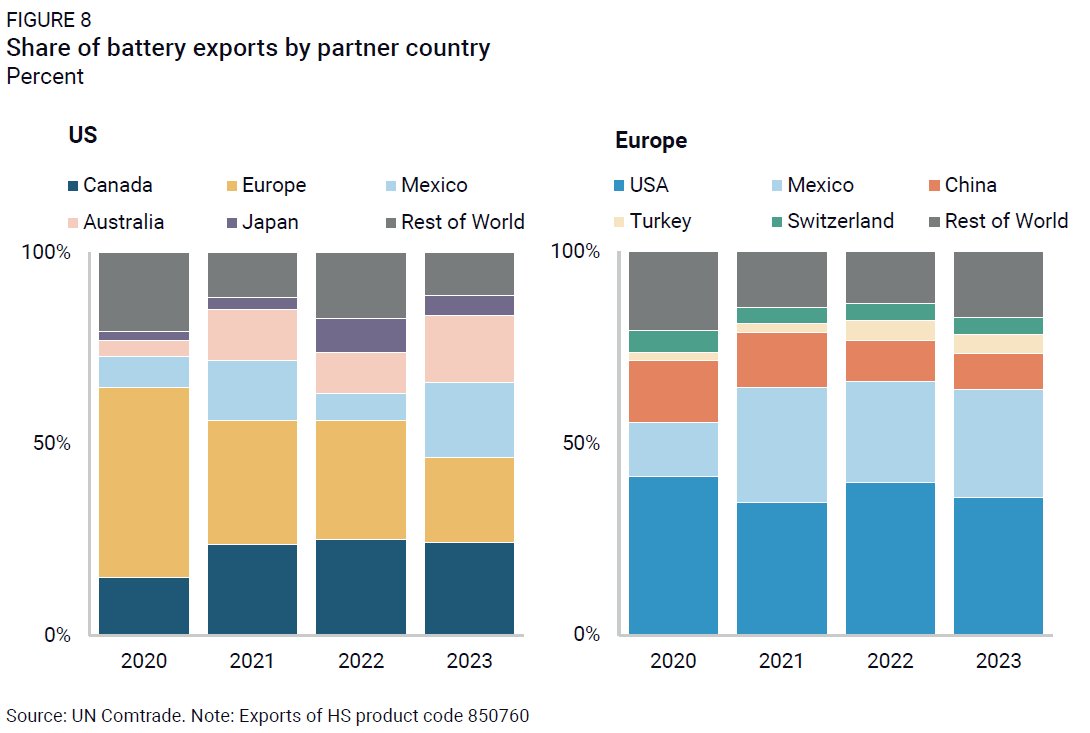

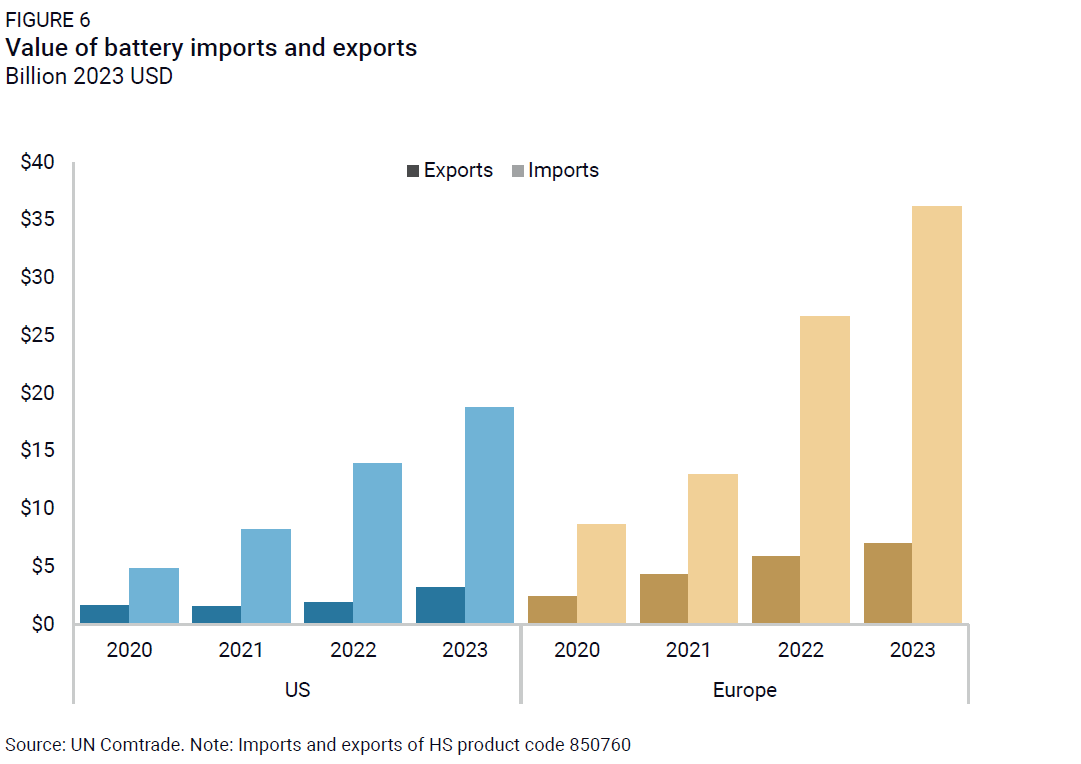

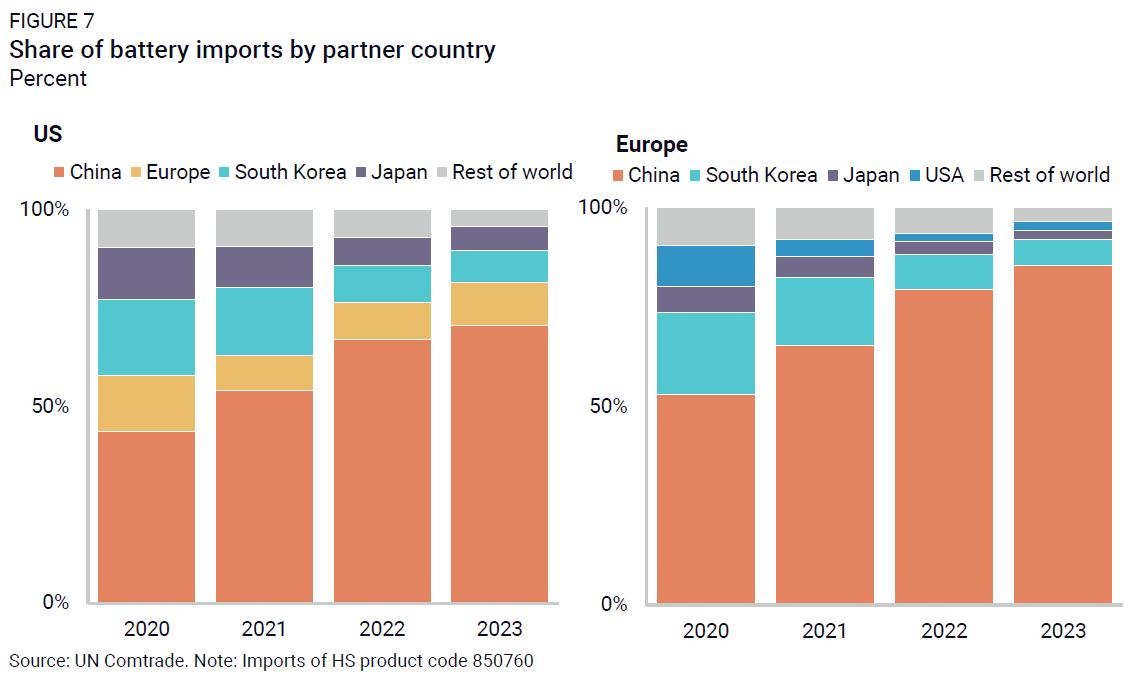

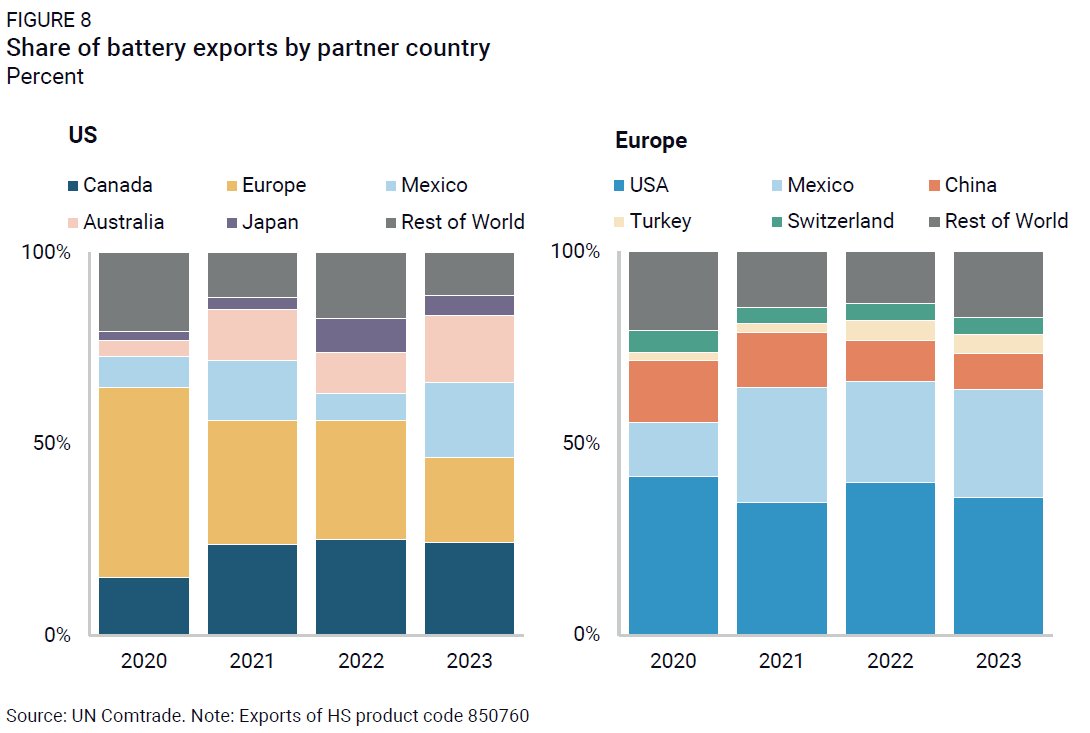

Domestic battery cell manufacturing capacity, however, does not mean the US and Europe are nearing self-sufficient supply chains. For starters, both regions rely on China for upstream components. Even for cells and modules, growing manufacturing capacity also obscures the fact that Europe relies heavily on imports, and ships a lot of domestically produced batteries abroad. In 2023, Europe imported over $35 billion and exported a quarter of that amount (Figure 6). Exports primarily go to North American facilities that largely serve the US EV market, while Europe imports cheap batteries from China to fill the gap in domestic demand (Figures 7 and 8). This strategy has helped make lower-cost EVs available to European consumers, boosting EV deployment, but exposes the EV supply chain to trade conflicts.

The US also relies on imports, overwhelmingly from China. US policy under the Biden administration has helped drive demand for US-made batteries in US markets, including through the EV subsidy domestic content requirements. This has helped keep batteries local, and nearly half of US exports go to US-bound auto production in Mexico and Canada. Although China looms increasingly large, the US and Europe are also important trade partners for batteries, with Europe supplying 10% of US battery imports in recent years.

The domestic build-out of battery manufacturing capacity also belies another trend: growing foreign investment in US and European plants. The overwhelming majority of operational European battery cell manufacturing capacity comes from companies with headquarters abroad. The largest operational facilities belong to LG (South Korea), Samsung (South Korea), CATL (China), and SK (South Korea). One widely anticipated homegrown European battery producer, Northvolt, has initiated bankruptcy procedures recently.

