Was Made in China 2025 Successful?

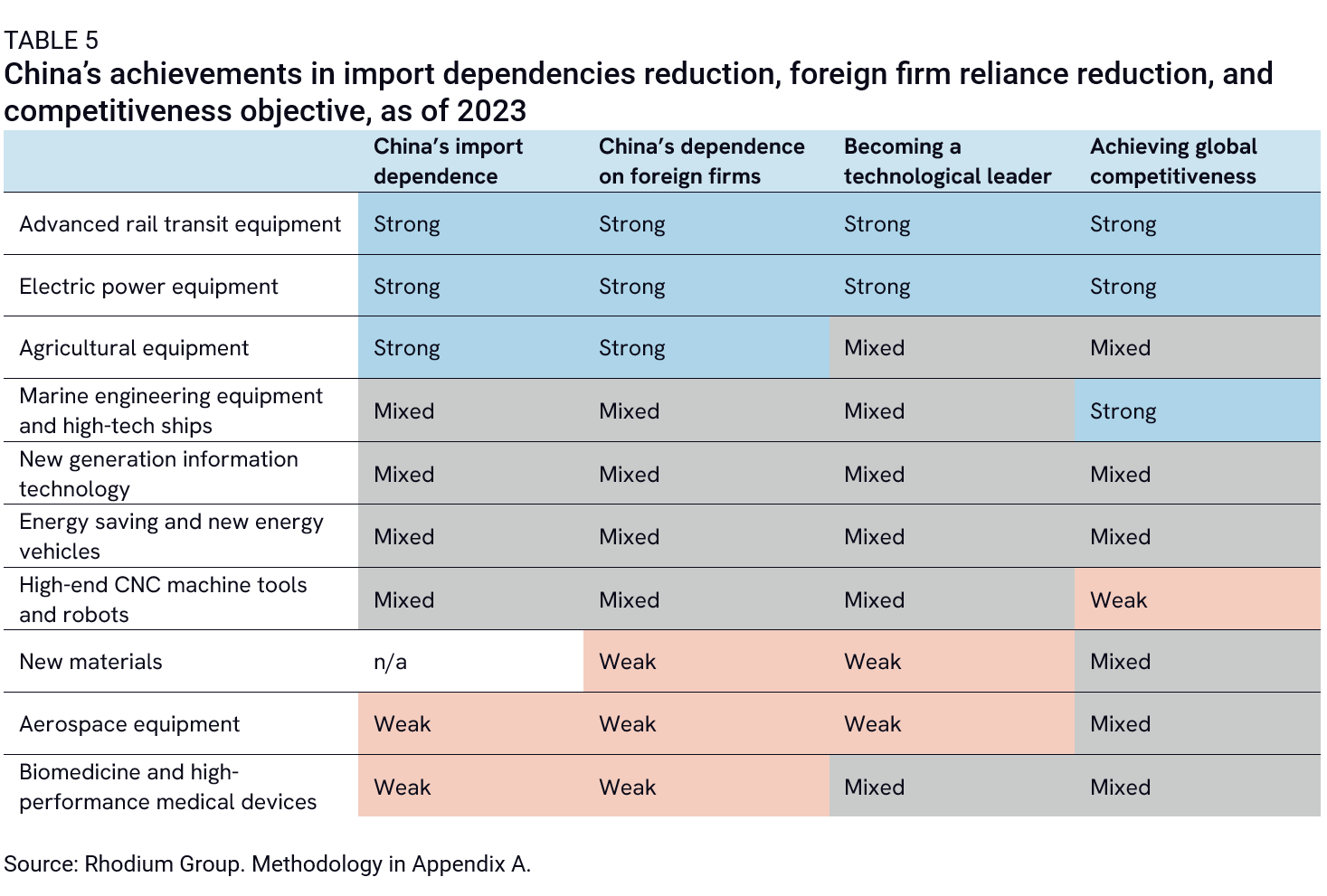

To answer whether MIC25 was successful, we measure outcomes across four of the plan's main categories: China’s import dependency, dependency on foreign companies, global competitiveness, and technological leadership.

A message from the US Chamber of Commerce

The US Chamber of Commerce is pleased to present this independent report, prepared by Rhodium Group, assessing China’s Made in China 2025 (MIC25) policy. This comprehensive analysis highlights the policy’s implications for global manufacturing and innovation. It offers detailed insights into MIC25’s goals, strategies, and impacts, covering financial policies, market access, and national security reviews.

This report is an independent product of Rhodium Group. Its unbiased and rigorous analysis ensures the credibility and integrity of the paper. This objective assessment of MIC25 involved extensive research, including interviews and surveys with industry experts, policymakers, and other stakeholders.

The US Chamber is dedicated to providing accurate and reliable information to our members and policymakers. Our aim is to support informed decision-making and sound policy development. This report reflects the US Chamber’s commitment to transparency and excellence, empowering our members and policymakers with the knowledge needed to navigate global economic policies.

Executive summary

Made in China 2025 (MIC25) was unveiled in 2015 as a sweeping industrial policy to transform China into a global leader in advanced manufacturing by 2025. The policy aimed to reduce the country’s reliance on foreign technology, enhance domestic innovation, and build global competitiveness and competitors in strategic industries such as robotics, semiconductors, and new energy vehicles. Following international criticism—particularly from the Trump administration and other governments concerned about its market-distorting effects—the policy officially disappeared from public discourse in 2018. However, the core objectives of MIC25 have continued under alternative frameworks and initiatives to incentivize localization and provide state support to priority industries.

This report builds on the US Chamber of Commerce’s 2017 analysis of MIC25 to evaluate its performance and long-term impact. In the years following the policy’s launch, financial state support intensified, though often through indirect channels. Tax benefits aimed at innovation surged by an average annual rate of 28.8% between 2018 and 2022, and the proportion of companies enjoying additional deductions and tax reductions more than quadrupled between 2015 and 2023. State investment through government guidance funds increased more than five-fold between 2015 and 2020. Market barriers, particularly involving sales to Chinese government-linked entities and favored domestic competitors compelled foreign companies to localize production to continue to access the market. Though discriminatory practices had been rife before, interviews with market participants confirmed that 2015 was a turning point in many sectors, with such practices growing and becoming increasingly targeted at high-tech areas.

But did all of this support actually make MIC25 a success? To answer that question, this report measures outcomes across four main categories: China’s import dependency, dependency on foreign companies, global competitiveness, and technological leadership.

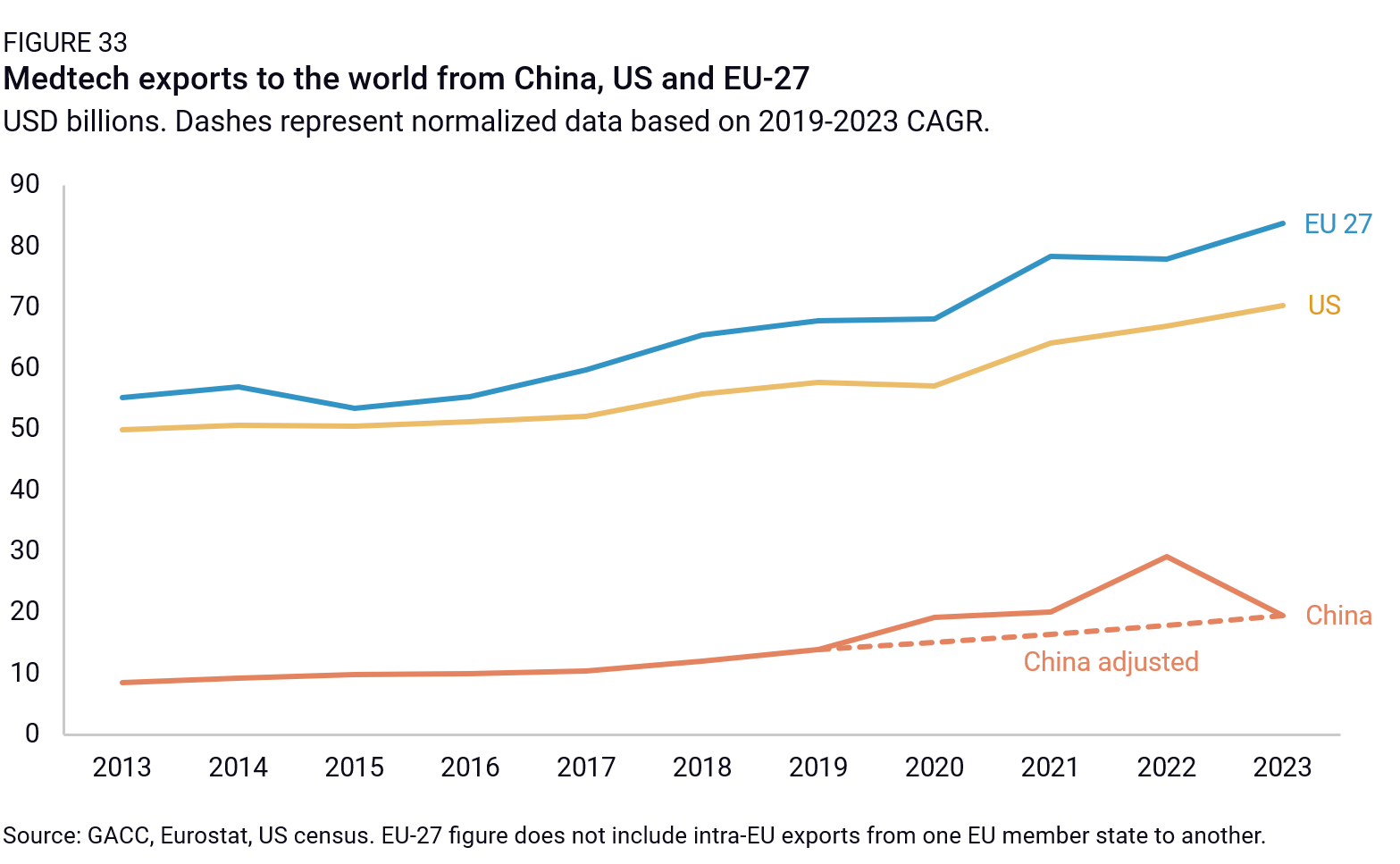

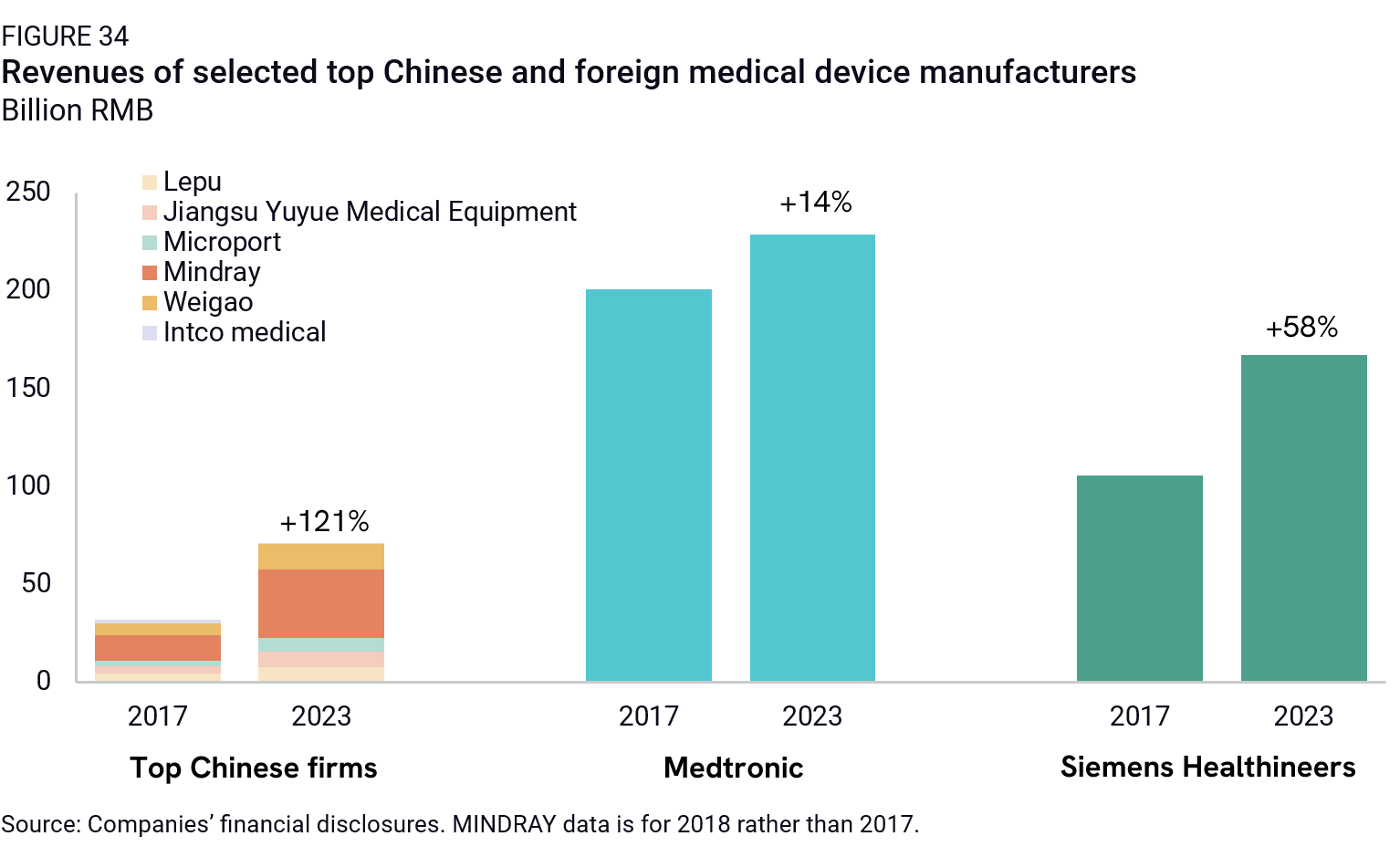

- Reducing import dependencies: China has largely succeeded in reducing its import dependencies by leveraging foreign firms. Beijing has pursued strategies such as requiring or pressuring foreign firms to localize high-tech production and research as a condition for continued access to the market —thereby reducing exports as local production grew—as well as acquiring foreign companies to enable large-scale technology transfers. This strategy has been successful in sectors like memory chips and some medical devices and equipment. Overall, import vulnerabilities are now more limited than ten years ago. However, they persist in a few key areas, where foreign firms have kept their most advanced technologies outside of China. In fact, China’s drive for industrial upgrades has, in some cases, even increased its demand for some highly specialized imported products.

