Driving the Transition to Zero Emission Vehicles: Does Biden’s Plan Chart the Course?

As the Biden administration finalizes vehicle GHG standards for MY2023-2026 and lays out a plan for developing mid-term standards through 2030, positioning the US to achieve 100% ZEV sales by 2035 should be the driving objective.

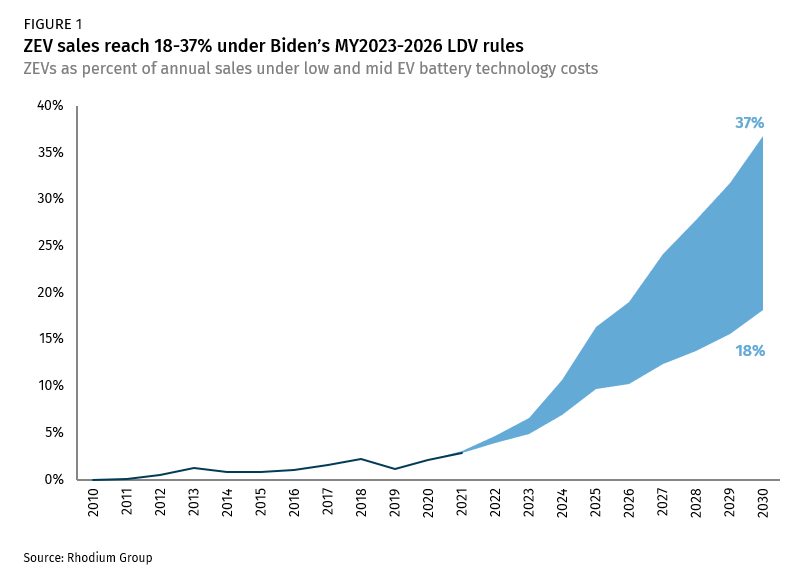

Last week President Biden announced his goal of reaching 50% zero emission vehicle (ZEV) sales by 2030 and initial regulatory steps to ratchet up passenger vehicle greenhouse gas emission (GHG) standards to meet that goal. As a first step, the Environmental Protection Agency (EPA) has proposed more aggressive GHG standards for model years (MY) 2023-2026. Rhodium Group modeled these proposed standards under a range of potential electric vehicle battery cost scenarios and found that ZEV sales would rise from just over 3% today to 18-37% of light-duty vehicle (LDV) sales by 2030, a modest increase from our current trajectory. But federal regulations are not the only factors driving the ZEV transition. A combination of investments under debate in Congress, state ZEV policies, and accelerating automaker investments has the potential to push ZEV deployment beyond Biden’s goal of 50% sales by 2030. As the Biden administration finalizes vehicle GHG standards for MY2023-2026 and lays out a plan for developing mid-term standards through 2030, positioning the US to achieve 100% ZEV sales by 2035 should be the driving objective.

Biden’s near-term GHG standards restore Obama-era ambition

Over the past few years, Rhodium Group has assessed how dramatic political shifts have shaped federal vehicle policies and the impact on fuel economy, GHG emissions, and the pace of electric vehicle (EV) deployment. In 2012, the Obama administration adopted standards that required annual improvements in vehicle efficiency of around 5%, reaching a fleetwide average of 177 grams CO2/mile by MY2026. After his inauguration in 2017, President Trump announced plans to roll back Obama-era standards, a move supported by many automakers at the time. In response, the state of California announced a deal with automakers to hit 3.7% annual fuel economy improvements through 2026. The automaker deal covered not only California, but nation-wide sales by five automakers representing 30% of the US market. Shortly after, the Trump administration finalized its proposed rollback, instituting a 1.5% annual fuel economy improvement (reaching 205 g/mi on average).

Now, EPA’s draft proposal not only goes farther than the Trump rollback and California-automaker deal, but proposes standards that would exceed Obama-era rules by MY2026, reaching 171 g/mi. EPA would require a nearly 10% improvement in fleetwide average emissions in MY2023, then approximately 5% improvements each year through MY2026. Beyond 2026, Biden’s Executive Order lays out a schedule for EPA to develop long-term fuel economy and GHG emissions standards through 2030.