In the US, more facilities are domestically owned, although foreign investment is increasing. South Korean firms have made substantial investments in US factories in recent years, including multi-billion-dollar investments from Samsung, Hyundai, SK, and LG Chem. Chinese firms have made mostly mid-sized investments—in the millions, not billions— notably focused on the upstream components of battery manufacturing. These factories could help diversify in-country supply chains if completed, although most have not yet broken ground.

Perhaps the biggest threat to domestic manufacturing in both the US and Europe is policy uncertainty. In the US, President Trump wants to restrict battery and auto imports from China—broadening and intensifying tariffs enacted by his predecessor—and has sent mixed messages about his openness to Chinese foreign investment in US factories. The administration has frozen all grants and loans—many of which were awarded to clean manufacturing projects—and has threatened core provisions of the IRA. An escalation of tariffs—or threat thereof—aims to protect domestic producers. But a trade war would likely damage the burgeoning domestic battery industry, which still relies heavily on foreign supply chains. Pulling the plug on federal support for manufacturing and consumer subsidies would deal a major blow.

The EU put up fewer barriers to imports from China until this fall, when member states approved countervailing duties on Chinese EVs following a substantial rise in imports. More than the US, the EU’s auto sector is highly integrated with China—in addition to a reliance on Chinese battery imports, many European companies have joint ventures with production in China, and Chinese brands make up nearly a quarter of EV sales in the bloc. It’s yet to be seen how the tariffs will balance protecting