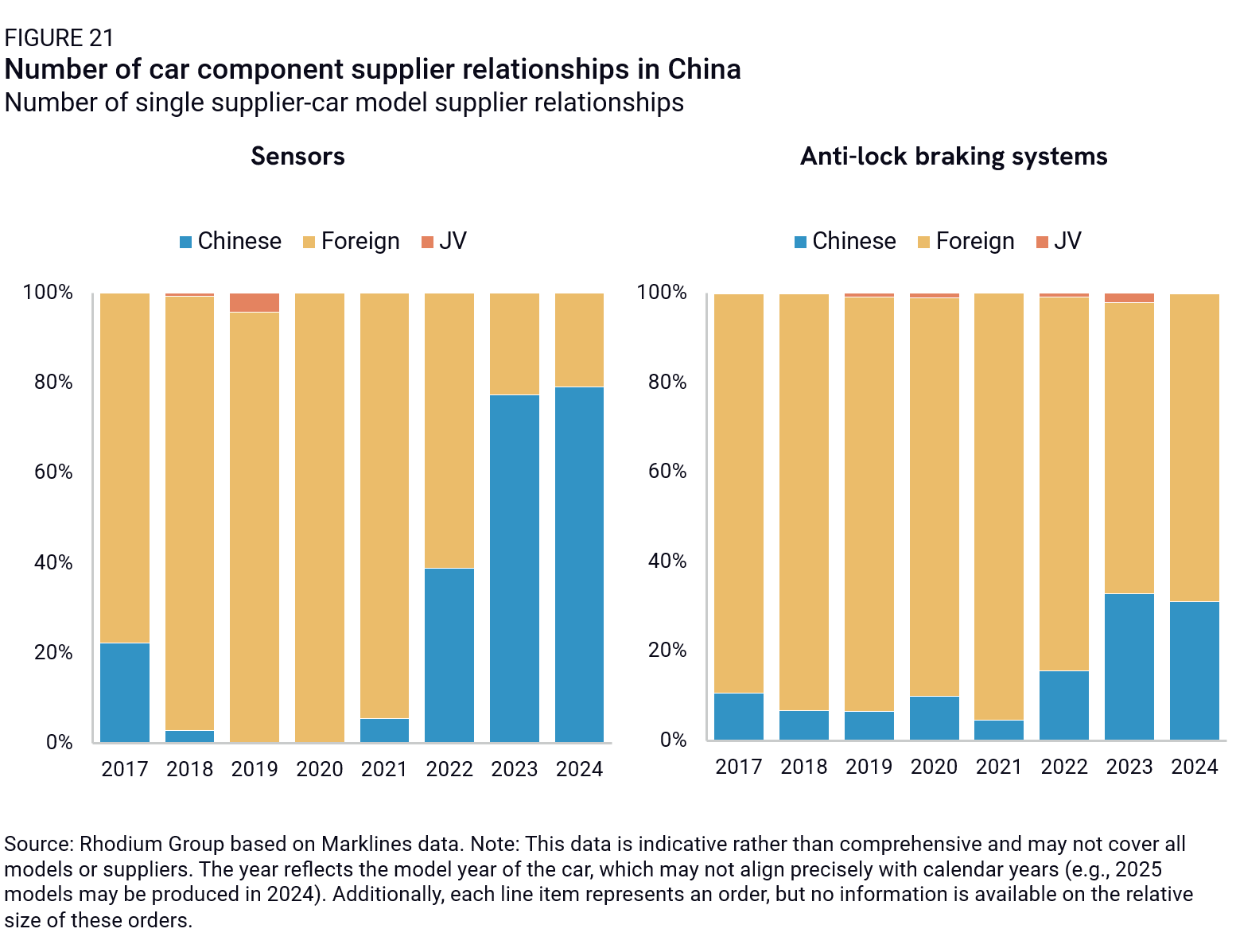

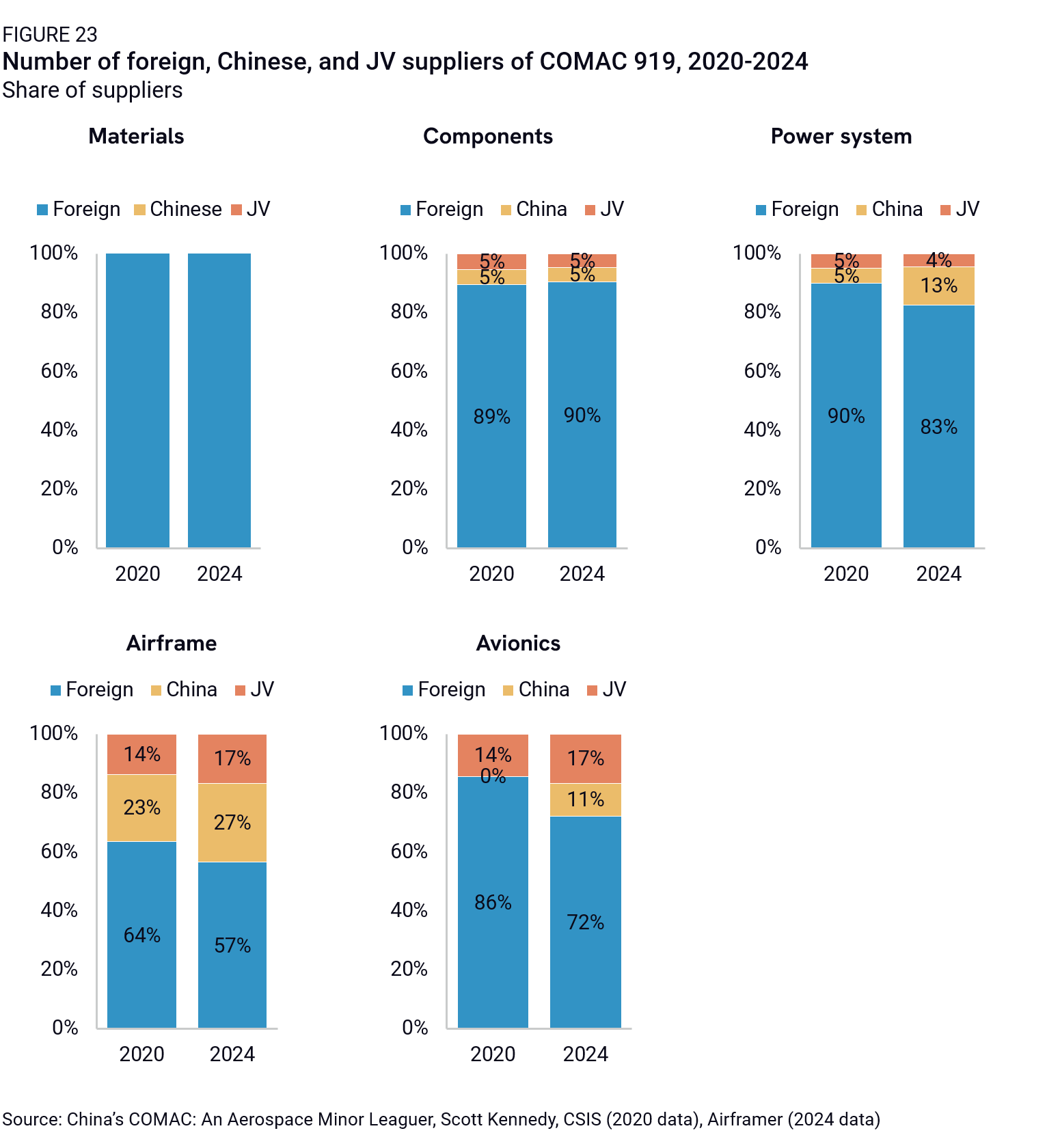

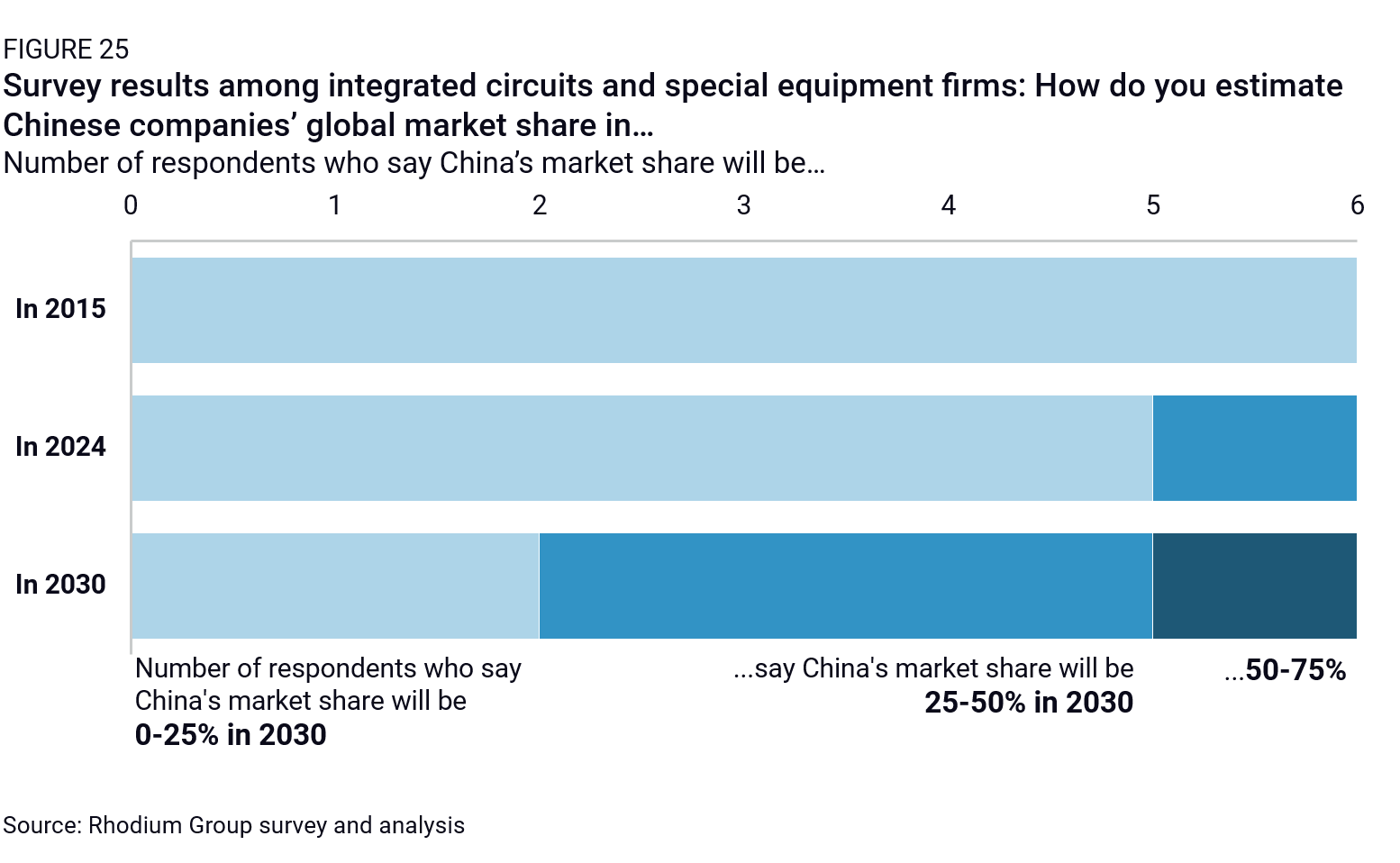

- Dependencies on foreign firms: Newer Chinese firms gained market share at the expense of established foreign companies in all targeted sectors. Stringent restrictions on foreign participation and state support particularly boosted domestic industrial cloud services, new energy vehicles and components, and power generation equipment. Chinese firms also spearheaded new products where foreign firms were previously dominant, like LiDAR, automotive sensors, and high-speed rail brakes. However, China still remains highly dependent on foreign companies in many critical sectors, including biomedicine drugs, high-end machine tools and machinery, commercial aircraft, and cutting-edge semiconductors. Although the market share of domestic companies is poised to increase significantly in the years to come, the most bleeding-edge technologies will remain a challenge to localize.