A modest boost to ZEV sales

The new passenger vehicle standards are the Biden administration’s first step in its plan to transform the transportation sector. To assess the impact of the proposed rules, we model the MY2023 to 2026 standard under low and moderate EV battery cost assumptions consistent with our Taking Stock 2021 projections. We find that ZEV sales under the revised rule would grow to 18-37% by 2030, depending on EV battery costs (Figure 1), a modest shift from current policy which would deliver ZEV sales of 17-35%. The revised GHG standards would put light-duty vehicle (LDV) emissions on track to fall by 25-28% below 2005 levels by 2030, 3 percentage points further than our current trajectory.

Federal GHG standards are not the only game in town

But of course, the standards themselves are not the only forces shaping the course of ZEV deployment over the next decade. Leading automakers have announced their own independent plans to make the transition to ZEVs. Four automakers representing 20% of total US sales have committed to 100% ZEV sales between 2025-2040. States have also taken the lead on committing to an all-electric future. In late 2020 the governors of California and Massachusetts announced executive orders requiring 100% of new passenger vehicle sales to be zero emission by 2035. Assuming a straight-line path to 100% ZEV sales by 2035, these state targets could push nation-wide ZEV sales to 24% to 39% of by 2030, even in the absence of new federal rules.

State and federal regulatory action is not the only tool available to policymakers seeking to scale up ZEV deployment and cut GHG emissions from passenger vehicles. Biden’s American Jobs Plan and leading members of Congress have made transportation electrification a priority. Congress is currently considering new investments in EV charging as part of a bipartisan infrastructure package. Lawmakers are also considering long-term extensions of EV tax credits among other measures as part of a budget reconciliation process.

As we note in our report Pathways to Build Back Better: Investing in Transportation Decarbonization (May 2021), additional federal investment can go a long way toward decarbonizing passenger transport in the US and scaling up ZEV deployment. Our analysis found that when investment is paired with GHG standards that achieve around 5% annual efficiency improvements, ZEVs rose to 40-52% of total vehicle sales by 2031, depending on the scale of investment and a range of potential battery cost trajectories.

Do new rules put the US on the road to net-zero by 2050?

Biden’s big announcement was celebrated by the big three US automakers—Ford, General Motors, and Chrysler—which announced in parallel that they are driving toward electric vehicles (EVs) making up 40-50% of all US sales by 2030. While a significant shift from discussions under the Trump administration, the 50% ZEV goal by 2030 falls far short of some of the most ambitious ZEV goals on the table. It also leaves much to be done to achieve 100% ZEV sales by 2035, a prerequisite to achieving net-zero emissions by 2050, according to the International Energy Agency. The 100% by 2035 goal has significant support in the US as well. It was championed by Biden during his presidential campaign, has been officially adopted by California and Massachusetts, was put forward as a company-wide goal by General Motors, and has support from 24 state governors.

A combination of investments under debate in Congress, state ZEV policies, and accelerating automaker investments has the potential to push ZEV deployment beyond Biden’s goal of 50% ZEV sales by 2030. Rhodium Group assessed a combination of these levers in our May 2021 Pathways to Build Back Better: Investing in Transportation Decarbonization report and found that getting on track for a straight-line path to 100% ZEV sales in 2035 would require a combination of investment and much more ambitious GHG standards that reach around 90 g/mi in 2031. That represents a 48% improvement over EPA’s proposed MY2026 standards in only five years. That would mean achieving annual improvements of nearly 12% for each model year from 2027 to 2031 in order to push ZEV sales to 53-61% of total LDV sales by 2031.

As the Biden administration finalizes vehicle GHG standards for MY2023-2026 and lays out a plan for developing mid-term standards through 2030, it will be critical to assess whether those standards position the US to achieve the ultimate objective of transitioning to 100% ZEVs by 2035.