local industry while averting an escalation with China that could slow the EV transition. The Trump administration is another wild card for European battery production. On one hand, President Trump’s threat to impose tariffs on the bloc could slow Europe’s substantial exports to the US. On the other hand, if the US pulls back from the global EV race, there will be opportunities for others—including Europe—to fill the gap.

An uncertain future

EV batteries are part of a highly complex market that has been rocketing to commercial scale in recent years. With China in a distant first place, Europe and the US stand at a critical juncture in determining how much they will compete in the race for leadership in the industry. In the US, heavy investments since the passage of the IRA have driven major new investments, putting the country on track to surpass Europe in cell and module capacity. Europe has seen steady but more gradual growth in domestic battery manufacturing investment, relying on foreign investment and trade to meet battery demand. With a new administration in Washington, shifting policy and escalating trade tensions create uncertainty for industry players on both sides of the Atlantic. In these uncertain times, frequent monitoring is crucial to understanding evolving dynamics and providing insights to decision-makers. Bruegel’s Clean Tech Tracker and the Rhodium-MIT CEEPR Clean Investment Monitor will continue to track the evolution of the battery sector in Europe and the US over the coming quarters. Our next Transatlantic Clean Investment Monitor briefing notes will explore how these deployment and manufacturing trends are evolving for other clean technologies.

This nonpartisan, independent research was conducted with support from the Children’s Investment Fund Foundation. The results presented reflect the views of the authors and not necessarily those of the supporting organization.