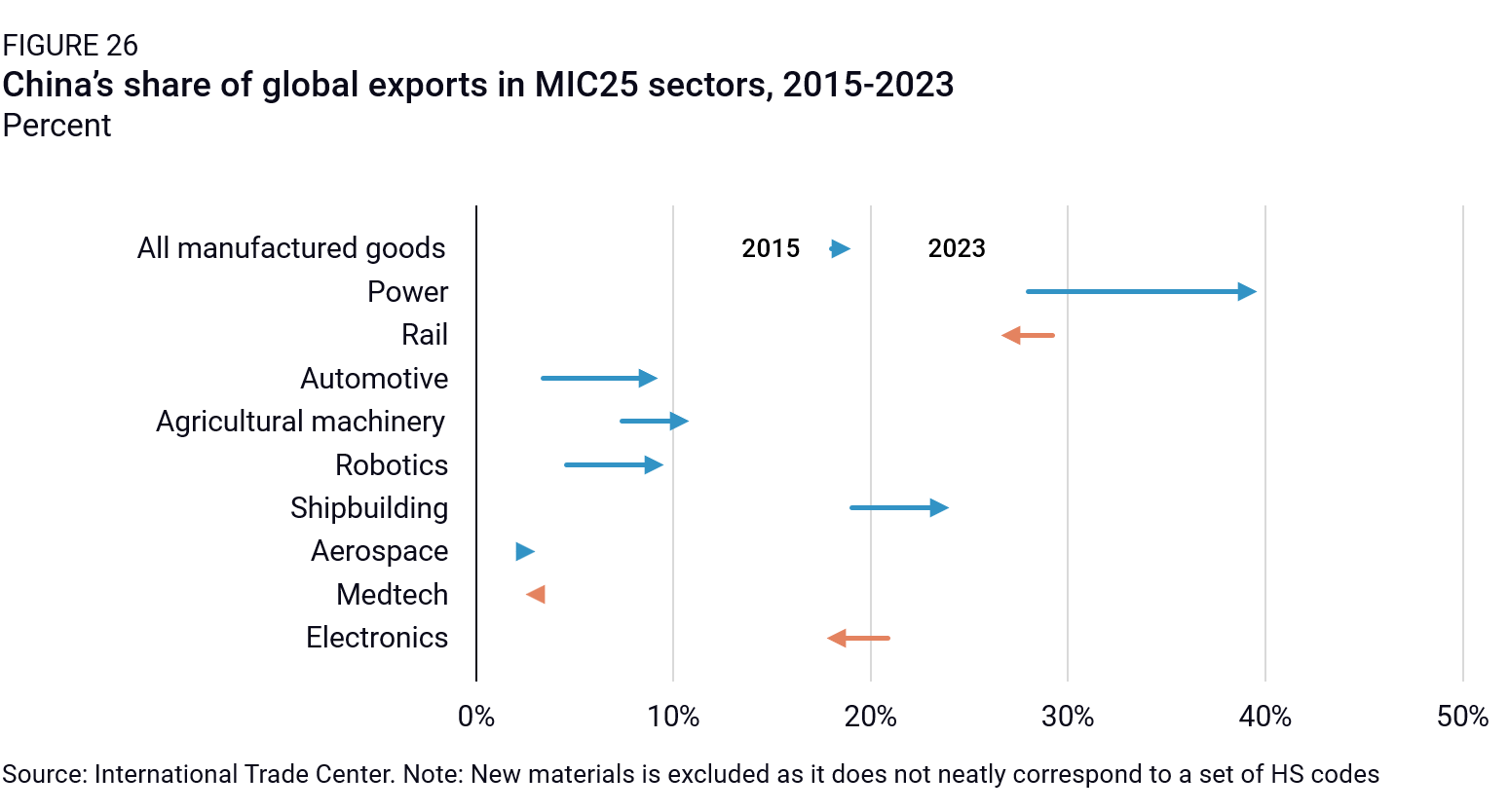

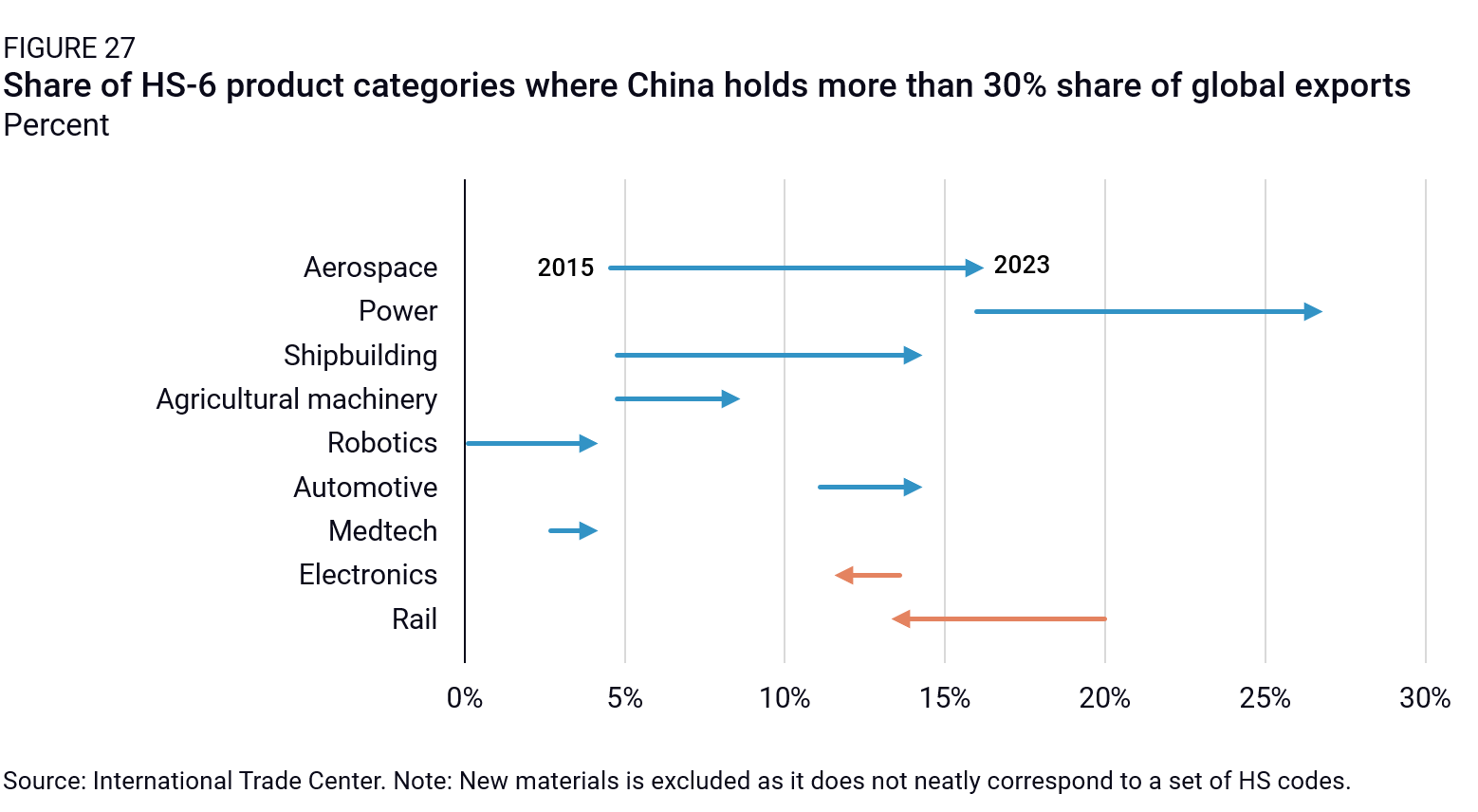

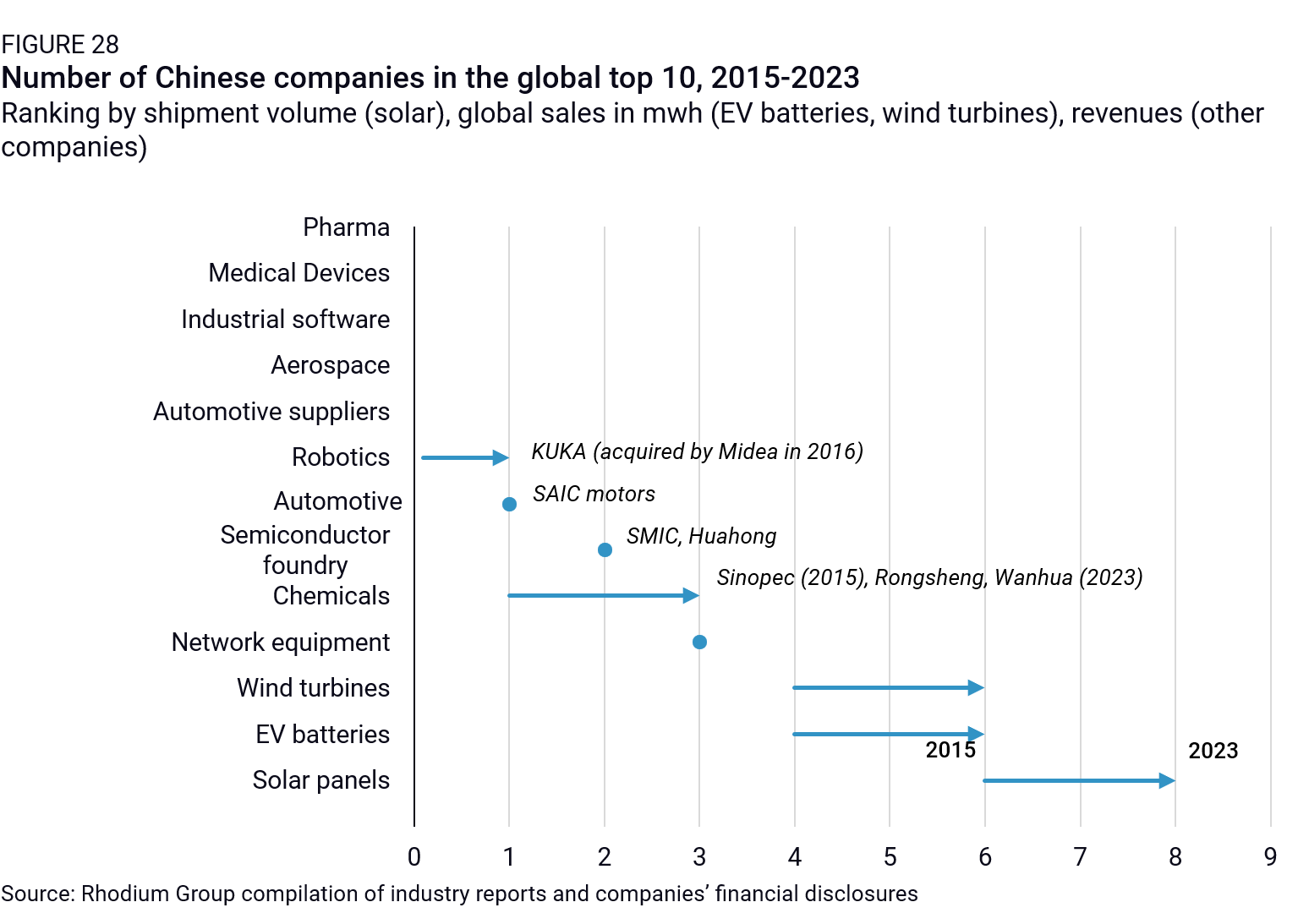

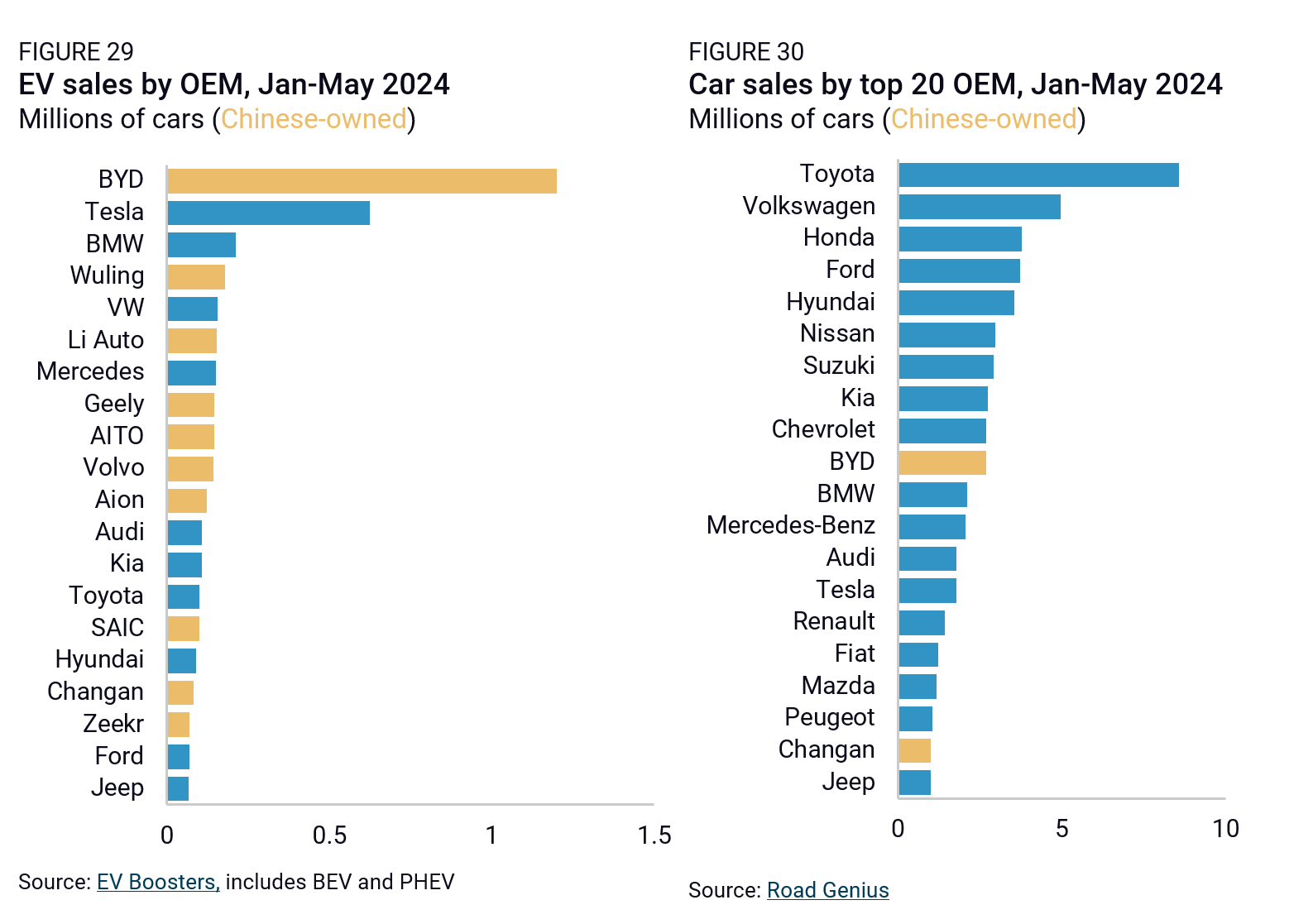

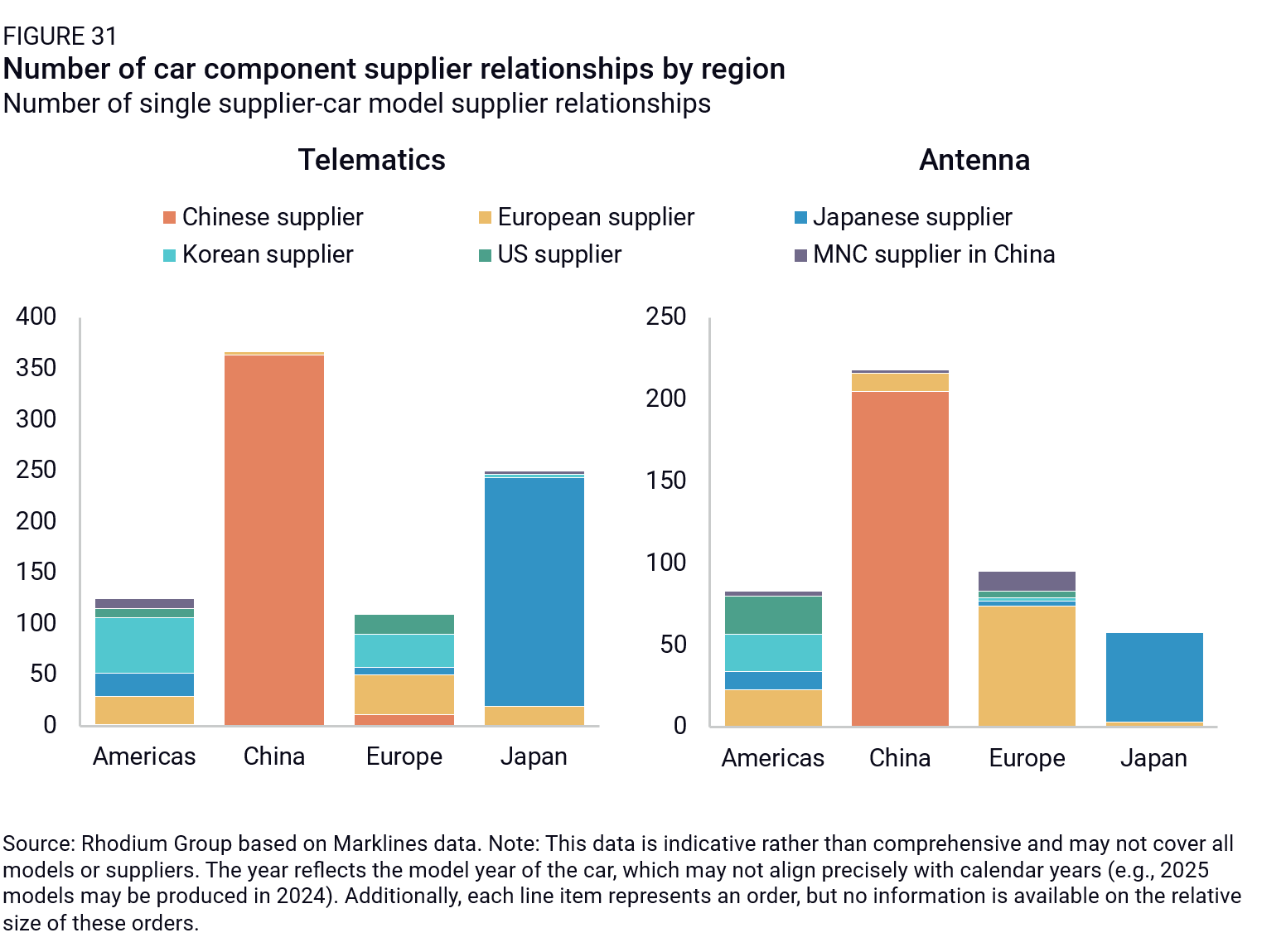

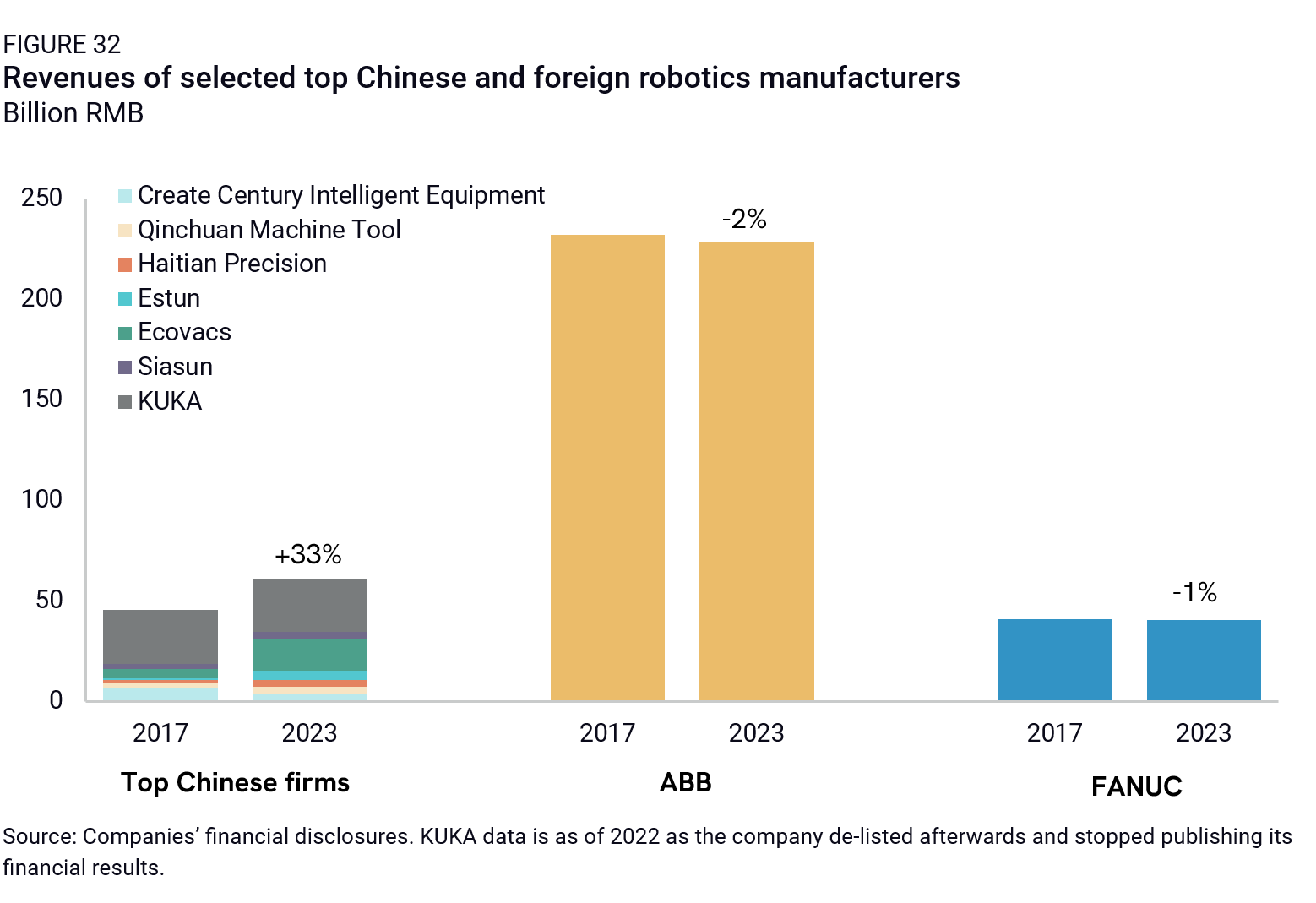

- Competitiveness: Chinese companies are globally competitive on price in many low- and mid-tech sectors and they achieved global competitiveness in some high-tech sectors, including information and communication equipment, clean technologies, EVs and connected vehicles, agricultural equipment, ships, drones, and high-speed rail, among others. They saw their greatest technological advancement and market share growth when they had one or more of three factors: high capital intensity, a large (often state-supported) demand market, and emerging industries without an established global leader. In most MIC25 sectors, Chinese companies generally lag behind their foreign counterparts in global revenue, market share, and cutting-edge technologies. Even in some areas where firms have achieved significant self-sufficiency—like auto antennas and telematics—it has not yet translated into global competitiveness.

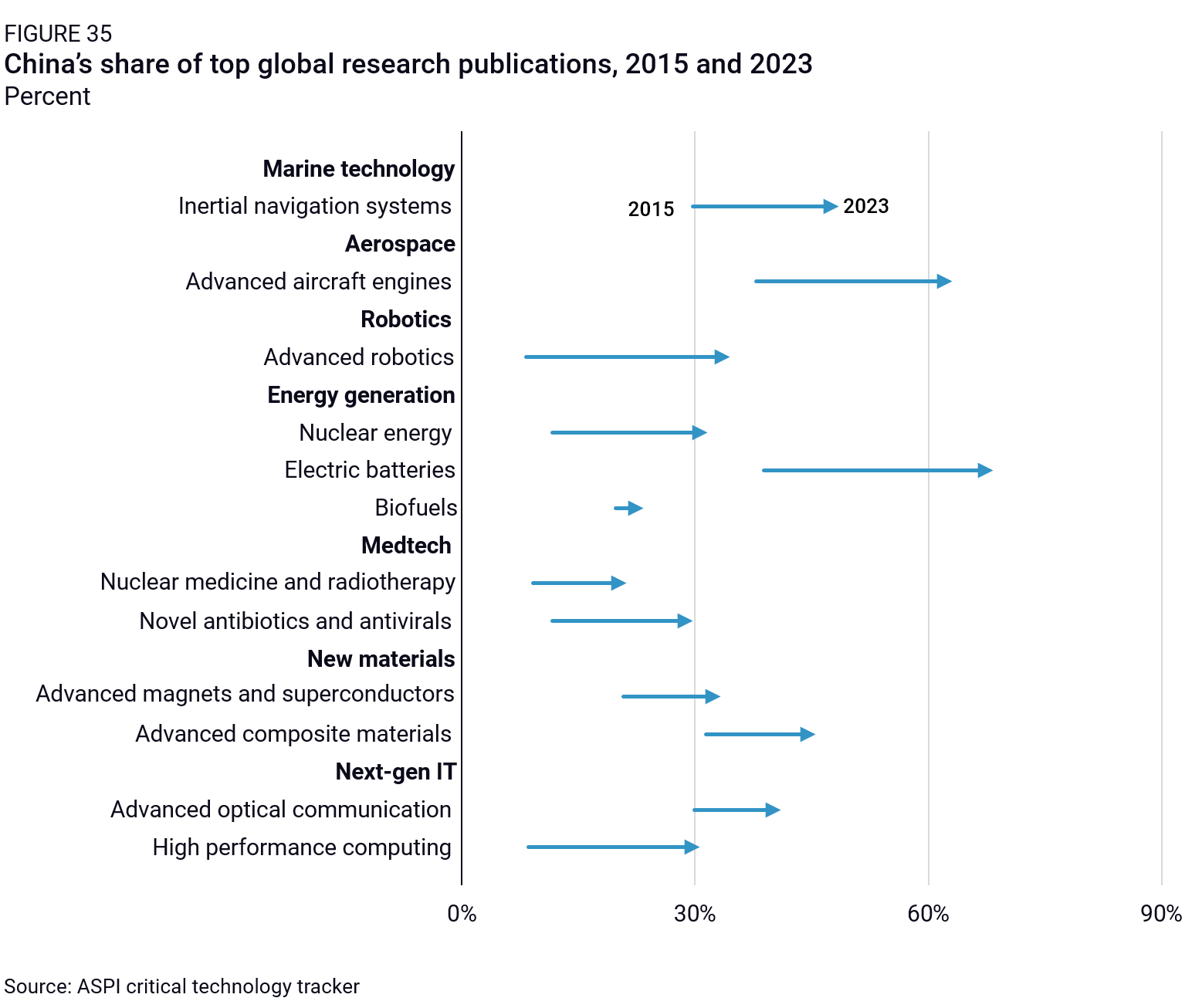

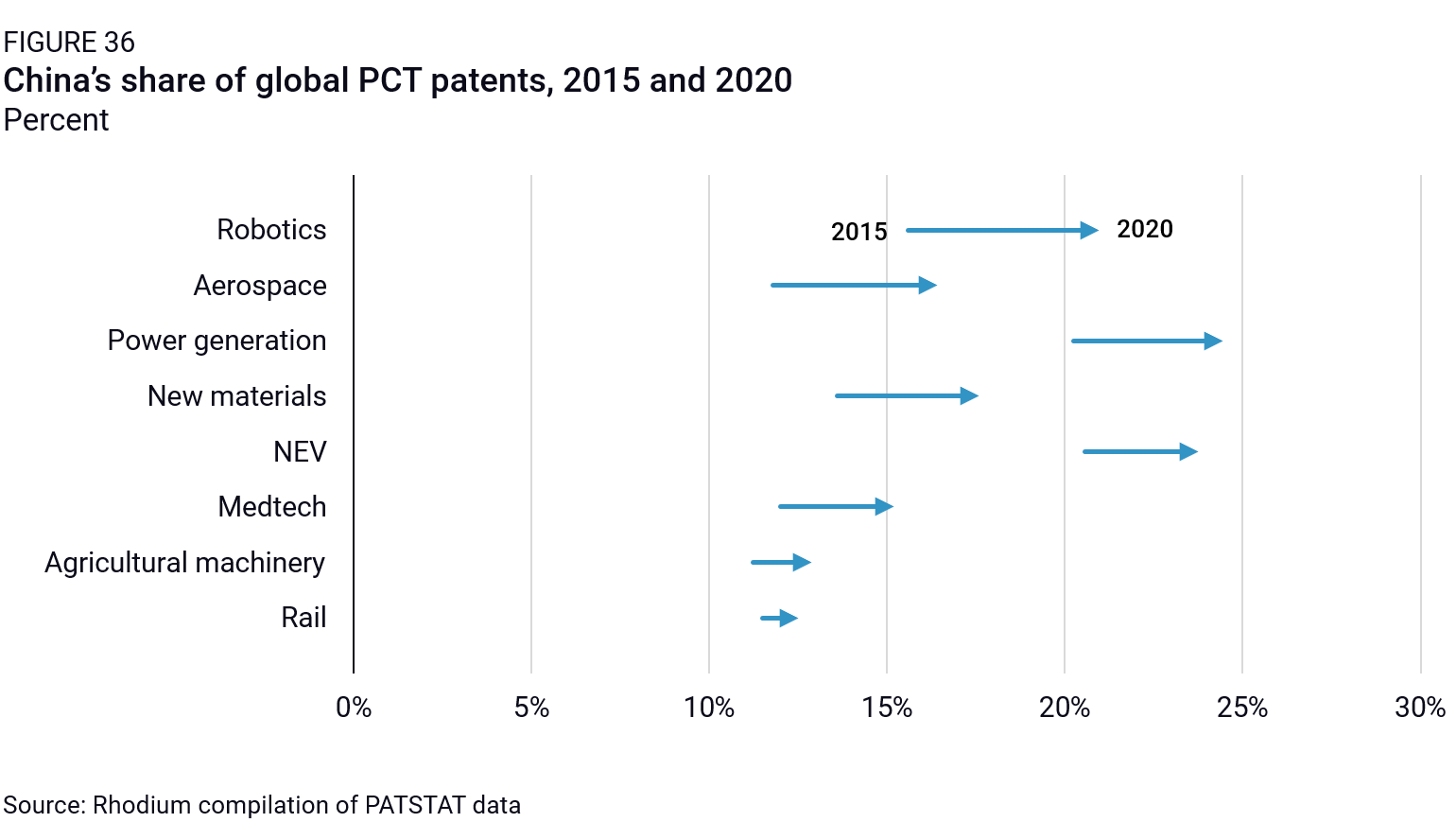

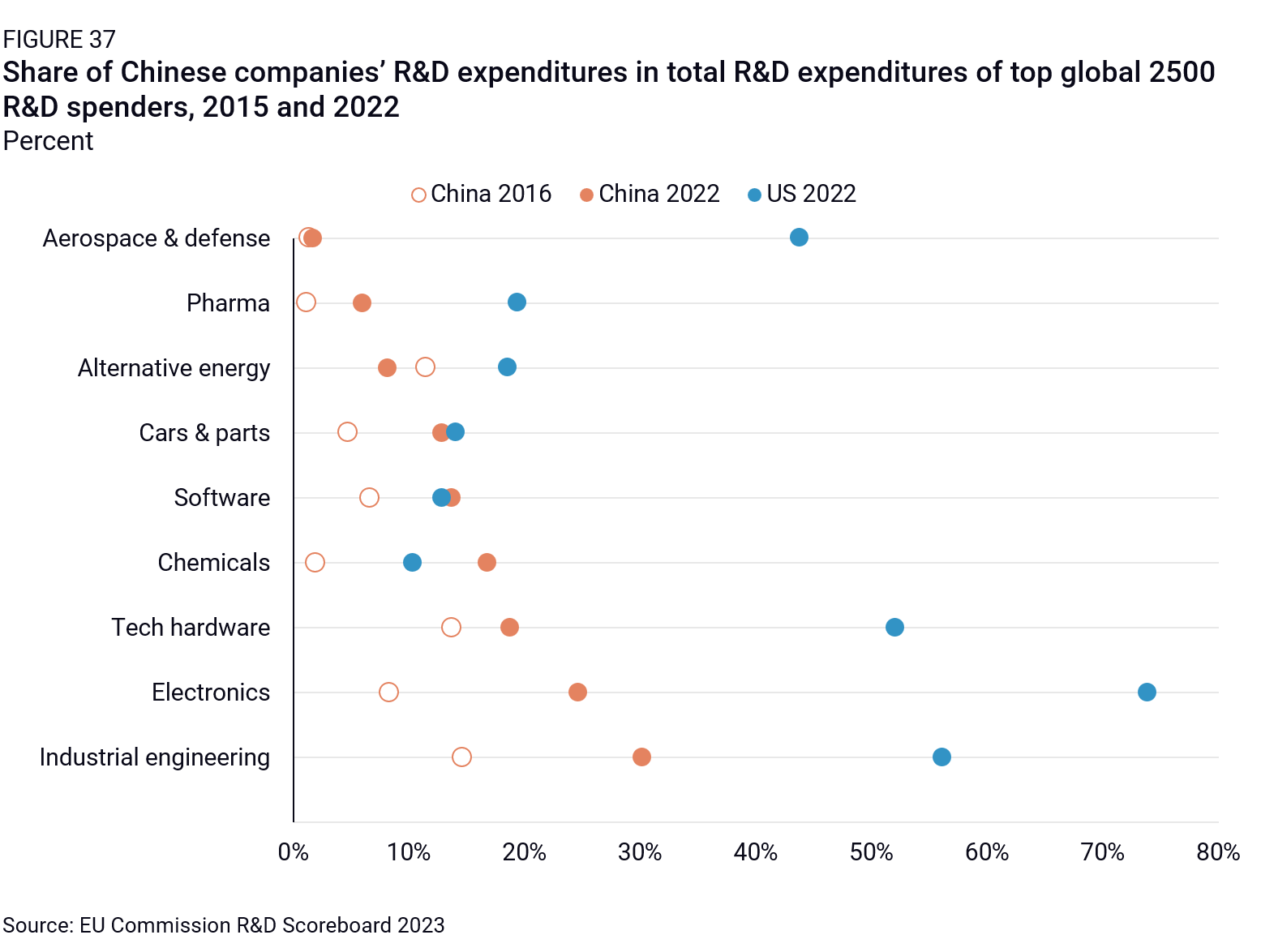

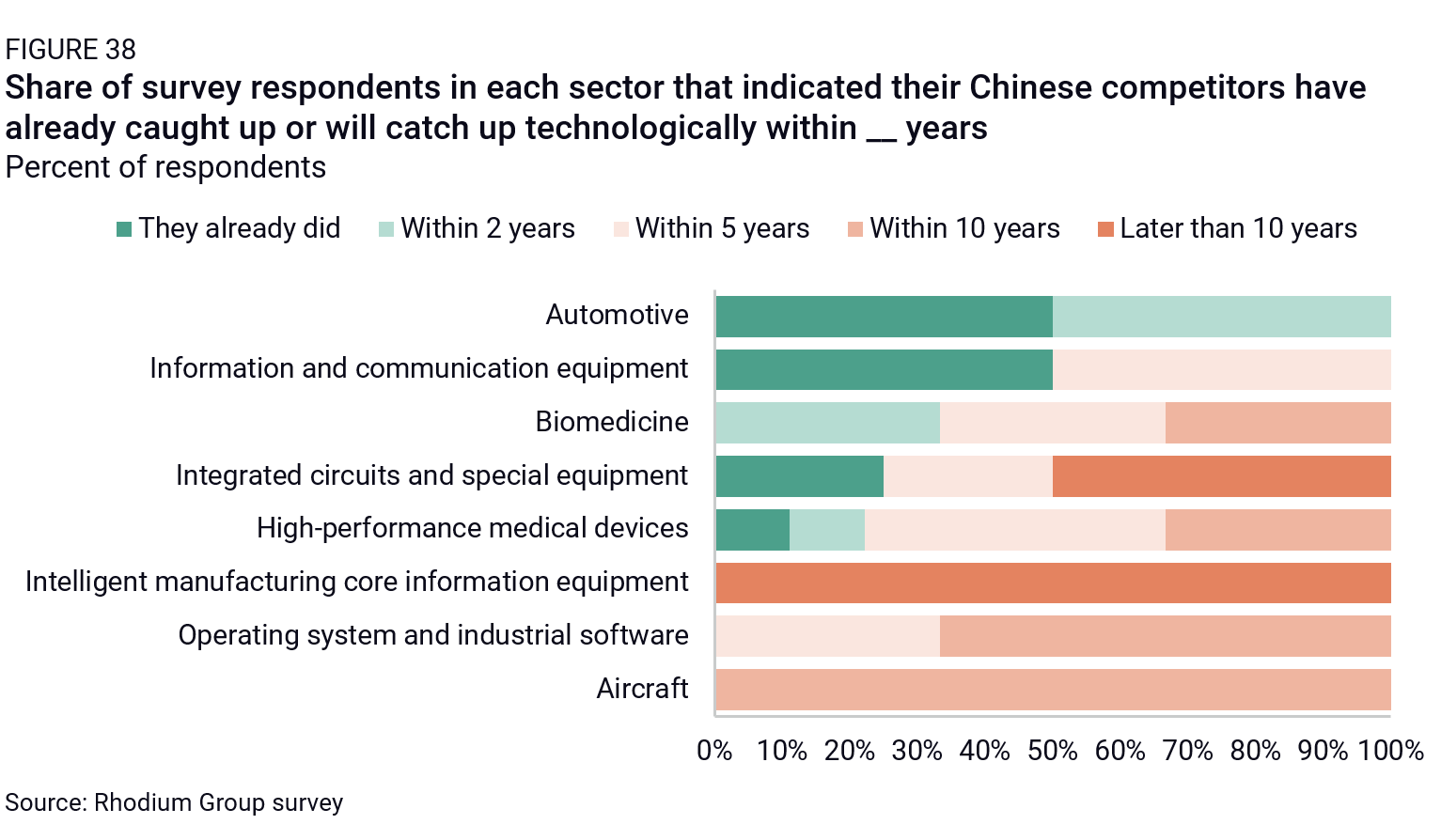

- Technological leadership: Chinese companies have made significant strides in closing the gap with foreign firms and advancing toward the technological frontier, with several sectors already demonstrating signs of parity or even leadership. China’s share of global patents has risen across most industries, with notable gains in electric vehicles, new materials, electronics, and robotics, where its share grew by more than 4 percentage points. In basic research, China’s output is equally remarkable, with its share of global top publications increasing by an average of 18 percentage points between 2015 and 2023. Despite this rapid progress, Chinese firms have yet to achieve parity in many MIC25 sectors, with 62% of foreign firms surveyed predicting that their Chinese competitors would catch up within 5 to 10 years. Key gaps remain in areas such as advanced semiconductors, where Chinese firms still lag significantly behind the global frontier.

Growing opacity around China’s technological capabilities, driven by national security imperatives, complicates efforts to fully assess its position and future trajectory. Nonetheless, Chinese firms appear well-positioned to make significant advances in several high-tech sectors under MIC25, including biotechnology, medical devices, and robotics. Moreover, China’s leadership in artificial intelligence—an area not originally part of MIC25 but now poised to transform global manufacturing and innovation ecosystems—has the potential to reduce barriers to manufacturing innovation and enable future breakthroughs. These developments suggest that China’s trajectory in technological leadership could accelerate in the coming years, with far-reaching ripple effects across global industries.

Our assessment of the results of MIC25 to date indicates the policy has driven substantial progress in building large industrial sectors, even as this success has been mitigated by continuing dependencies, particularly in high-tech components and specialized imports. At the same time, China has successfully created reverse dependencies—areas where the world increasingly relies on Chinese firms and China-based production. While this has long been the case in low- and mid-tech sectors, it is now extending into high-tech areas like electric vehicles, solar energy, and telecommunications and is reshaping competitive dynamics in industries ranging from clean technologies to robotics.

