Note

The Stakes for Energy Costs in Budget Reconciliation

We estimate how much energy costs could rise for households and industry if Congress chooses to roll back and repeal key pollution regulations and energy tax credits.

Rhodium Group’s Energy & Climate practice uses a multidisciplinary, data-driven approach to produce unique, independent insights into global energy dynamics, greenhouse gas emissions, and climate change.

We help public and private decision-makers understand what kind of climate future we are on track for, and what matters most for reducing greenhouse gas emissions—at the local, state, national, and international levels. By combining policy expertise with a suite of detailed energy-economic models, our research provides data-driven insights into the impacts of energy and climate change policy and real-world developments on greenhouse gas emissions, energy markets, economic output, and clean technology pathways.

Note

We estimate how much energy costs could rise for households and industry if Congress chooses to roll back and repeal key pollution regulations and energy tax credits.

Note

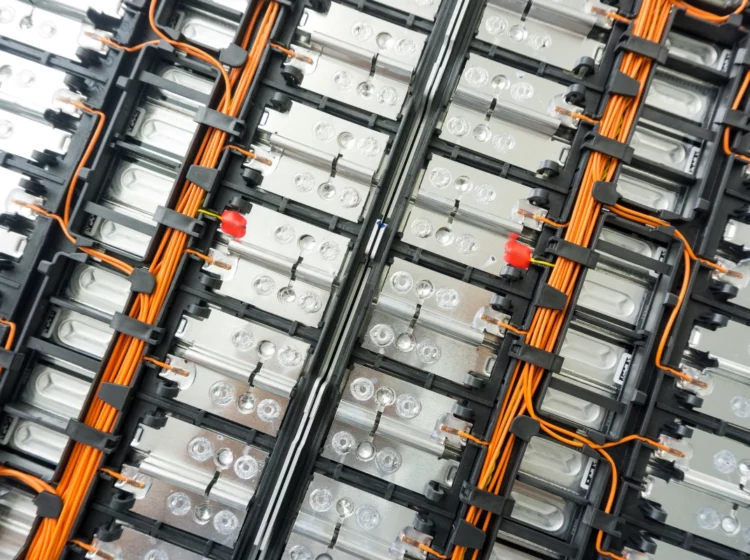

Next-generation geothermal energy has a number of advantages in meeting growing electricity demand from data centers. We estimate how much of this demand could potentially be served by geothermal over the next decade.

Note

This note is the third in a series of quarterly briefings comparing clean technology deployment and manufacturing trends in Europe and the United States as part of a collaboration between Bruegel and Rhodium Group.

Report

In the final quarter of 2024, clean energy and transportation investment in the United States totaled $70 billion, reflecting a slight 1% decline from the previous quarter but a 6% increase from the same period in 2023.

Filters:

Showing 171 – 180 of 215 total results

Report

RHG, in collaboration with the Center on Global Energy Policy, analyze the economic, energy market, environmental and geopolitical implications of lifting the US crude oil export ban.

Report

CSIS and Rhodium Group assess the energy market and economic impact of proposed EPA greenhouse gas emission regulations for US power plants.

Note

This report assesses the impact of the Clean Power Plan on US greenhouse gas emissions and whether, when combined with other enacted or planned emission reduction actions, the US is on track to meet its Copenhagen pledge.

Report

Report

Rhodium Group and The Center on Global Energy Policy examine the impact of US LNG exports on European security and Russian foreign policy.

Report

An RHG-led team of climate scientists, economists and risk analysts assesses the economic risks of climate change in the United States by region of the county and sector of the economy for the Risky Business Project.

Note

Now that the Clean Power Plan proposal is out, what do we know about its potential economic costs?

Note

Whether or not to allow crude oil exports from the US is shaping up to be one of the hottest energy policy topics in Washington in 2014. RHG's Houser and Mohan provide a backgrounder on the debate.

Book

A new book by Trevor Houser and Shashank Mohan analyzes the economic implications of the unconventional oil and gas boom in the US.

Report

Trevor Houser and Beibei Bao analyze natural gas policy and market developments in China and map out the factors that will shape future supply and demand.