Taking Stock 2022: US Greenhouse Gas Emissions Outlook in an Uncertain World

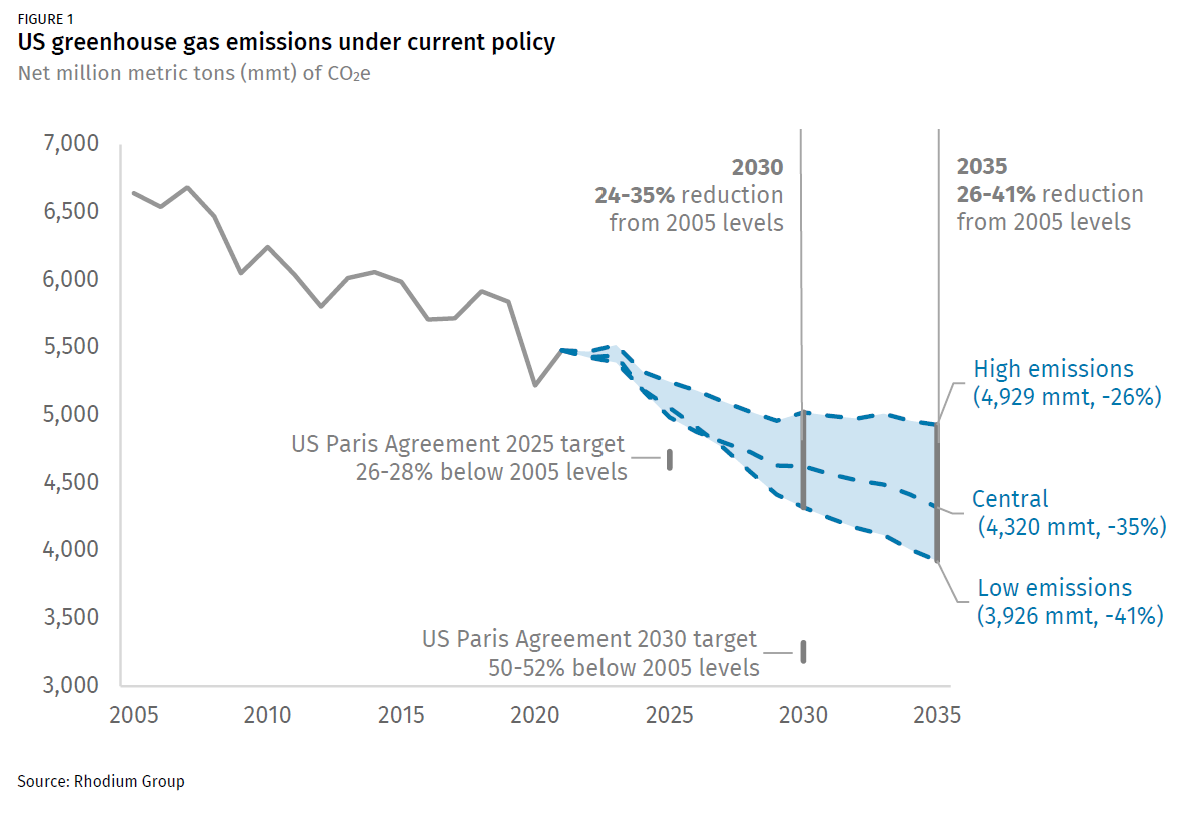

In our annually updated outlook for US greenhouse gas emissions under current policy, we find that the US is on track to reduce emissions 24-35% below 2005 levels by 2030, absent any additional new action.

For the past eight years, Rhodium Group has provided an independent annual assessment of US greenhouse gas (GHG) emissions and progress towards achieving the country’s climate goals in our Taking Stock report series. Each year, we research trends in the key drivers of US GHG emissions—including technology cost and performance advancements, changes in energy markets, policy developments, and expectations for the economy—and estimate a range of emissions outcomes based on these trends.

Given these trends and current federal and state policies in force as of June 2022, we find that the US is on track to reduce emissions 24% to 35% below 2005 levels by 2030, absent any additional policy action. This falls significantly short of the US’s pledge under the Paris Agreement to reduce emissions by 50-52% below 2005 levels by 2030. These estimates represent a rosier outlook for emissions reductions compared to Taking Stock 2021 (which estimated a 17-30% reduction by 2030 under current policy), but this change is largely attributable to slower macroeconomic growth projections and higher fossil fuel prices—not large policy changes. Even by 2035, GHG emissions remain stubbornly high at 26% to 41% below 2005 levels.

In Taking Stock 2022, we focus on a wide range of uncertainties that can affect emissions outcomes. Global and US energy markets and the economy look very different now than they did a year ago, amid the war in Ukraine and high inflationary pressures from COVID-recovery turmoil. These geopolitical and macroeconomic trends affect the energy costs and technology developments underpinning our emissions projections, and this year has reminded us all of the inherent challenge in forecasting the future in these realms. In our analysis, we account for near-term increases in fossil fuel prices attributable to global energy market instability from the war in Ukraine. We also incorporate updated medium-term price forecasts for natural gas and oil, which are generally higher than in the recent past. And we update our technology cost and performance inputs to incorporate the latest forecasts from leading experts.

Uncertainty reigns on the US policy front as well. There has been some policy movement in the past year, although not close to the level of action required to meet the US’s 2030 climate target, and the recent Supreme Court ruling in West Virginia v. EPA has called EPA’s regulatory pathways into question. In our analysis, we update our suite of current policies to include all relevant policies on the books as of June 2022. This includes passage of the Infrastructure Investment and Jobs Act at the end of 2021 and enactment of new greenhouse gas emissions and fuel economy standards for light-duty vehicles on the federal level, as well as updates to state policies like new renewable portfolio standard targets.

Our projections for US emissions in Taking Stock 2022 can help inform policymakers as they design decarbonization approaches that are robust to future developments. And now, more than ever, it’s important for policymakers to focus on maximizing the impacts of policy: the clock is ticking on both achieving the US’s 2030 climate goals and on reducing emissions to avert the worst impacts of climate change.

Detailed national and 50-state results for all Taking Stock emissions baseline scenarios—including GHG emissions and underlying sectoral data—are available in Rhodium’s ClimateDeck data platform.

Key findings

As shown in Figure 1, we find that under current policy and with no additional action, the US is on track to reduce emissions by 24-35% below 2005 levels in 2030, and 26-41% below 2005 levels in 2035. The range accounts for macroeconomic, energy market, and technology costs uncertainty. As is evident from the trajectories, the US is not on track to meet its 2025 or 2030 climate goals, nor does it meet those goals later in 2035.

In addition to the economy-wide outlook for US emissions under current federal and state policy, this report also unpacks key sectoral developments underpinning these topline figures, including the following trends:

- Industry becomes the largest-emitting sector absent meaningful policies to curtail emissions growth, with emissions remaining relatively flat depending on the scenario.

- Emissions from the power sector generally continue to decline, but gas and renewable prices have a major impact on the 2035 outcome.

- Fuel economy improvements and more EV sales drive declines in transportation sector emissions.

- By 2035, household energy costs drop by 16-25% relative to 2021 bills as more electric vehicles on the road lead to lower costs at the pump.

New for this year, we also model a range of additional cases beyond our core emissions scenarios, which include a steady progress case representing a return to stable declines in the cost of clean energy technologies as well as lower oil and natural gas prices from prolific domestic production; a continued volatility case in which events beyond the scope of the energy sector roil global energy markets and short-circuit clean technology growth; and a high growth case that demonstrates the impact that variation in GDP can have on emissions.