In addition, overlapping technological achievements across sectors have arguably created a reinforcing effect that will amplify China’s progress and grip over global supply chains in the years to come. Strengths in foundational technologies such as advanced materials, semiconductors, and artificial intelligence catalyze advancements in downstream applications like robotics, new energy vehicles, and telecommunications. These will likely continue to accelerate innovation and competitiveness in the future and may position China to deepen its influence across a wide range of strategic sectors globally.

But despite important areas of consequential success, Beijing’s industrial policies have had unintended consequences, particularly for economic growth. China’s industrial policy ecosystem has led to profound waste, as local governments piled in with duplicative and inefficient projects. Over the past decade, total factor productivity growth has stagnated and overall economic growth has slowed as the government struggles to transition the economy to a more sustainable model. The emphasis on industrial policy has also contributed to a stall in broader economic reforms, straining relations with China’s key partners. Beijing’s systemic bias toward supporting producers over households or consumers has created a growing imbalance between domestic supply and demand, especially in sectors like automotives, EV batteries, and legacy semiconductors. This industrial overcapacity has contributed to a rapidly expanding trade surplus, intensifying friction with China’s trading partners and adding pressure to its innovation and industrial ecosystems. At the same time, local governments are grappling with the mounting fiscal costs of these policies, forcing difficult trade-offs in their expenditures and further exposing the economic strains of this approach.

Overall, China’s economic growth is currently slowing, and significant imbalances and inefficiencies are hindering its progress. However, China’s economy has also benefitted from a remarkable surge in industrial and technological capabilities and performance tied directly to MIC25. That surge, in turn, is driving China’s competitiveness and innovation in MIC25 sectors on a global scale. Given the sheer size of China’s economy and its strategic policy goals, this duality highlights how the country can simultaneously experience slowing growth and strengthening industrial and technological competitiveness. This momentum will likely continue in the coming years, although funding constraints from slower growth and the potential dampening effect of increased state control over innovation could lower this trajectory in the longer term.

Assessing the impact of Made in China 2025

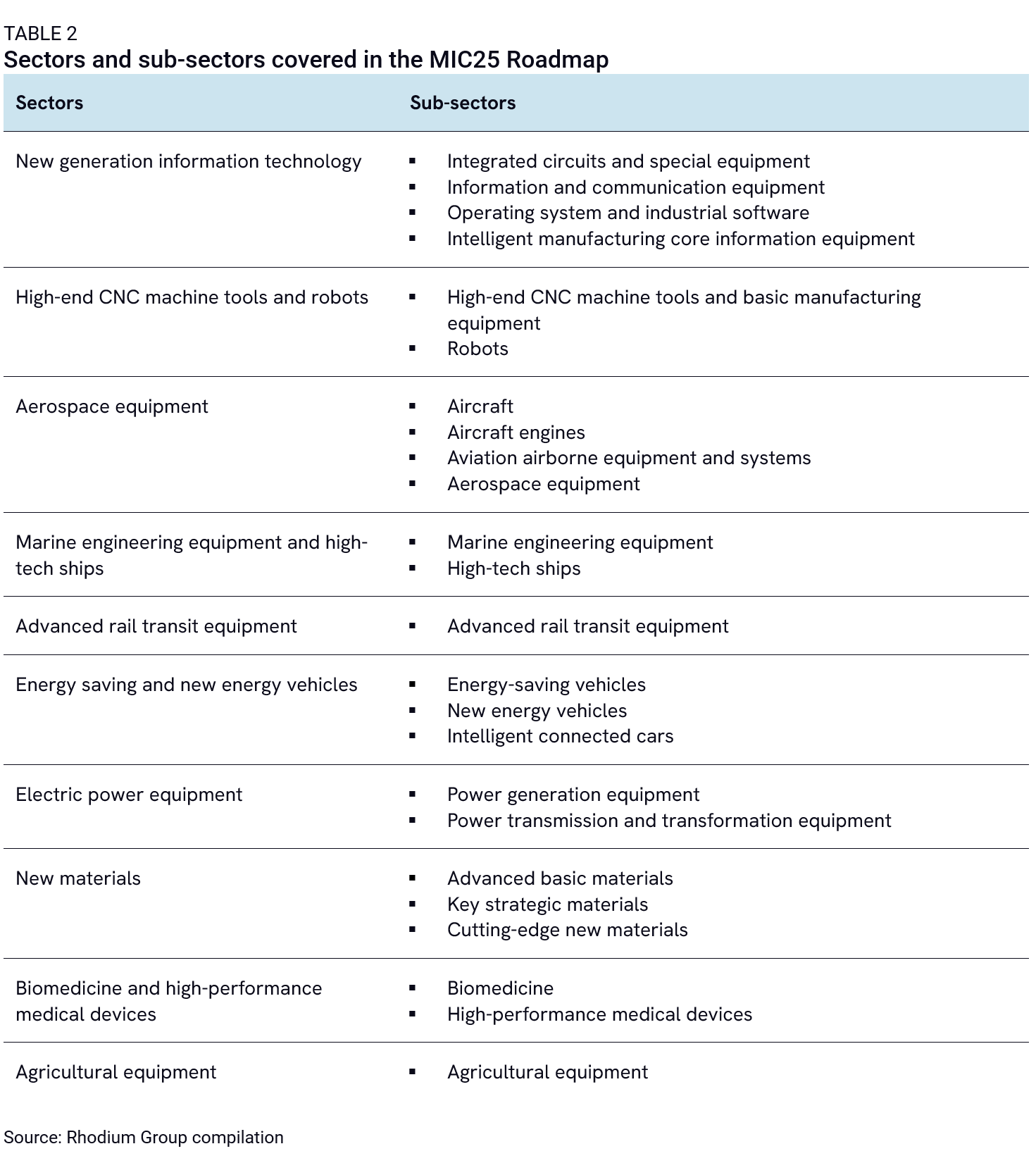

In 2015, China unveiled its Made in China 2025 (MIC25) strategy—a ten-year blueprint aimed at transforming the country into a global leader in advanced manufacturing. This comprehensive plan targeted ten strategic industries, including next-generation information technology, aviation, rail, vehicles, advanced medical technologies, and agricultural machinery, among others. Accompanying this plan was the “Made in China 2025 Major Technical Roadmap,” which outlined detailed, quantified targets for market shares, domestic self-sufficiency, and technological development in key sectors.

None of this was entirely new. As early as 2010, the US Chamber of Commerce highlighted China’s intensifying efforts to reduce reliance on foreign technologies and promote “indigenous innovation” through industrial policies. However, MIC25 marked a significant escalation of these long-standing practices. From the outset, the strategy sparked concern among policymakers and businesses worldwide. The US Chamber’s 2017 report on MIC25 provided a detailed examination of the policy’s approach, documenting its ambitious goals, quantified targets, and reliance on state-led strategies to tilt the playing field in favor of domestic companies. The report raised concerns about how MIC25 signaled a shift further away from market economy norms, with China reinforcing government control and implementing discriminatory industrial policies to tilt the playing field in favor of domestic companies and reduce market access to US and other non-Chinese firms. Observers also argued this strategy would distort global markets, cause overcapacity, and exacerbate economic tensions, while also raising questions about the broader costs to China’s own economic growth.

By 2018, the US had placed tariffs on Chinese imports believed to directly benefit from MIC25 policies. These tariffs targeted $50 billion worth of goods across two tiers explicitly citing industries aligned with MIC25. The US also tightened export controls and reformed its screening process for foreign investments to curb Chinese efforts to acquire critical technologies. In parallel, international pressure mounted, with governments calling for China to halt market-distorting subsidies and overcapacity in MIC25-targeted sectors like steel, autos, and semiconductors. In response to global backlash, including from the US and Europe, the Chinese government began de-emphasizing the MIC25 branding in official communications by 2018. However, the program continued under alternative frameworks, such as “high-quality growth” and “dual circulation,” backed by ever-larger subsidies, import substitution policies, and a growing emphasis on economic securitization.

This report builds on the 2017 Chamber analysis by examining the impacts of MIC25 and its legacy. A decade after MIC25 was introduced, we can see its impacts—both positive and negative—more clearly. Chinese firms have achieved significant success in sectors such as electric vehicles (EVs) and renewable energy, gaining dominance in global markets and driving technological advancements. However, the structural imbalances resulting from China’s industrial policies—a strong emphasis on channeling state and commercial resources into high-tech industries with minimal fiscal support for household consumption—have contributed to slow economic growth and persistent overcapacity. These imbalances have become even more pronounced since the COVID-19 pandemic, with notable repercussions for global trade. Between 2019 and 2022, China’s share of global manufacturing expanded by 3.5%, and its share of global exports increased by 2.8%, forcing significant adjustments in the manufacturing sectors of other countries.

As countries grapple with how to respond to China’s industrial policies, many are pursuing a mix of defensive measures and proactive, homegrown industrial strategies. These efforts have sparked intense debates over their effectiveness, the risks of overinvestment and market distortions, and their implications in an era of intensifying geopolitical risk. The global landscape has shifted significantly, shaped by challenges such as the COVID-19 pandemic, rising tensions between China and its trade partners, and the evolving China-Russia partnership. These factors have amplified concerns over economic security, supply chain resilience, and technological sovereignty, further complicating the debate over industrial policies. In this context, understanding the outcomes of MIC25 is not just important for contextualizing China’s policies, it is also critical for framing the policy responses of other economies. By evaluating China’s experience, we aim to provide actionable insights into the broader costs and benefits of industrial policies and offer lessons for designing more balanced and effective strategies in the face of an increasingly competitive global landscape.

This report evaluates the outcomes of MIC25 at a granular level, assessing its effects on market competition, trade, innovation, and firm competitiveness across sectors. In particular, we aim to answer three key questions:

- Has industrial policy in China since 2015 evolved toward greater state financial support and discriminatory practices?

- Has MIC25 achieved its intended outcomes in self-sufficiency and global market share in targeted sectors?

- What are the broader impacts of MIC25 on trade dynamics, innovation, and firm-level competitiveness?

To answer these questions, we have combined data analysis from a wide range of sources with surveys and interviews conducted with US Chamber of Commerce members operating in China. By analyzing specific sectors and sub-sectors, we aim to quantify and detail the impacts of MIC25, identifying areas where Chinese firms have succeeded and others where they continue to lag behind their global competitors.

Chapter 1: MIC25’s role in China’s evolving industrial policy 2025

Made in China 2025 (MIC25) is a significant policy and a crucial turning point in China’s industrial policy framework, but it represents just a piece of China’s broader strategy. China’s industrial policies began well before 2015 and have continually adapted to address both geopolitical and domestic challenges. This chapter examines these developments, emphasizing how MIC25 has transformed industrial policy priorities, funding, and the regulatory ecosystem.

The long legacy of industrial policy in China

This report draws on the existing literature to define industrial policy as “any type of selective, targeted government intervention that attempts to alter the sectoral structure of production toward sectors that are expected to offer better growth than would occur in the (non-interventionist) market equilibrium.”1 This definition draws a distinction between horizontal policies (e.g., boosting R&D or employment across the economy) and sector-specific support that distorts the structure of the economy. It encompasses not only traditional subsidies—direct grants, tax breaks, or access to finance and inputs at below-market rates—but also other forms of market distortion, including restrictions on market access, a discriminatory business environment, and the ability of the championed Chinese businesses to draw on government resources and capabilities where helpful.

While all governments offer some form of support to boost favored industries, China’s approach is distinguished by an extensive, whole-of-government industrial policy that often disrupts fair market competition.2 Under the current economic system that China scholars call “party-state capitalism,”3 industrial policy is not limited to specific tools but is implemented through widespread state involvement across the economy.

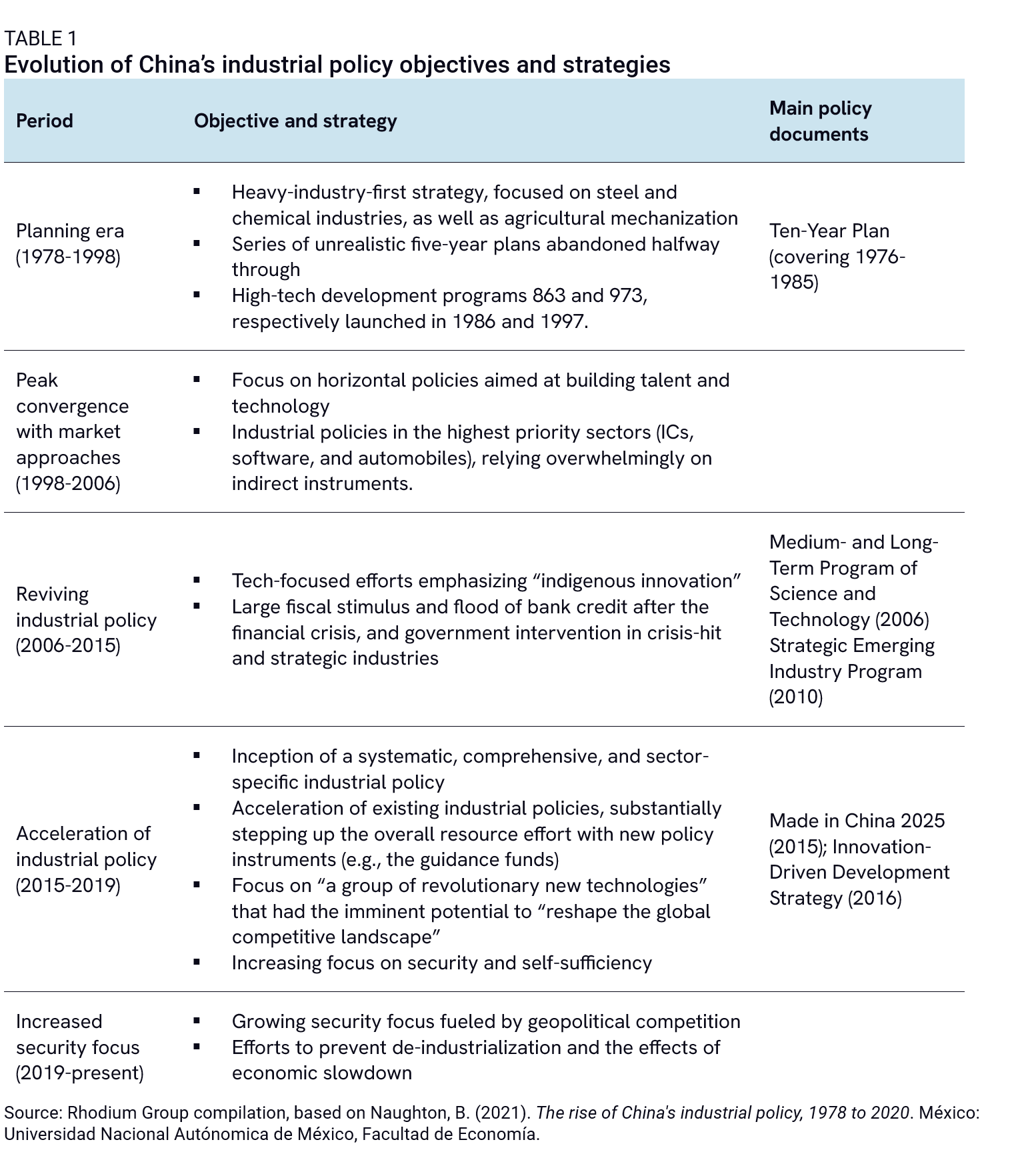

However, China’s industrial policy has not always been constant. In the early 2000s, while the economy remained largely state-directed, Beijing simultaneously created space for increased participation by private and foreign firms and gradually moved away from strict central planning (Table 1).

The lighter-touch approach to China’s industrial policy was successful in a number of ways. Before 2008, China’s huge protected market was instrumental in promoting domestic companies in the early stage of industry development while enlisting the help of foreign companies through trade and FDI. Fast-growing consumer demand and major strides in reducing trade and investment barriers gave multinational corporations (MNCs) a compelling reason to invest in China. At the same time, China regulated investment and procurement to encourage foreign firms to localize production in key sectors if they wanted to access the market—effectively exchanging “market share for technology.”

A prime example of this strategy is China’s high-speed rail (HSR). Under the “Long-Term Plan of HSR Network” approved in 2004, China sought foreign high-speed rail manufacturers to enter its market in exchange for technology transfer. This involved three key principles: importing advanced technologies, organizing joint design and production with foreign partners, and developing a Chinese HSR brand. Major international players, such as Kawasaki, Bombardier, Alstom, and Siemens, were invited to participate in tenders from 2004 to 2006, requiring them to collaborate with Chinese manufacturers in the bidding process.

This approach was effective in developing domestic capabilities in HSR and other sectors. By 2009, domestic HSR manufacturers captured about 85% of the domestic market.4 In 2008, solar cell production in China accounted for 40% of the global output. The same year, Chinese companies accounted for 79% of the domestic cardiovascular stent market, up from 5% in 2004. In 2011, China accounted for more than 30% of global exports of permanent magnets used for wind turbines.5 Overall, China’s share of global manufacturing rose from 5% in 2001 to 12% in 2008, while China’s share of global exports reached 9% the same year.

Despite some successes by local companies, these early “made in China” achievements were in large part the product of foreign investment, with foreign enterprises accounting for more than half of China’s exports in 2008. Much of the made-in-China phenomenon was still concentrated in low-value added products. As of 2010, more than two-thirds of Chinese processing trade enterprises focused on labor-intensive production. China’s export-oriented economy, with net exports accounting for 8% of GDP in 2008,6 was also dependent on global markets.

The financial crisis of 2008-2009 helped bring about a new phase in China’s industrial policy. Beijing reacted to the crisis by unleashing an unprecedented flow of financial resources to stimulate domestic production. The size of the banking system quadrupled in just eight years, between 2008 and 2016. Chinese manufacturing firms received ample low-interest loans with little regard for firm productivity, leading to a rapid increase in their production capacity. High investment rates modernized China’s infrastructure and production technology, supporting its rise as a global manufacturing powerhouse.

Simultaneously, Beijing intensified industrial programs dedicated to developing domestic innovation capacities. The government had already planned to fund 16 “megaprojects” as part of the 2006 Medium to Long term Program of Science and Technology (MLP), but that funding really skyrocketed after 2008, from RMB 6 billion in 2008 to RMB 33 billion in 2009 and RMB 50 billion annual in subsequent years.7 The “Strategic Emerging Industries” (SEI) program, issued in 2009 marked the beginning of a full-fledged targeted industrial policy aimed to develop innovative domestic industries.2

This approach was effective in driving China’s industrial growth. By 2015, China accounted for 26% of global manufacturing value-added, against 14% in 2008.8 Local companies made some impressive achievements in the electronics and medical device sectors. China’s share of global manufacturing exports rose from 12% to 18% over the same period. In 2015, Xiaomi and Huawei were the top vendors of smartphones in China, with Apple and Samsung ranking third and sixth, respectively. Domestic companies accounted for 25% of the domestic color doppler ultrasound market in 2016, against only 10% in 2010. The market share of Chinese robot suppliers grew to 29% in 2015. Chinese-branded cars accounted for 25% of the domestic market in January 2015.9 Overall, low-tech goods accounted for only 28% of China’s exports in 2014, compared with 41% in 2000.

Nonetheless, China remained reliant on foreign firms for many high-tech products, and the limitations of its industrial policy were becoming increasingly clear. Chinese semiconductor suppliers represented 1.9% of total worldwide revenue in 2013, up from 0.2% in 2003 but below earlier market expectations. While China was the second-largest domestic aviation market in the world, it still did not have its own large commercial aircraft. China still relied on foreign manufacturers such as GE HealthCare, Siemens, and Philips for most of its high-tech medical devices, including MRI machines and CT scanners. Labor productivity in China was still several times lower than in most industrialized economies. China’s debt-driven industrial strategy was also reaching a turning point. The widespread moral hazard built in this model generated financial risk and a heavy debt burden, with China’s debt-to-GDP ratio growing to 254% in 2016, up from only 142% in 2006.

MIC25: A shift in China’s industrial policy approach

The perceived insufficiencies of China’s industrial policy motivated the new Xi administration to act, in the form of the Made in China plan issued in 2015 and the Innovation-Driven Development Strategy (IDDS) plan issued a year later. A ten-year action plan published in 2015, MIC25 was designed to propel China to the forefront of technological innovation and increase the global competitiveness and market shares of Chinese companies. According to the MIC25 plan’s own assessment, “China is still in the process of industrialization, and there is still a major gap compared with advanced countries. The manufacturing industry is large but not strong. The capacity for independent innovation is weak, and key and core technologies and high-end equipment are highly dependent on foreign countries.” The plan emphasized the development of critical technologies across various advanced manufacturing industries, including information technology, new energy vehicles, robotics, biomedicine and medical devices, and aerospace (Table 2).

The MIC25 plan was a flexible high-level strategy, gradually translated into specific implementation plans through a multitude of central, local, and industry-specific documents over the following years. Within the first two years, a dozen additional documents provided detailed guidance for its rollout. This was followed by implementation regulations at the ministry level, resulting in a massive body of 445 national policy documents by the end of 2018. Although MIC25 was primarily focused on hardware and advanced manufacturing, the significance of artificial intelligence (AI) in Beijing’s industrial policy strategy expanded considerably after 2015. The MIC25 strategy influenced and intertwined with broader initiatives, such as the “Internet+” strategy launched in 2015 and the New-Generation Artificial Intelligence Development Plan introduced in 2017. Together, they formed a network of mutually reinforcing policies aimed at accelerating economic modernization and positioning China as a global leader in manufacturing, technology, and innovation.

Local governments played a key role in translating the national vision into actionable directives, developing localized implementation plans and pilot projects, frequently with government funds, aligned with MIC25’s objectives. Over time, the goals of MIC25 were refined through central and local iterations based on successes and challenges. The 2018 update of the Technology Roadmap—a significant milestone—adjusted priorities to reflect technological advancements and China’s increasing emphasis on self-reliance. The evolution of MIC25’s priorities is also evident in subsequent implementation plans, with a growing focus on areas such as “green manufacturing” and internet technologies.

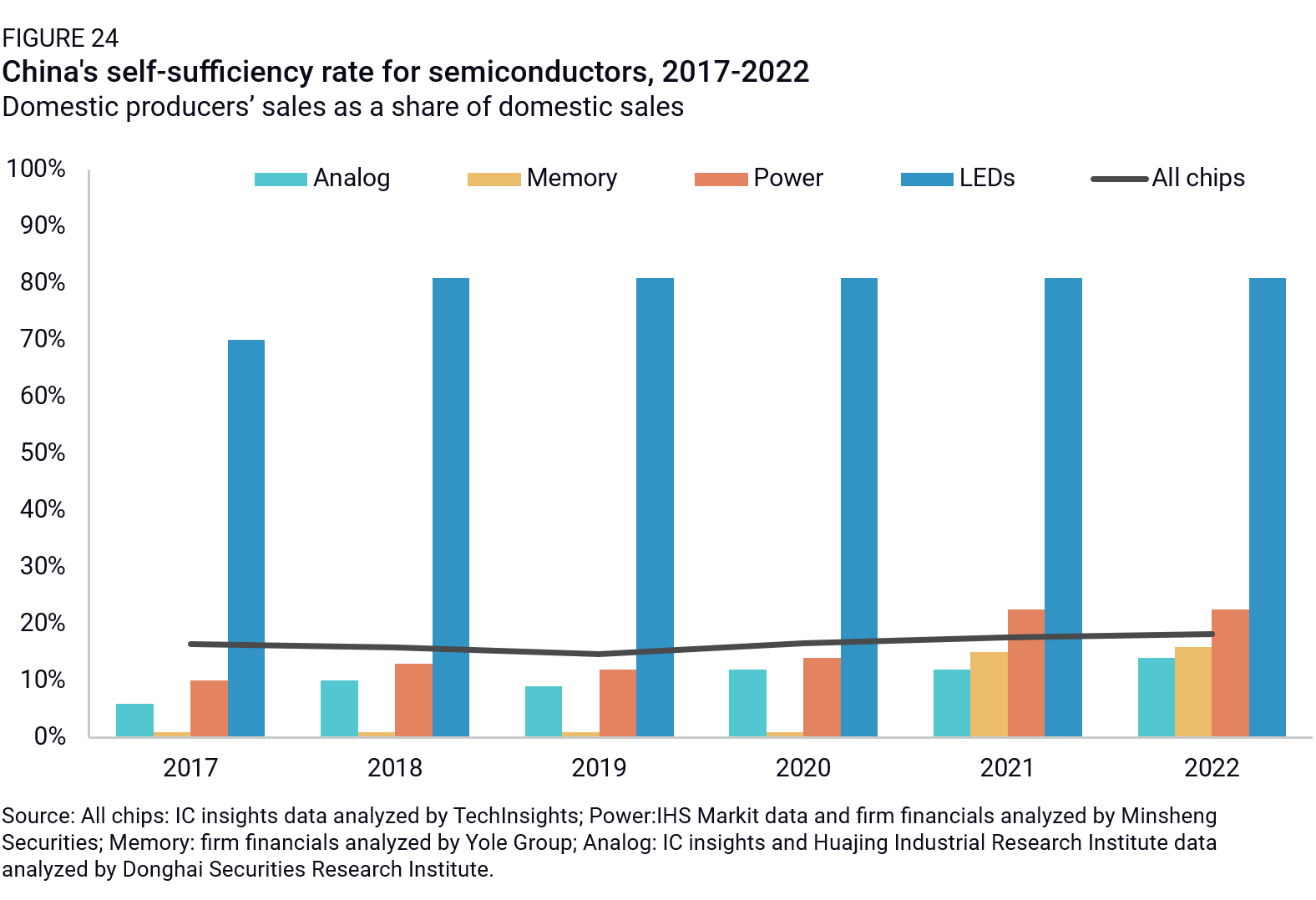

Central to the plan was gradually replacing both imports and foreign company products with products made in China by Chinese firms. MIC25 outlines that by 2025, China aims to achieve 70% self-sufficiency in core basic components and key basic materials. By 2049 (the 100th anniversary of the country’s founding), China should be at the forefront of the world’s manufacturing powerhouses. The strategy emphasized “indigenous innovation” and “self-sufficiency,” entailing a focus on controlling essential core technologies and enhancing industrial supply chains to ensure national economic and security resilience. The self-sufficiency ambition was even more evident in the Key Technology Roadmap, issued together with the MIC25 plan and including detailed targets for the market share of China-made and Chinese-made products in each sector. Despite the Ministry of Industry and Information Technology’s (MIIT) claim that the roadmap is purely scientific and non-policy-driven, the Roadmap is widely regarded as a political guiding document, endorsed at the highest levels of government.

None of these objectives were new. Indigenous innovation and technological self-reliance have been the centerpiece of China’s innovation strategy since the 2000s. MIC25 builds on earlier initiatives like the 863 Program, a high-tech development plan issued in 1986, and the Medium and Long-Term Plan for the Development of Science and Technology, a 15-year plan issued in 2006. Rather, what was new with MIC25 was the range and depth of China’s industrial policy efforts that it unleashed and its explicit focus on addressing China’s remaining dependencies on foreign countries for key inputs and technologies.

While comprehensive, the original MIC25 plan emphasized three policy approaches in particular: enhanced policy implementation (through institutions like the State Leading Group for Building China into a Manufacturing Powerhouse); making the market environment more competitive though manufacturing industry contestability and support for small and medium enterprises; and targeted financial assistance, including venture capital, loans, and expanding fiscal and tax policy funding.

But according to a 2017 US Chamber of Commerce report, MIC25 mostly relied on intensified government control and preferential use of financial support and legal and regulatory tools, including conditional market access. These measures were aimed at systematically strengthening domestic firms while selectively integrating foreign capital into strategic sectors. MIC25 mainly used the following key policy instruments:10

- Leveraging state investment through state-guided investment funds: Nearly 800 state-guided funds, with a combined value of RMB 2.2 trillion by 2017, were established to support R&D and industrial innovation, with a focus on MIC25-related industries.11 These funds were used to channel state-directed capital into key sectors to spur technological advancements and reduce reliance on foreign technologies.

- Increasing subsidies and credit channeling to key actors: Financial policies encouraged banks to provide targeted support to MIC25 industries, including loans for innovation, tax incentives, and export credit insurance. These measures aimed to lower financial barriers for domestic firms and boost their global competitiveness.

- Strategic overseas investment: MIC25 supported Chinese companies in acquiring foreign technology and expertise, especially in areas like semiconductors and advanced manufacturing. These investments allowed Chinese firms to rapidly acquire technologies to bridge gaps with global leaders.

- Creation of national champions through SOE consolidation: The State Council issued directives to consolidate state-owned enterprises (SOEs) in sectors like telecommunications, aviation, and smart manufacturing. This consolidation aimed to create globally competitive “national champions” by streamlining resources and scaling operations.

- Promoting the establishment of new domestic competitors: The policy intended to displace the foreign “chokehold” on key technologies. Favored companies benefited not just from the usual Chinese industrial policy tools of financial and regulatory support and favoritism in the market, but also from visible, high-level political support rarely bestowed on such nascent businesses.

- Support for “little giants” and smaller companies: MIC25 placed a growing emphasis on fostering smaller firms with innovative potential. These companies were supported through funding, pilot projects, and integration into global value chains to build a robust ecosystem of agile, market-driven players.

- Protecting local actors with restricted market access: China implemented strict market access rules for foreign firms, including joint venture requirements and technology transfer mandates in MIC25 priority sectors like auto manufacturing, civil aviation, and telecommunications. These restrictions allowed domestic firms to dominate key areas while benefiting from foreign expertise and investments.

- Encouraging foreign investments in critical areas: While protecting domestic firms, the strategy also outlined bringing in more foreign capital and guiding foreign investment into “high-end manufacturing fields such as new generation IT, high-end equipment, new materials, and biotech and pharma.” The goal was to selectively integrate foreign expertise into sectors where it could complement domestic capabilities: This would accelerate technological development by diffusing technological know-how throughout the broader Chinese economy, including to domestic Chinese competitors. For example, China’s leading medical imaging manufacturer, United Imaging, was founded by several Chinese engineers who previously worked at Siemens’ imaging plant in China. Siemens subsequently tried unsuccessfully to bring legal action against them in Chinese courts for theft of intellectual property.

The outspoken rhetoric of MIC25, emphasizing self-sufficiency and favoring domestic actors, including through product and technology localization targets, provoked significant international criticism, straining trade relations and fueling broader geopolitical and economic tensions. In the United States, MIC25 was seen as a direct threat to national security and technological leadership. The inclusion of explicit market share targets in early versions of the plan raised alarms among trade experts, signaling China’s intent to heavily influence global market outcomes. In 2018, a Trump administration investigation under Section 301 of the 1974 Trade Act labeled China’s trade policies, including MIC25, “unreasonable and discriminatory.”12 This justified sweeping tariffs on MIC25-related industries and tightened export controls and investment screening, a stance largely continued under the Biden administration.

In response to international backlash, China downplayed the strategy, reducing media coverage and references to terms like “MIC25” and “self-sufficiency rate.” By 2019, MIC25 was absent from policy lists and key speeches, leading to speculation it had been abandoned. However, its core objectives persisted, with Beijing quietly doubling down on the industrial policies articulated in MIC25, while recalibrating public messaging to reduce scrutiny. Since then, the focus on self-sufficiency has only intensified. In a 2020 speech published in Qiushi, Xi Jinping outlined the Party’s goal of building “an independent, controllable, safe, and reliable domestic production and supply system” capable of sustaining the economy during extreme circumstances. Under Xi Jinping, self-sufficiency and state control have become central priorities, driven by domestic political pressures and rising geopolitical tensions.

A ramp-up in China’s industrial policies

Ten years later, the intensification of financial support is clearly visible in the data. China’s intensification of financial support for its industries has been unprecedented in scale and scope, particularly through non-conventional means that circumvent and ignore WTO compliance concerns and minimize fiscal strain. Research estimates that Chinese industrial policy spending far outpaces other economies, with state support averaging 4.5% of firm revenues in covered sectors—significantly higher than the OECD average of 0.69%. This is only considering conventional industrial policy instruments. Looking more broadly, the state-directed financial system has likely played an even more central role in this strategy, with vast credit allocation to politically prioritized sectors enabling Chinese firms to expand rapidly, often without the same considerations for profit and return as their international peers. This abundance of state-backed credit, combined with tools like below-market borrowing, tax benefits, and direct grants, has allowed Chinese firms to lower prices, invest heavily, and capture domestic and then global market share at a faster pace than competitors.

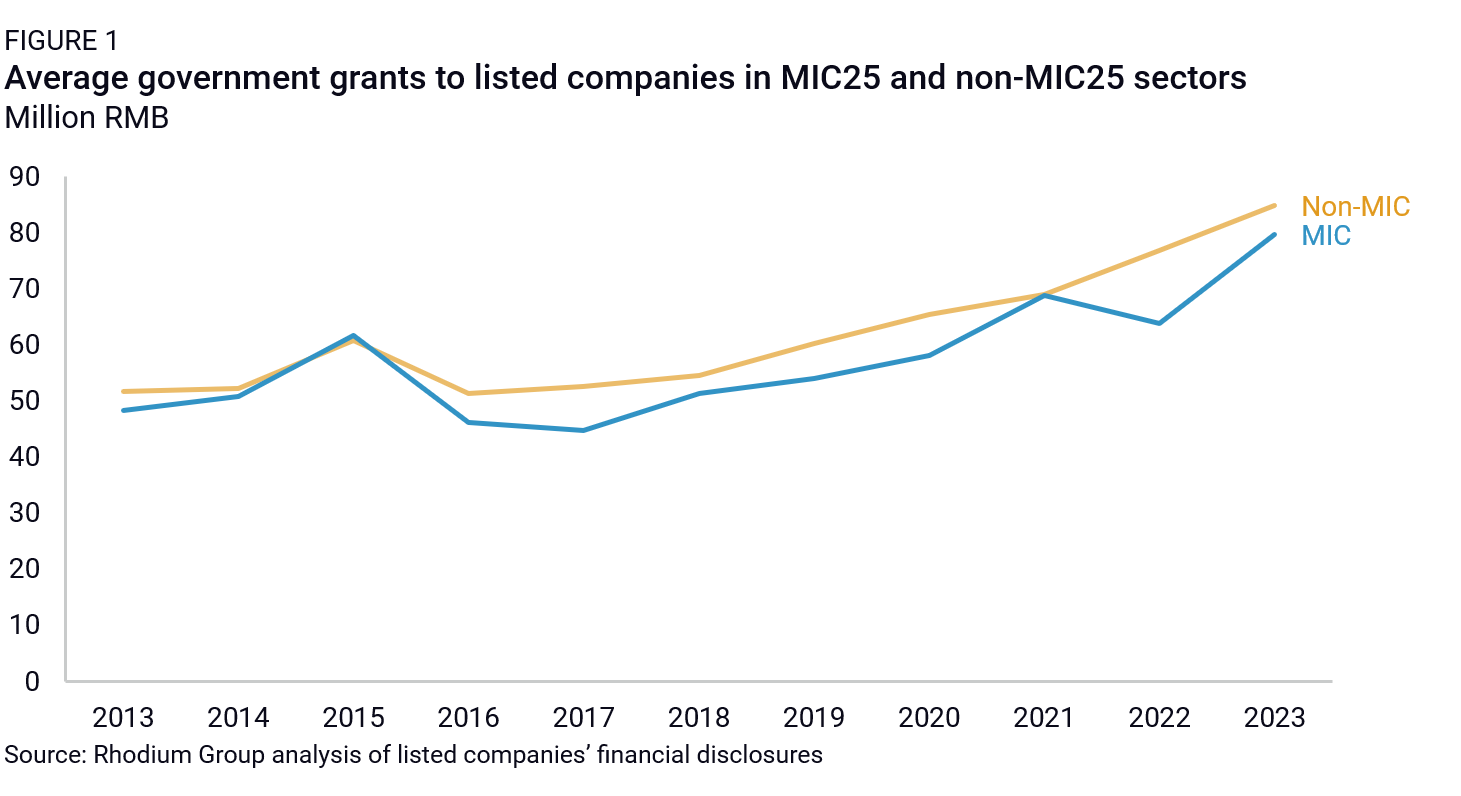

Direct support through grants—the most visible tip of China’s industrial policy iceberg—has experienced the least impressive growth in this ecosystem. Average government grants to listed companies grew by 80% between 2015 and 2023, a faster pace than in previous years, but slower than China’s GDP growth. More importantly, the intended re-focusing of resources toward key sectors is not visible in the data. Instead, firms in non-MIC25 sectors (which, according to our estimates, accounted for 67% of the number of listed companies in 2023) seem to have benefited at least as much from the ramp-up in government grants (Figure 1).

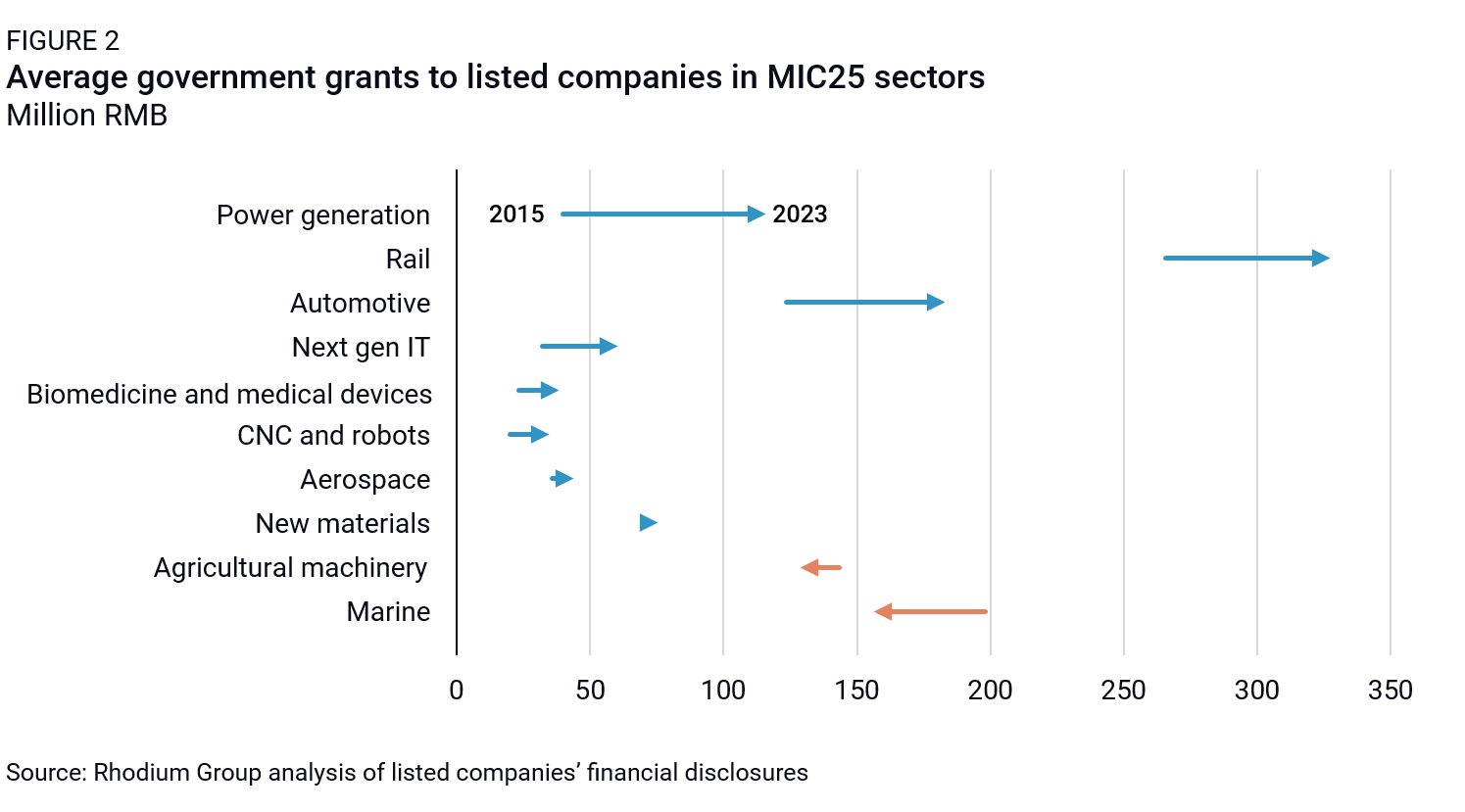

Looking more precisely at MIC25 sectors, average grants to listed firms have increased the most for the power generation and next-generation information technology (IT) sectors, which include products seen as highly strategic by Beijing, such as electric vehicles (EVs), EV batteries, wind turbines, and semiconductors (Figure 2). Only in those two sectors did average direct grants increase faster than GDP growth. All other sectors, except agricultural machinery and marine technology, have seen an increase in the disbursed average government grants, but at a slower pace than GDP growth.

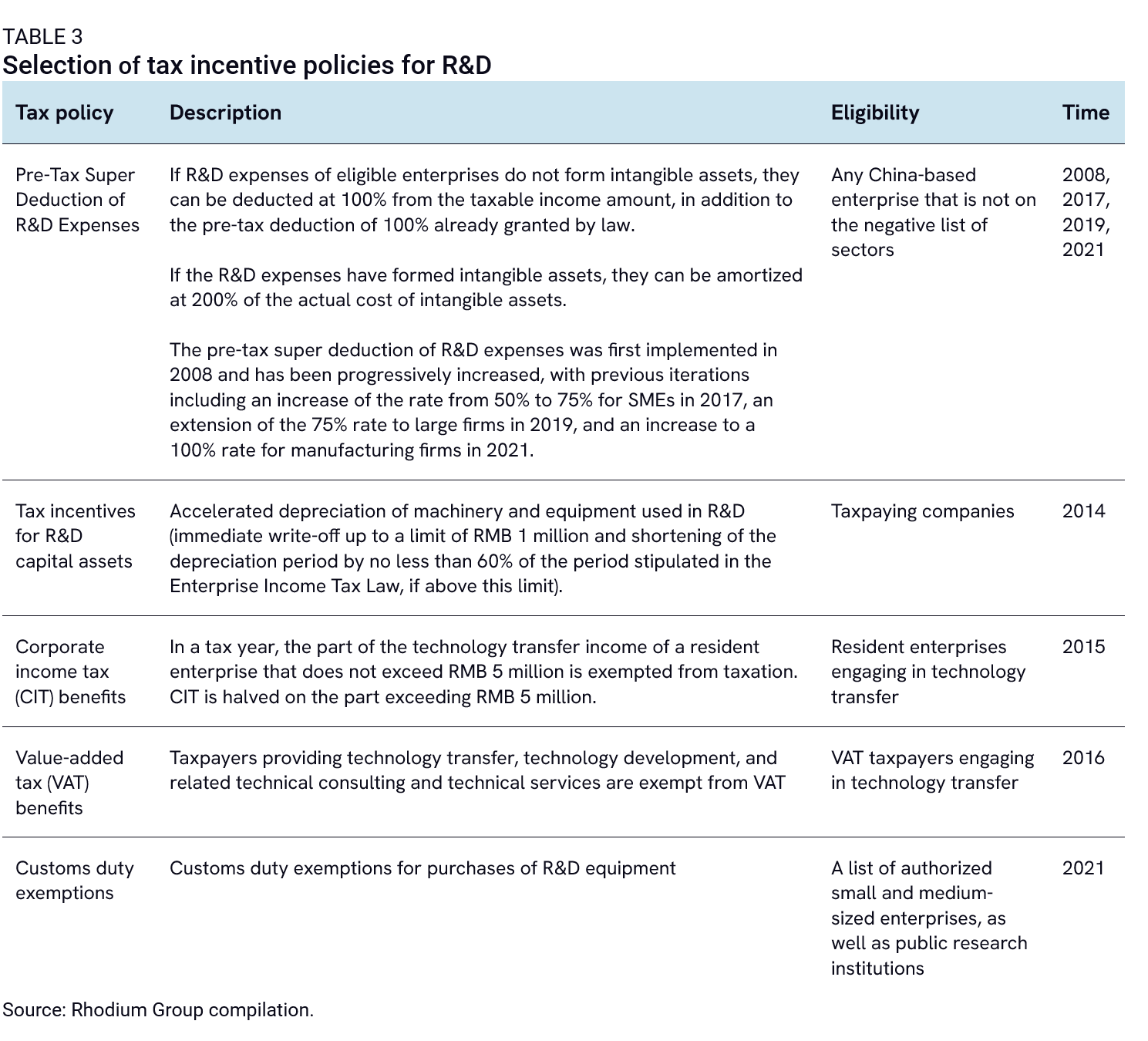

In comparison, government support through tax benefits has seen a much more dramatic growth, and one that has been more closely tailored to MIC25. The magnitude of tax benefits aimed at fostering innovation surged by an average annual rate of 28.8% between 2018 and 2022. The proportion of companies enjoying additional deductions and tax reductions more than quadrupled between 2015 and 2023. Most of these tax cuts, including major increases in the amount of taxes deducted as part of the “super deduction of R&D expenses,” were introduced in the past decade (Table 3).

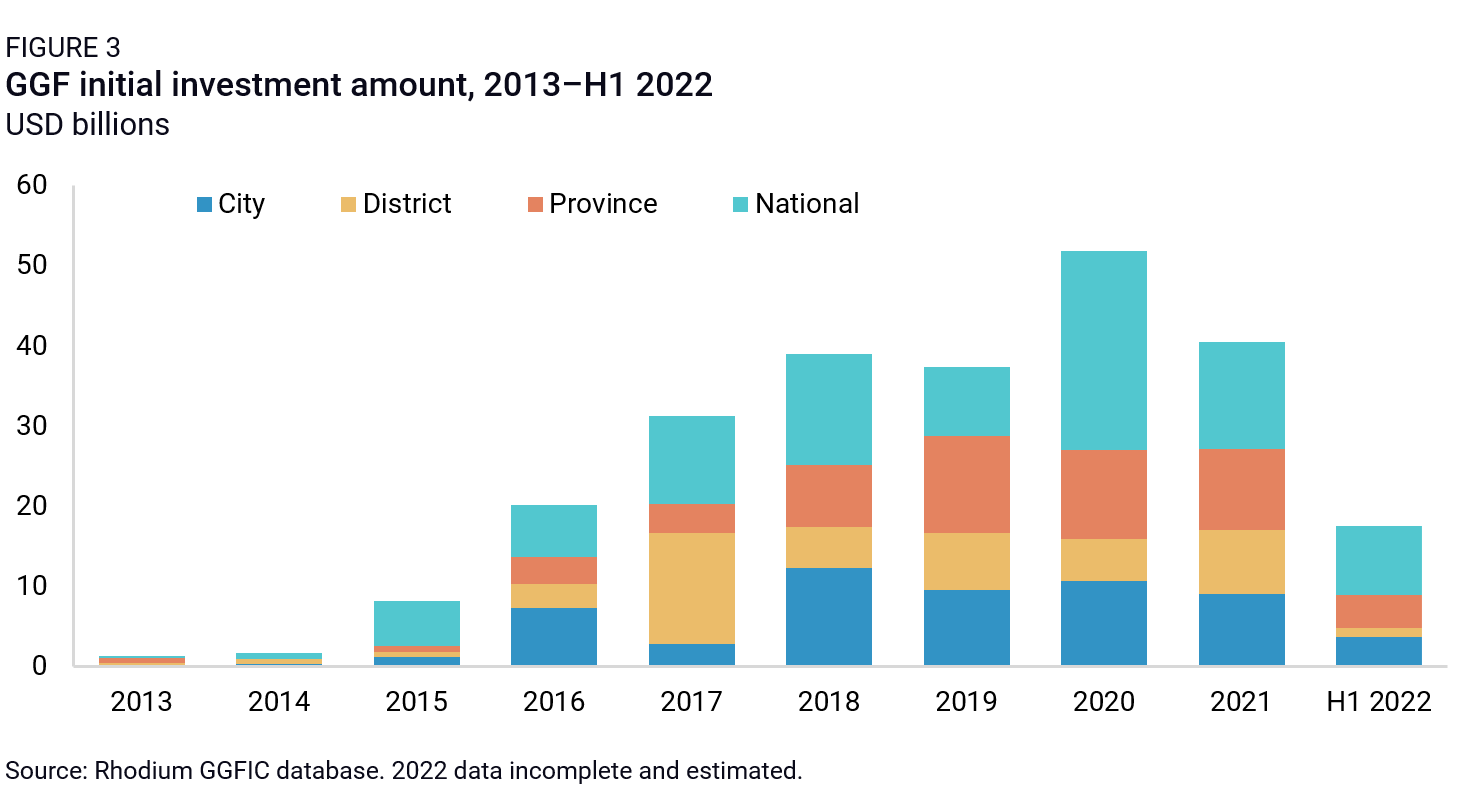

China’s industrial policy in the past decade also saw regulatory innovation in the form of new indirect instruments of state support such as government guidance funds (GGFs), which were first rolled out in 2005, but experienced tremendous growth following the MIC25 strategy in 2015 (Figure 3). GGFs are government-established funds, which partner with other public and private funds to invest in industries and companies that are targeted by Chinese industrial policy as strategic areas for development. Beijing continues to rely on them to fund industrial policy. The third and largest ($47.5 billion) phase of the China Integrated Circuit Industry Investment Fund was launched in 2024, and in January 2025, a GGF was set up to invest in AI with initial capital of $8.2 billion.

Perhaps even more significant was Beijing’s indirect support through China’s state-controlled financial system. Major state-owned banks and other financial institutions are heavily influenced by political directives. Capital markets increasingly focused on advanced manufacturing, as exchanges limit which firms are allowed to list on certain boards. As then China Securities Regulatory Commission (CSRC) chairman, Yi Huiman, explained in 2022, capital markets exist to “help implement national strategies regarding technological self-reliance and the development of modern industries.” Similarly, credit is allocated based on quantity-based targets and sectoral priorities rather than market fundamentals. This creates an environment where state-backed firms face softer budget constraints, enabling them to sustain losses, scale quickly, and maintain artificially low prices. The implicit guarantees throughout China’s financial system have also led to an extraordinary financial expansion in the past two decades, which allowed Chinese firms to dominate key global markets, push down on prices, and disrupt global competition. Although the rate of credit growth slowed down after 2016—credit reached unsustainable levels and the government was focused on deleveraging—it remained very high. Over the past three years, lending has also increasingly been channeled to manufacturing sectors to compensate for the decline in the property sector. Beijing has sought to exert more control on the allocation of credit, with state-directed economic targets encouraging lenders to extend substantial financing to specific sectors and actors based on Beijing’s perceived support. Political targets and national policy plans (such as the MIC25 Roadmap) are mentioned in major banks’ reports as key guidance for the allocation of loans.

Notably, state support has also extended beyond just financial aid. A decade after the launch of the MIC25 strategy, concerns from analysts and policymakers about reduced market access and rising discriminatory practices appear to have been well-founded. In annual American Chamber of Commerce business confidence surveys, “inconsistent regulatory interpretation and unclear laws” rose to the top of foreign businesses’ concerns in 2016, from a second or third position previously, and stayed there until 2019, after which it was topped by the rising tensions in US-China relations. Similarly, 58% of respondents of the European Chamber of Commerce in China’s annual Business Confidence Survey in 2024 reported missing business opportunities because of such barriers, up from 42% in 2022. These barriers, particularly involving government-linked customers (which occupy a larger share of China’s state-led economy in comparison to those in other leading economies), result in significant disadvantages for foreign firms. In the same survey, a fifth of respondents who lost business opportunities as a result of market access or regulatory barriers reported they would have been worth more than a quarter of their annual revenue. Though discriminatory practices had been rife before, interviews with market participants confirmed that 2015 was a turning point in many sectors, with such practices growing, becoming national rather than local in scope, becoming matters of formal policy rather than informal practice, and increasingly targeting high-tech areas. Foreign firms have also increasingly been pressured to localize their production, through rising market restrictions and procurement discrimination, the EU Chamber of Commerce found in a 2025 report.

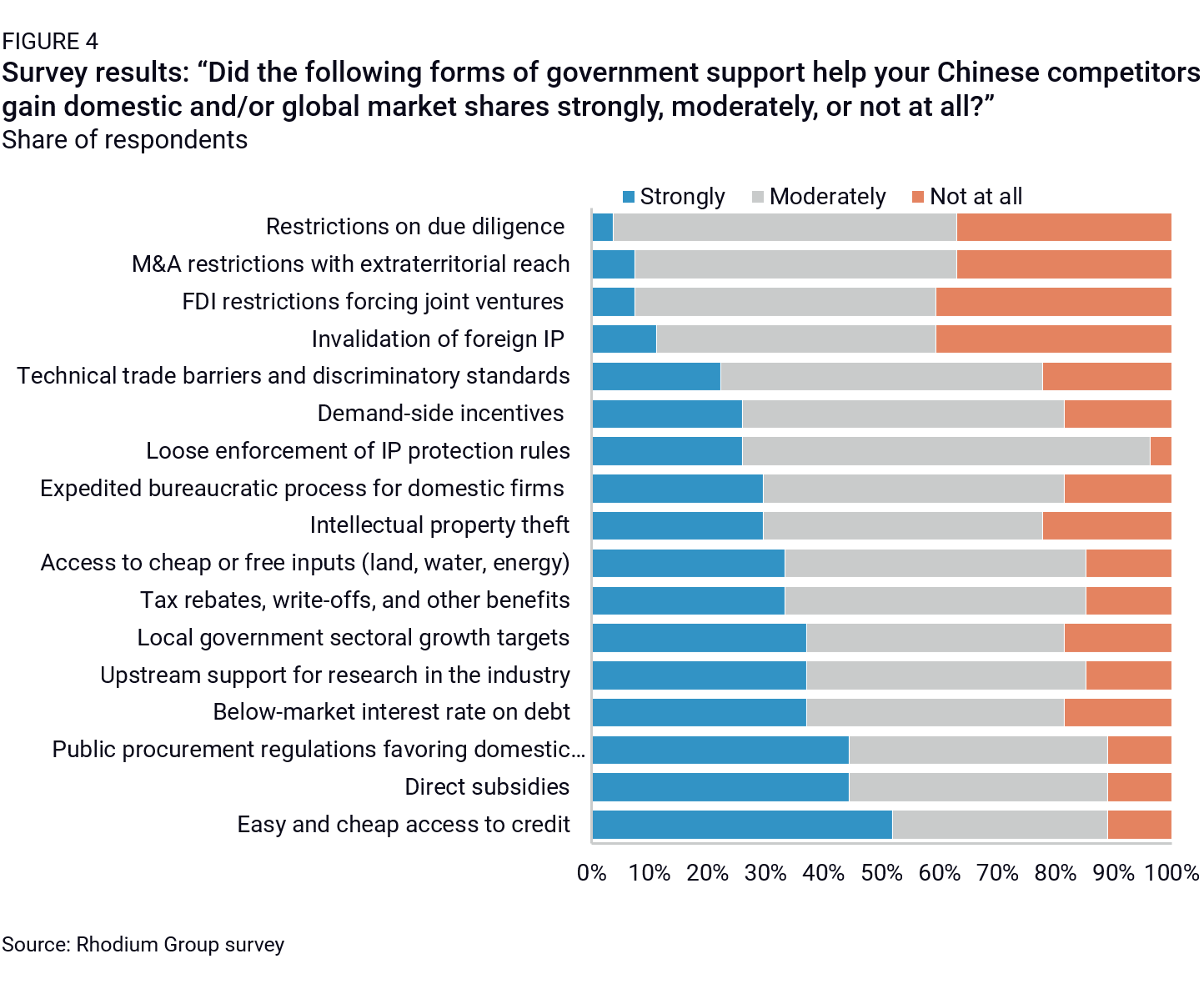

In our survey of US Chamber of Commerce members, respondents generally assessed that Chinese state support increased over the past decade (41% saying strongly and another 37% saying moderately). Respondents identified easy and cheap access to credit and below-market debt, direct subsidies, and biased public procurement regulations as the state support that helped their Chinese competitors gain market shares (Figure 4).

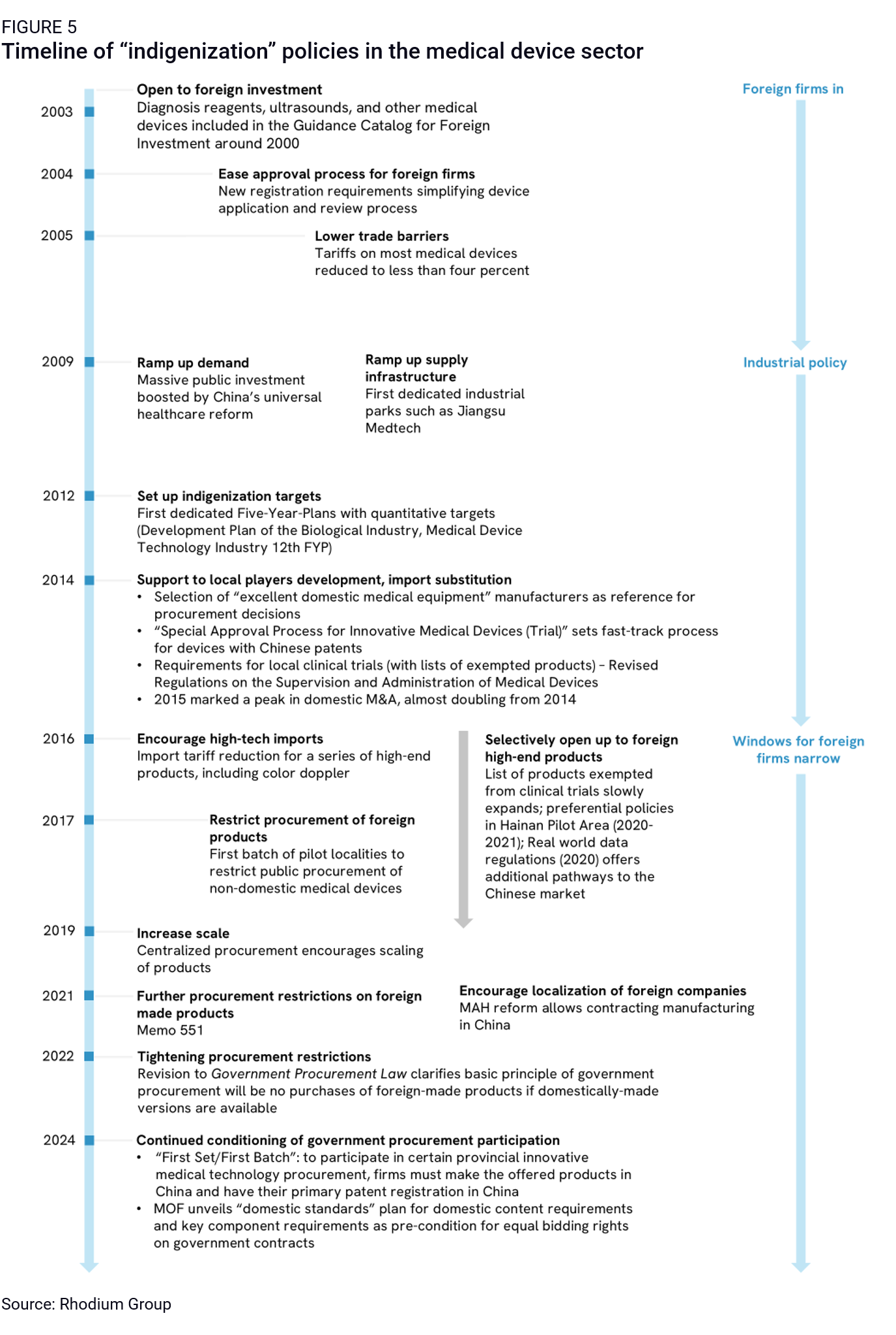

The medical device sector is a case in point. As a 2019 paper noted, “accessing the Chinese market for medical devices has never been easy but it has become increasingly challenging in recent years.” Policies aiming to force foreign companies to localize high-tech production and research and squeeze them out of market segments where local players were strong enough to compete intensified after 2014-2015 (Figure 5).

Although Beijing has since toned down its rhetoric and dropped references to MIC25 from policy papers, the strategy seems to have kept its promises, both in terms of the expected ramp-up in financial support and increasingly leveraging China’s legal and regulatory environment and market access to favor domestic companies.

How to assess MIC25’s success

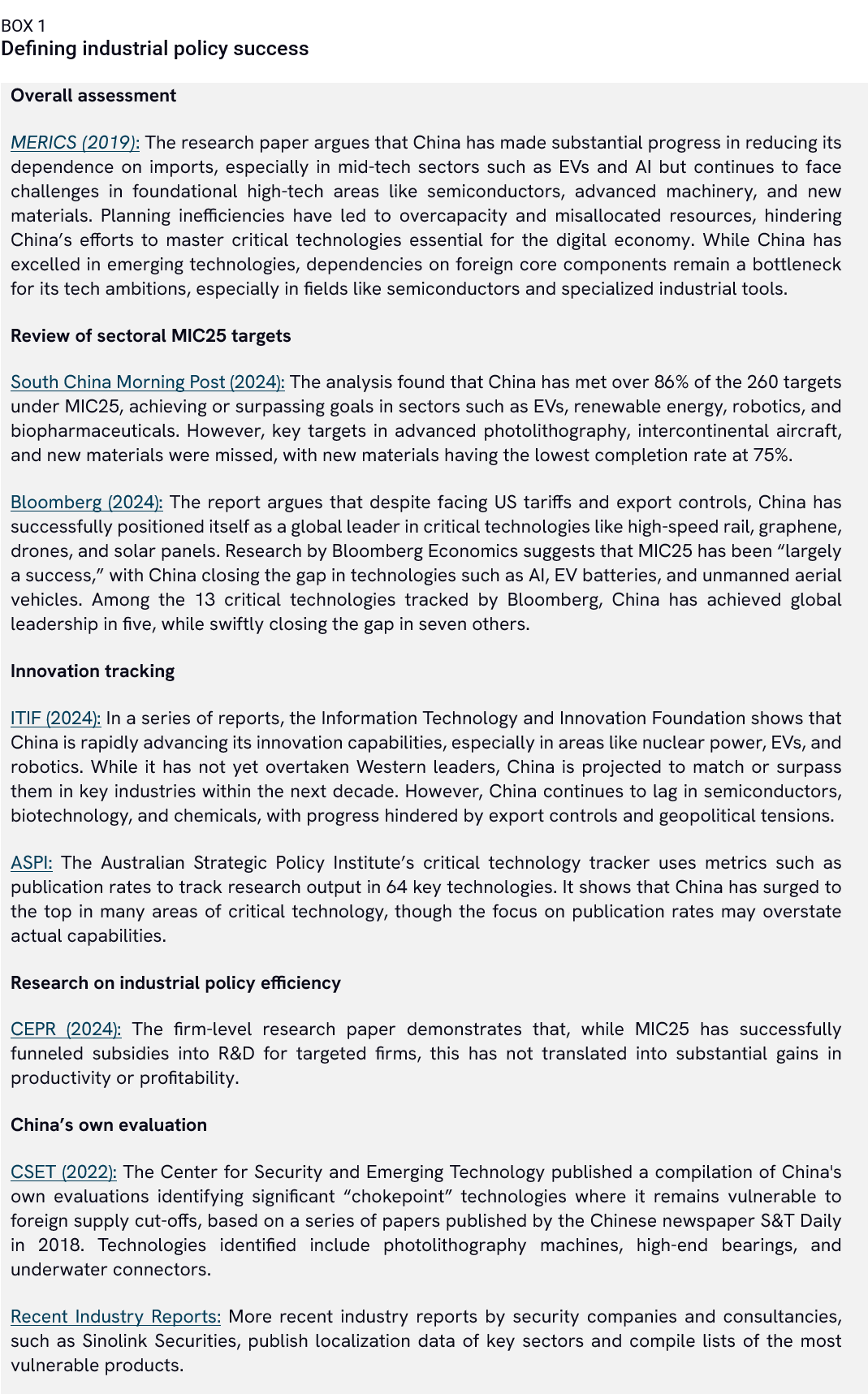

Before diving into MIC25’s track record to date, one needs to establish clearly what is our marker for success and failure. In short, the dependent variable for research needs to be clearly established. This is not an easy task, because there are so many ways to examine success. MIC25 encompasses numerous objectives, ranging from innovation to self-sufficiency to competitiveness. Previous research has generally selected one of these criteria to evaluate success (Box 1).

Even “self-sufficiency” remains a fluid and somewhat ambiguous concept in MIC25. The Roadmap refers to it using multiple indicators:

- The domestic market share of locally-made products,

- The share of independently designed and produced goods by Chinese firms, and

- The proportion of parts and intermediary inputs that are both localized and under Chinese control.

This conceptual flexibility might be intentional. As one executive noted, companies have been “quietly told” that production within China could count toward national self-sufficiency targets.13 However, interviews suggest this inclusion often changes over time as local companies gain the strength to compete directly. Furthermore, with an opaque regulatory environment, moving goalposts, and a top-level political emphasis on national self-sufficiency, many Chinese buyers unsurprisingly feel safest selecting products from “indigenous” firms over those from foreign-invested enterprises (FIEs). Indeed, the fact that the Ministry of Finance (which has jurisdiction over procurement policy) has felt obligated to repeatedly affirm that FIE products will be considered eligible to meet the requirements of China’s new government procurement policies only underscores that such national treatment is neither established custom nor expected.

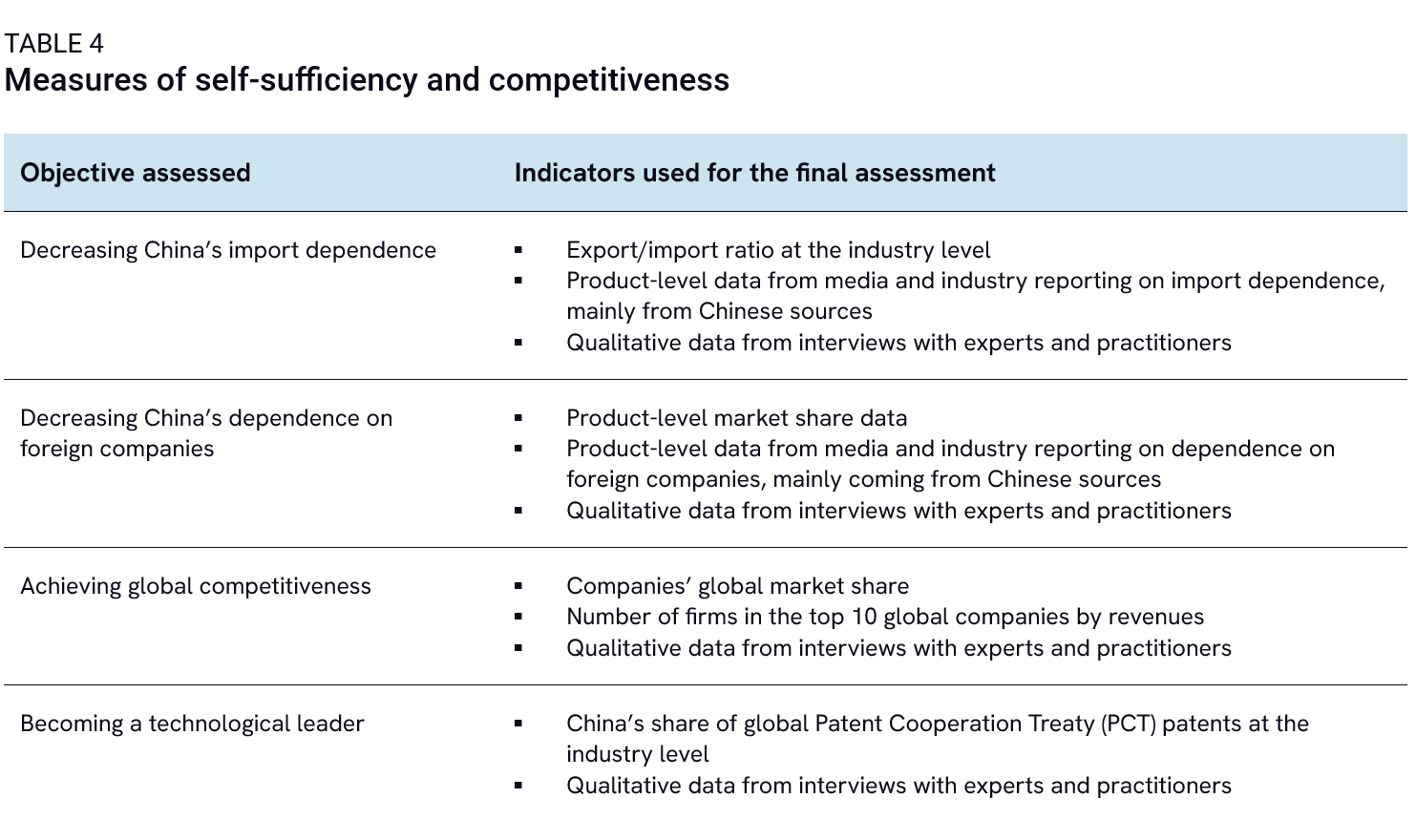

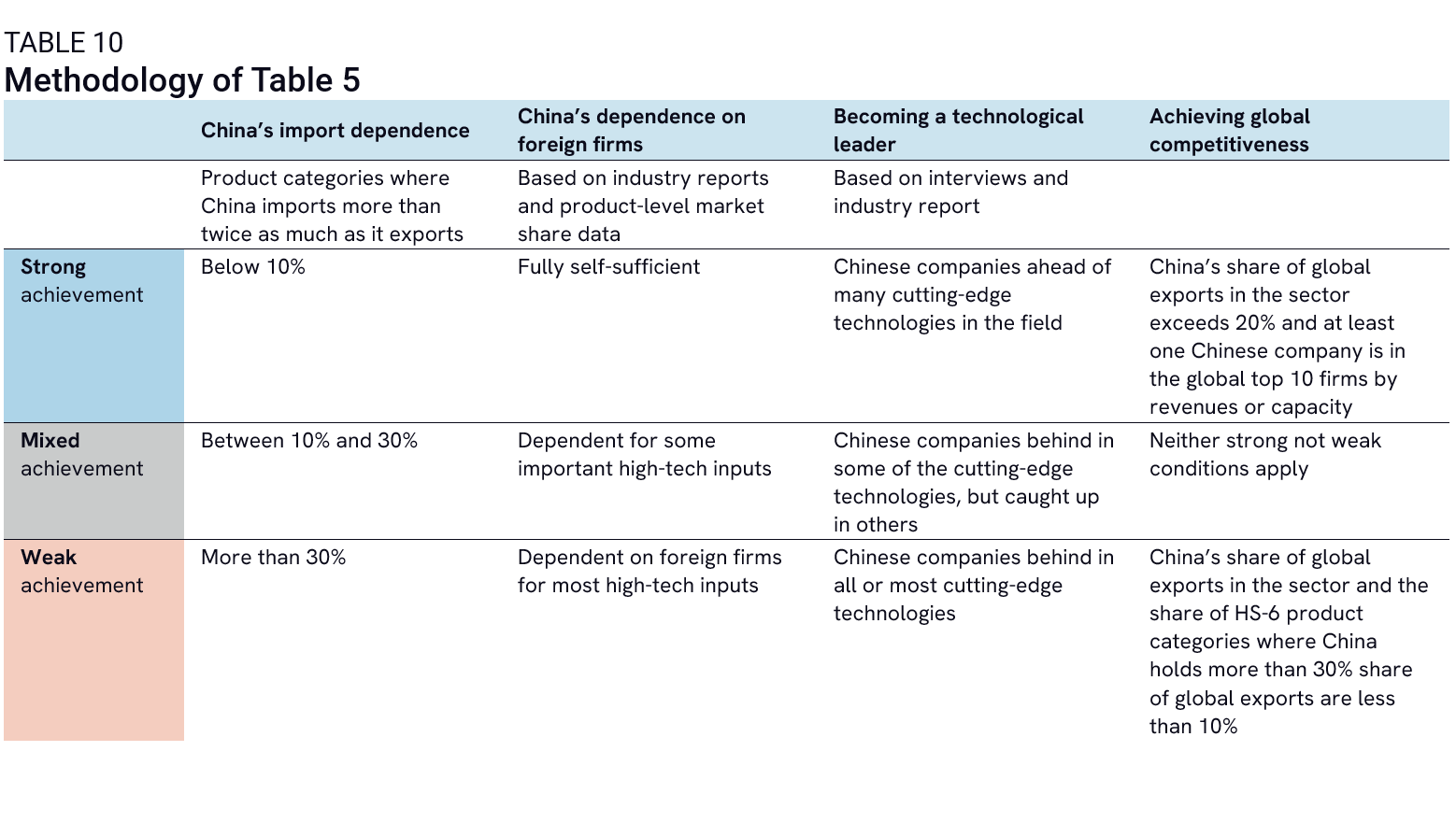

This report addresses MIC25’s diverse goals by assessing progress across four main categories:

- Decreasing China’s import dependency,

- Decreasing China’s dependency on foreign companies,

- Achieving global competitiveness, and

- Becoming a technological leader.

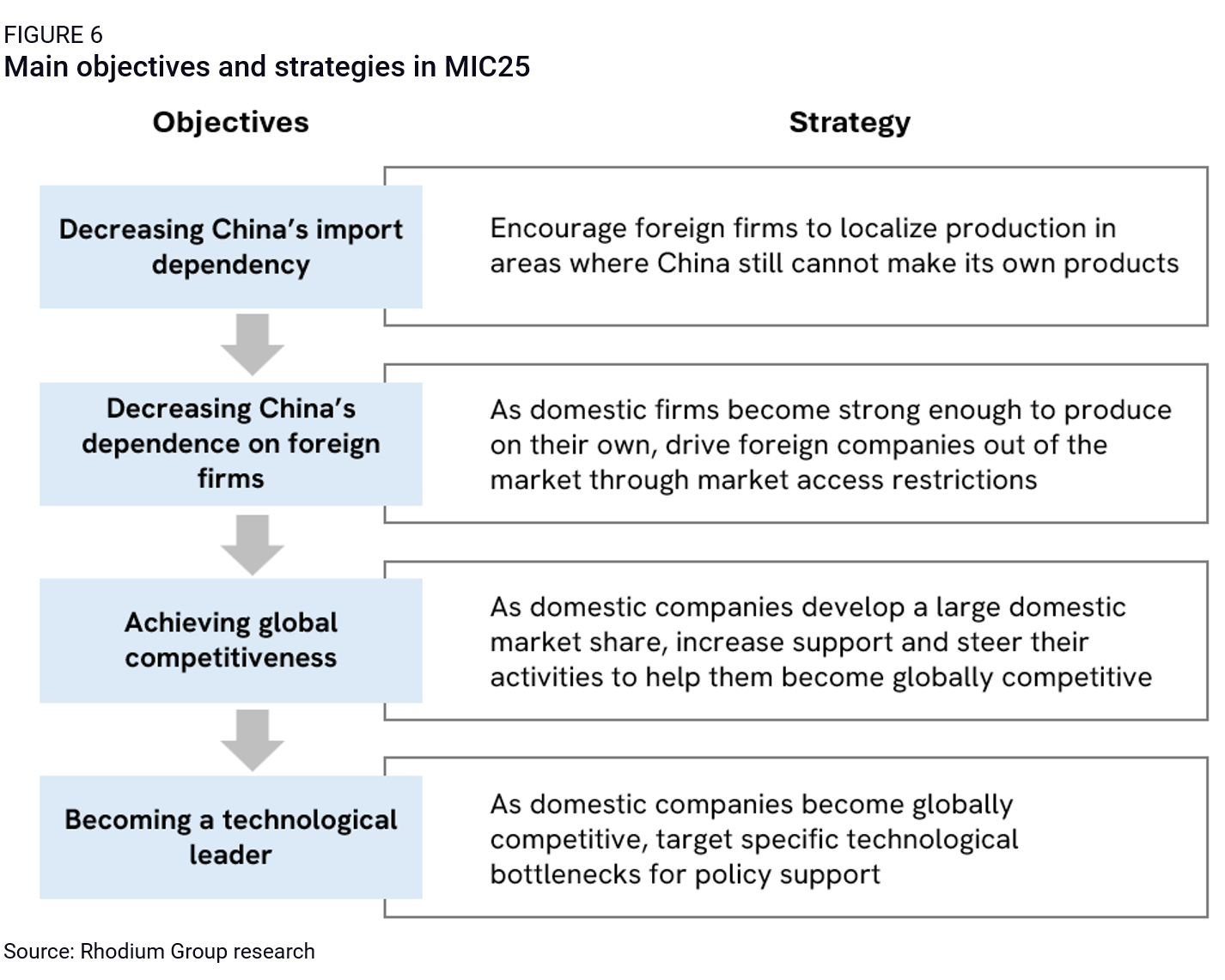

While these objectives are interrelated, each is conceptually distinct. For instance, China might lower its import dependence while still relying on foreign-owned companies producing domestically. Likewise, it could meet domestic demand through local firms that may not yet be globally competitive or may produce lower-quality products—even as local dominance in China’s large market serves as a springboard for global competitiveness. Each objective requires tailored policies to achieve specific outcomes, as illustrated in Figure 6.

Each objective is evaluated using a broad set of indicators (Table 4). Given that each sector in the Roadmap encompasses thousands of products, each with unique characteristics, capturing comprehensive sectoral coverage is challenging. To address this, the report uses at least two or three representative products for each sub-sector covered in the Roadmap, both in the low-to-medium tech and high-tech segments. Selection is based on MIC25’s quantifiable targets, data availability, relevance to US-China technology competition or national security concerns, and each product’s significance within China’s industry, ensuring that each chosen product meets at least two of these criteria.

Due to limited data availability for certain sectors, our assessment of current progress is conservative. Given the rapid pace of capacity buildup in some sectors, particularly in recent years, the lack of more recent data means that some significant advancements may not yet be fully captured in this analysis.

We also triangulate our data using a survey of companies in the United States and interviews with experts and market participants. We mostly focus on eight of the ten sectors covered in the MIC25 strategy, with the exception of high-speed rail (where China’s self-sufficiency and technological leadership objectives were already basically achieved by 2015) and new materials (which is difficult to capture as a single, well-defined sector). Data on these two sectors, however, can be found in Appendix B.

Additionally, we examine not only the specific quantified targets set by MIC25 but also the broader achievements of Chinese companies. While these targets offer insight into government intentions from a decade ago, they are somewhat arbitrary and have evolved since then. Therefore, it’s essential to assess both progress against these targets and the actual achievements of Chinese firms today, providing a fuller picture of sectoral advancement regardless of past benchmarks. Both specific targets and broader achievements are examined in detail in each following chapter of this report.

Progress is mainly assessed as of today, as summarized in Table 5. It is important to note, however, that this table presents an average that combines progress metrics across product categories within each sector, which may obscure critical nuances. For example, while China has achieved strong performance across all dimensions in sectors such as advanced rail transit equipment and electric power equipment, progress remains weak in areas like high-end CNC machine tools, and aerospace equipment. Some sectors have seen mixed progress, such as new-generation information technology, biomedicine, and marine technology. China leads in telecommunications equipment, the MIC25 sector where the highest share of foreign firms (44%) report facing Chinese competitors that can produce equal or superior products at comparable or lower prices, according to a 2025 EUCCC report. In contrast, semiconductors and operating systems remain among China’s most significant areas of vulnerability.14 Similarly, marine engineering equipment shows strong global competitiveness, but only mixed results in reducing import dependence and reliance on foreign firms. Detailed discussions of separate product categories are provided in each chapter. When possible, each chapter also discusses relative progress and likely future progress to measure the pace of China’s indigenous industrial development.

Lastly, this report analyses MIC25’s intended achievements. Chapter 2 examines achievements in the first objective (decreasing China’s import dependence). Chapter 3 examines achievements in the second objective (decreasing China’s dependence on foreign firms). Chapter 4 examines achievements in the third and fourth objectives (achieving global competitiveness and becoming a technological leader in global markets). The report concludes by also looking at the unintended effects of China’s industrial policies—including inefficiencies, overcapacity, high fiscal and debt burden, and limits on future GDP growth.

Chapter 2: Decreasing import dependencies by pressuring foreign companies to localize production

One of the key objectives of MIC25 was to eliminate import dependencies by either fostering domestic players or attracting foreign firms to localize their production within China. Targets for “Made-in-China” products—defined by their market share regardless of whether they are produced by domestic or foreign firms—were set in the Roadmap for key sectors such as IT, power generation, and medical devices. While Chapter 3 will look more specifically at the achievements of domestic players in gaining market share in China, this chapter focuses on the role of foreign companies in reducing China’s import dependencies.

Overall, China has been more successful in reducing its import dependencies and achieving its localization targets than in decreasing its reliance on foreign companies. China has both through formal measures and informal signals pressured foreign companies to localize production and research domestically, particularly in areas where products from emerging Chinese competitors would otherwise be the exclusive beneficiary of new buy-local preference policies. At the same time, some foreign companies have leveraged their manufacturing capacity in China to cater not only to domestic demand but also to regional and global markets. As a result, they have reduced their exports to China as they increased their production in China. However, many foreign firms continue to retain their most advanced intellectual property and cutting-edge technologies outside of China. Constraints persist in these areas, and paradoxically, China’s drive for industrial upgrades has, in some cases, even increased its demand for these highly specialized imported technologies.

Foreign firms’ localization in China

Foreign firms have been investing in manufacturing operations in China for decades and have continued this trend since 2015. Although the pace of new investments has slowed significantly compared to the previous decade, they have increasingly focused on high-tech sectors that align with China’s strategic priorities.

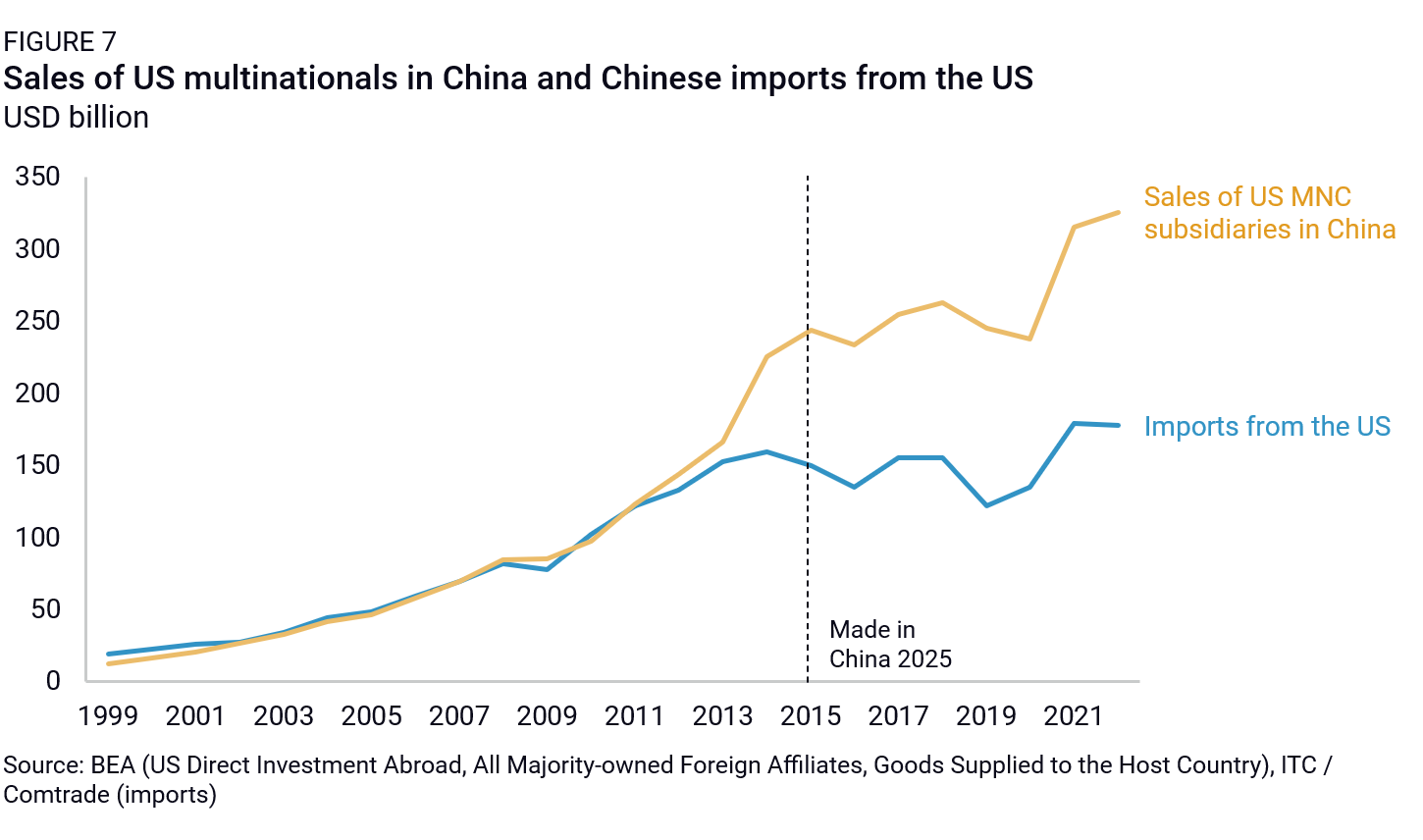

Between 2015 and 2023, US MNC subsidiaries in China—for which there is good available data—increased their R&D expenditures and value-added output by 77% and 43%, respectively. While this growth was slower than the previous seven-year period, which saw increases of 105% and 156%, it remains a significant expansion. Notably, despite escalating geopolitical tensions, US MNCs have accelerated the localization of both their value-added production and research investments in China since 2020. Additionally, the rise in sales by US subsidiaries in China has coincided with stagnating US exports to China, underscoring the role of import substitution driven by increased localization efforts (Figure 7).

MIC25’s role in this trend is not entirely certain. On the one hand, the rise in protectionist and discriminatory measures—central to the MIC25 strategy—may have deterred some firms from investing in China. China’s growing mature market, its large talent base, and the increasing competitiveness of local players, certainly have also been key factors in motivating foreign firms to localize production and research despite the increasingly challenging business environment.

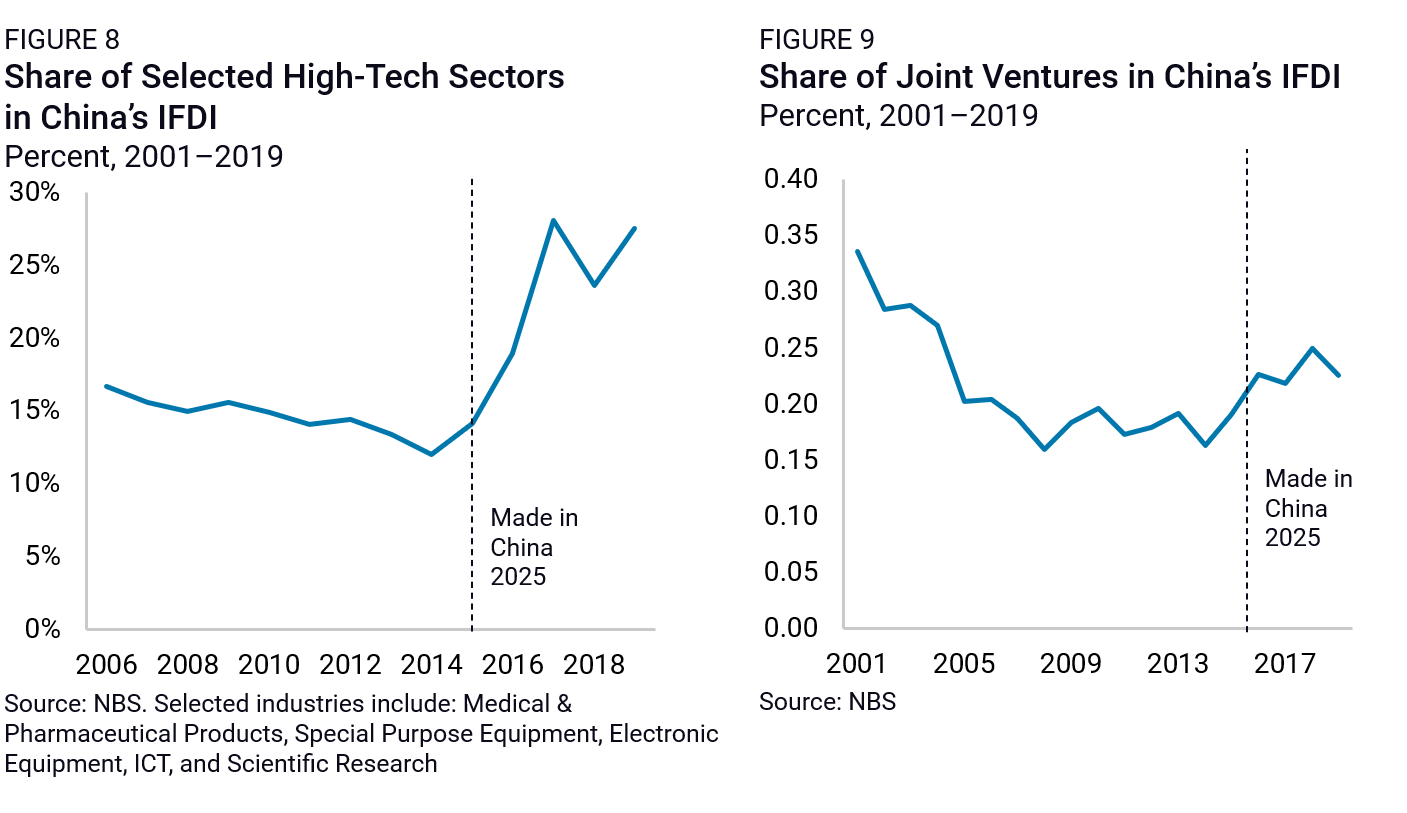

However, China’s targeted localization strategies, which require foreign firms to enter joint ventures or adopt a more “local” footprint to continue to enjoy full access to the Chinese market, have helped ensure that foreign investments align with China’s self-sufficiency objectives. Evidence suggests (though we only have data up to 2019) that these localization requirements have had a tangible impact on foreign investment. For example, the share of inbound FDI concentrated in high-tech sectors covered by MIC25 jumped after 2015, nearly doubling in a few years (Figure 8). In the same period, the share of joint ventures (which typically allow for more IP transfers) in total foreign FDI to China picked up, after declining for several years (Figure 9).

Foreign companies have localized manufacturing in China primarily to maintain access to the Chinese market. This shift has been driven in large part by government pressure and tightening market access for imports. At the same time, some firms have also used their China-based manufacturing operations to serve markets beyond China. In our survey of US Chamber of Commerce companies, two thirds of firms that reported increasing manufacturing capacity in China over the past decade said they did so solely to meet domestic demand, while one third reported that the expansion was aimed at serving regional or global markets as well.

Localization of foreign firms in the medical device sector

The drive for localization has been especially evident in the medical device sector. One somewhat unique characteristic of China’s medical device market (relative to some other sectors targeted under MIC25) is the key role of public hospitals, which reportedly accounted for 85% of medical care in China as of 2022. Because of a specific carve-out in the 1947 General Agreement on Tariffs and Trade (GATT)—the foundation of the modern WTO—government procurement is exempt from the GATT’s national treatment obligation, which normally requires its members to treat imported and domestic goods equally.

One growing tool in China’s toolbox of increasingly muscular industrial policies is what some have called the “weaponization” of this GATT government procurement loophole. Leveraging its large public procurement market, China has introduced a set of explicitly discriminatory, anti-import measures that go beyond the implicit or de facto discrimination practiced in other parts of the economy.

China’s recent procurement restrictions have fallen especially hard on the medical device sector, both because of its overwhelming reliance on government customers in China and because of China’s growing perception that adequate (if not world-leading) domestic substitutes are becoming available. In 2021, China quietly issued Notice 551, which indicated that for 315 types of medical and scientific devices that could be produced domestically (including most imaging equipment), government hospitals would henceforth be expected to procure a progressively higher percentage of their annual purchases from domestically made producers. China has since taken additional steps to entrench favoritism for domestic players through its procurement regime:

- In 2022, China announced revisions to its Government Procurement Law, indicating that one cornerstone of its procurement policy would be that where domestic products are available, imports should not be procured (and unlike other countries with domestic preference programs for procurement, at this juncture China has announced no limitations on how broadly this policy will be applied).

- In 2024, China announced that medical device companies looking to participate in procurement projects for “innovative medical technologies” would be required not merely to make the product in China, but to have the primary patent registration for the product be in China (while most MNCs have their primary patent registrations in their home market).

- In late 2024, China announced that in order to bid on government procurement projects, goods will not merely need to be “produced” in China but meet a not-yet-announced domestic content level. Furthermore, for “specific products” and sectors—widely interpreted to be a reference to those targeted under MIC2025—higher Chinese content levels, and Chinese production of key components or processes, may also be required.

In many respects, the legal and regulatory regime now facing MNC medical device companies trying to export to China has reverted to the uncertain environment that existed before China joined the WTO in 2001. Perhaps in reflection of this deteriorating environment, in early 2024, the European Commission launched its first ever investigation under the EU’s International Procurement Instrument (IPI), to determine whether China’s practices discriminatory policies and practices in its government procurement of medical devices. The investigation concluded in January 2025 that “China has put in place a multilayered overarching system of generally applicable preferences for the procurement of domestic medical devices that has led to a systematic discrimination against imported medical devices and foreign economic operators, implementing a comprehensive ‘Buy China’ policy.” As of this writing, the European Commission is working, in the absence of any policy changes by China, to develop appropriate remedial measures in the European Union procurement market.

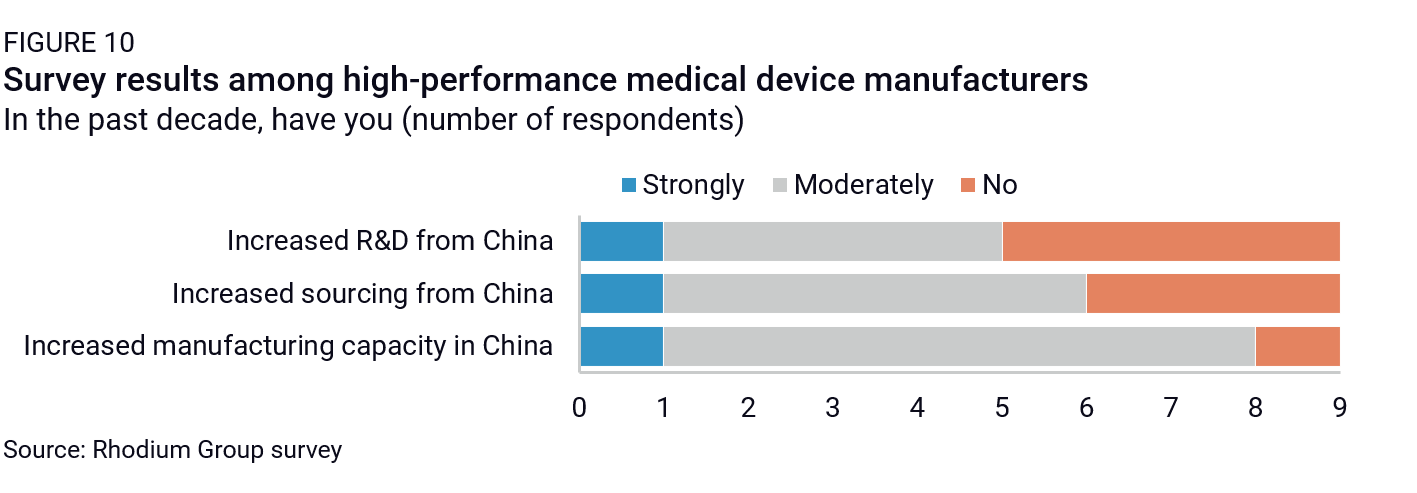

In response to the increased inability to serve the Chinese market with imported products, multinational corporations have steadily increased their production and R&D activities in China in response. Over the past decade, eight of the nine surveyed American high-tech medical device producers have increased their manufacturing capacity in China. A majority have also increased sourcing from and R&D in China (Figure 10).

Major medical device companies, for example, have announced and realized localization plans in recent years. One European medical device company reportedly locally manufactures more than 90% of the company’s products sold in China, including some high-end medical equipment. The company also reportedly intends to ensure that 90% of its products for the Chinese market are sourced and assembled in China by 2024. Another likewise, pledged to deepen localization in China, including with the production of its latest 7T MRI equipment. The localization rate of the company’s supply chain in the country reportedly exceeds 80%.

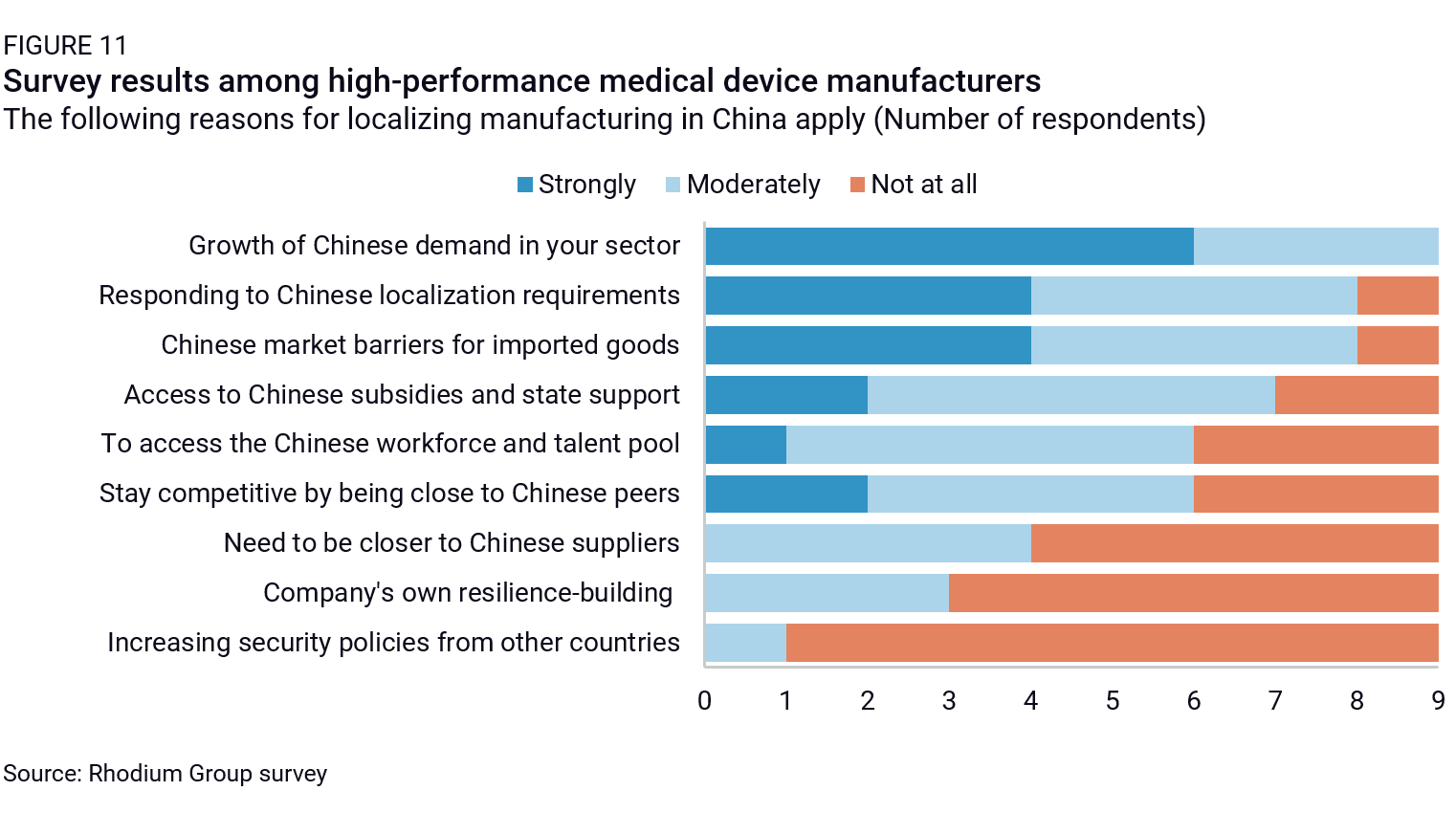

According to survey data, Chinese localization requirements and barriers to imports (two sides of the same coin) ranked just behind demand growth to tie for the second most prominent reason for increasing high-performance medical device manufacturing presence in China (Figure 11). Setting aside MNC’s efforts to meet China’s localization requirements, emerging Chinese competitors are eroding the market share (and in some devices, market leadership) of foreign MNCs in Chinese government hospitals that previously enjoyed strong market share and have been present in China for decades. According to a 2025 EUCCC report, biopharmaceuticals and high-performance medical devices are the MIC25 sectors with the highest share of foreign firms (83%, compared to an average of 46% across sectors) reporting losses of market access since 2025.14

Localization in the aviation and semiconductor sectors

Nonetheless, foreign companies in many sectors have refrained from localizing their most cutting-edge technology in China. Instead, they have focused on investing in legacy technologies or limited activities such as assembly and maintenance, while keeping the manufacturing of key components outside of China.

The aerospace sector is a prime example of refraining from localizing cutting edge technology, due to its sensitivity to export control regulations. For example, the C919’s (China’s first narrow-body airliner) CFM LEAP engine is sourced from a French-US JV that requires a US license. The US aerospace company Rockwell Collins, which has several JVs in China to produce communication and navigation systems, came under scrutiny for sending technical data to China to have electronic components made there. As a result of these sensitivities, aerospace companies, many with commercially significant relationships with Western defense agencies, have not localized manufacturing to the extent that high-speed rail companies had in the 2000s. Airbus’s operations in China focus primarily on the final assembly and completion of aircraft rather than high-tech manufacturing.15 Boeing’s approach is even more cautious, primarily focusing on completion work and delivery of narrowbody aircraft, with 100% of its aircraft assembly and 80% of its supplier spending in the United States. Other joint venture operations focus primarily on maintenance and installation. For example, Safran’s joint venture with China Eastern Airlines, established in 2017, focuses on the maintenance and repair of landing gear. In another example, Parker FACRI, a joint venture between Parker Aerospace and AVIC established in 2016, offers final assembly and testing for aircraft flight control actuation system components.

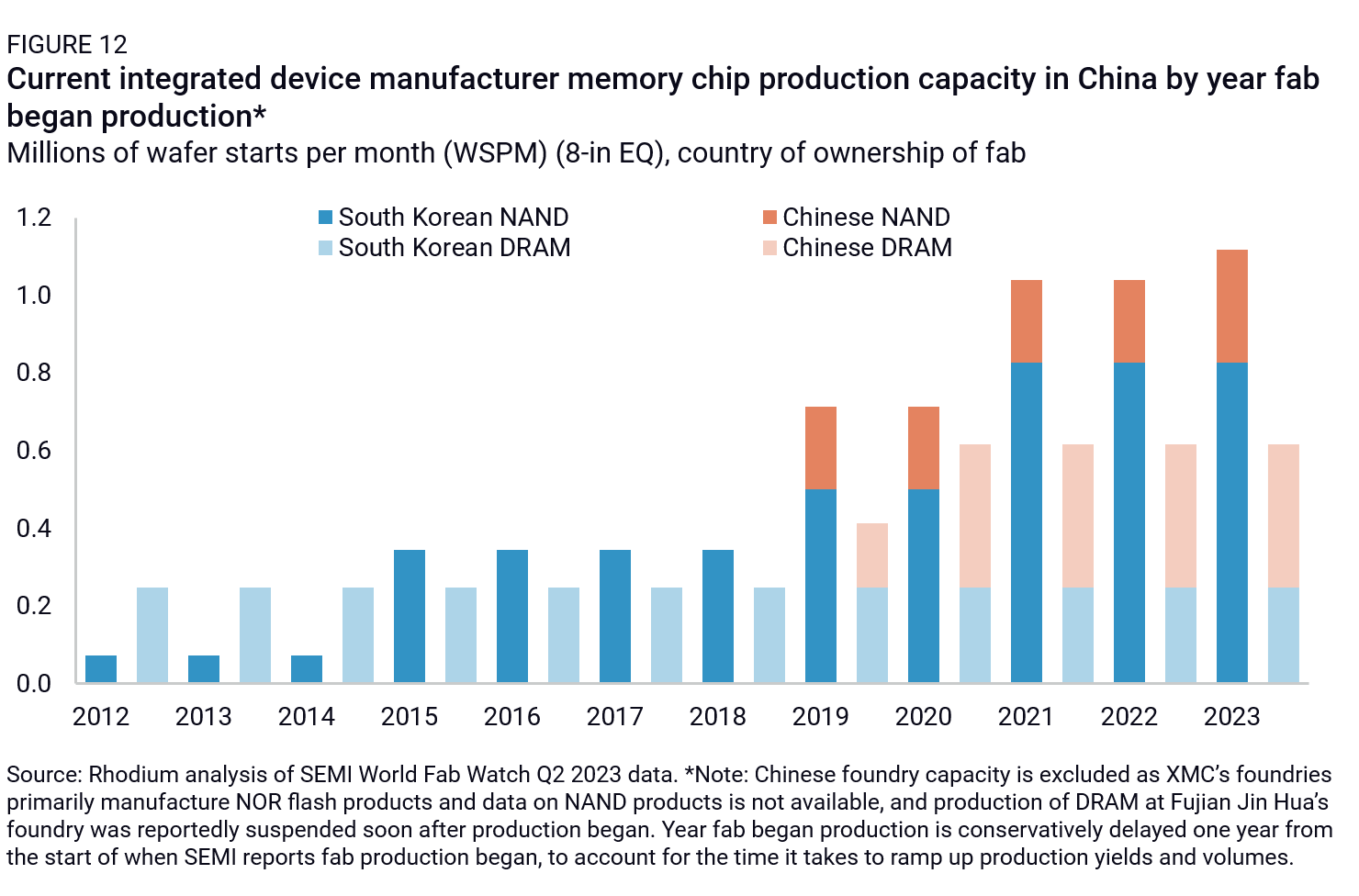

Semiconductors present another example of both the achievements and limits of foreign localization. China received a large proportion of investment in the semiconductor industry in the past decade, averaging around 40% of industry FDI annually between 2013 to 2019. South Korean-owned DRAM and NAND memory chip fabs, in particular, have significantly expanded their capacity since 2015, contributing to reducing China’s reliance on imports in that area (Figure 12). Samsung’s state-of-the-art plant in Xi’an, opened in 2019, accounts for 40% of its NAND business and represents the world’s largest NAND manufacturing base. SK Hynix’s Wuxi factory, opened in 2006, is responsible for about half of the company’s DRAM production. These investments played a key role in reducing China’s reliance on imports of memory chips, as around 62% of China’s memory chip production is owned by South Korean firms.16

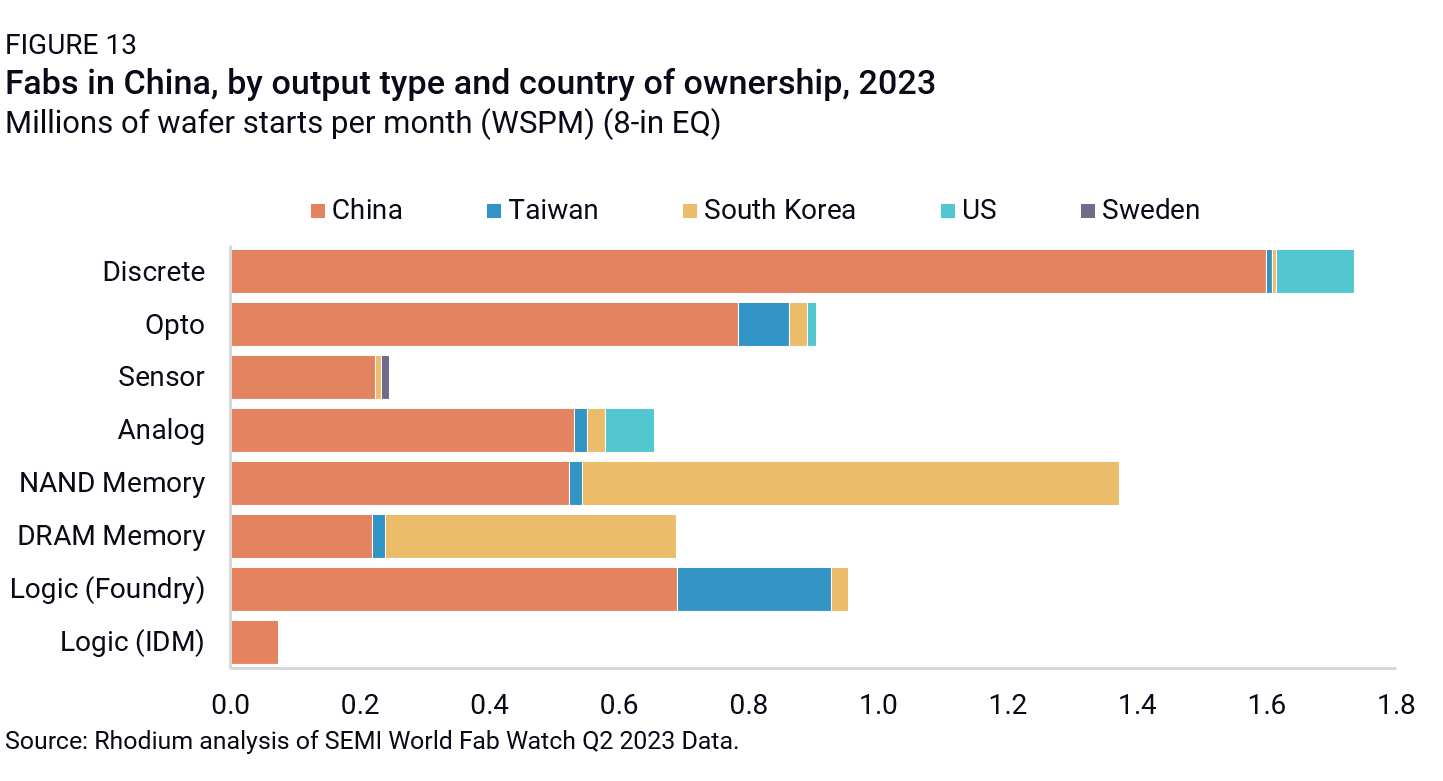

However, foreign logic chip producers in China, including TSMC and UMC, have localized much less of their production in China and do not manufacture their most advanced logic chips there (Figure 13). Due to growing geopolitical tensions around semiconductor manufacturing, Korean memory chipmakers are also walking back from their China-focused strategy and investing in their newer fabs and research centers at home.

Achievements in reducing import dependencies

Fueled by advancements from domestic firms and the localization efforts of foreign companies, every sector targeted by MIC25 has seen substantial reductions in import dependencies. Nonetheless, vulnerabilities persist, as China’s drive for industrial upgrades has paradoxically increased its demand for highly specialized imported technologies in discrete areas.

Aggregate picture

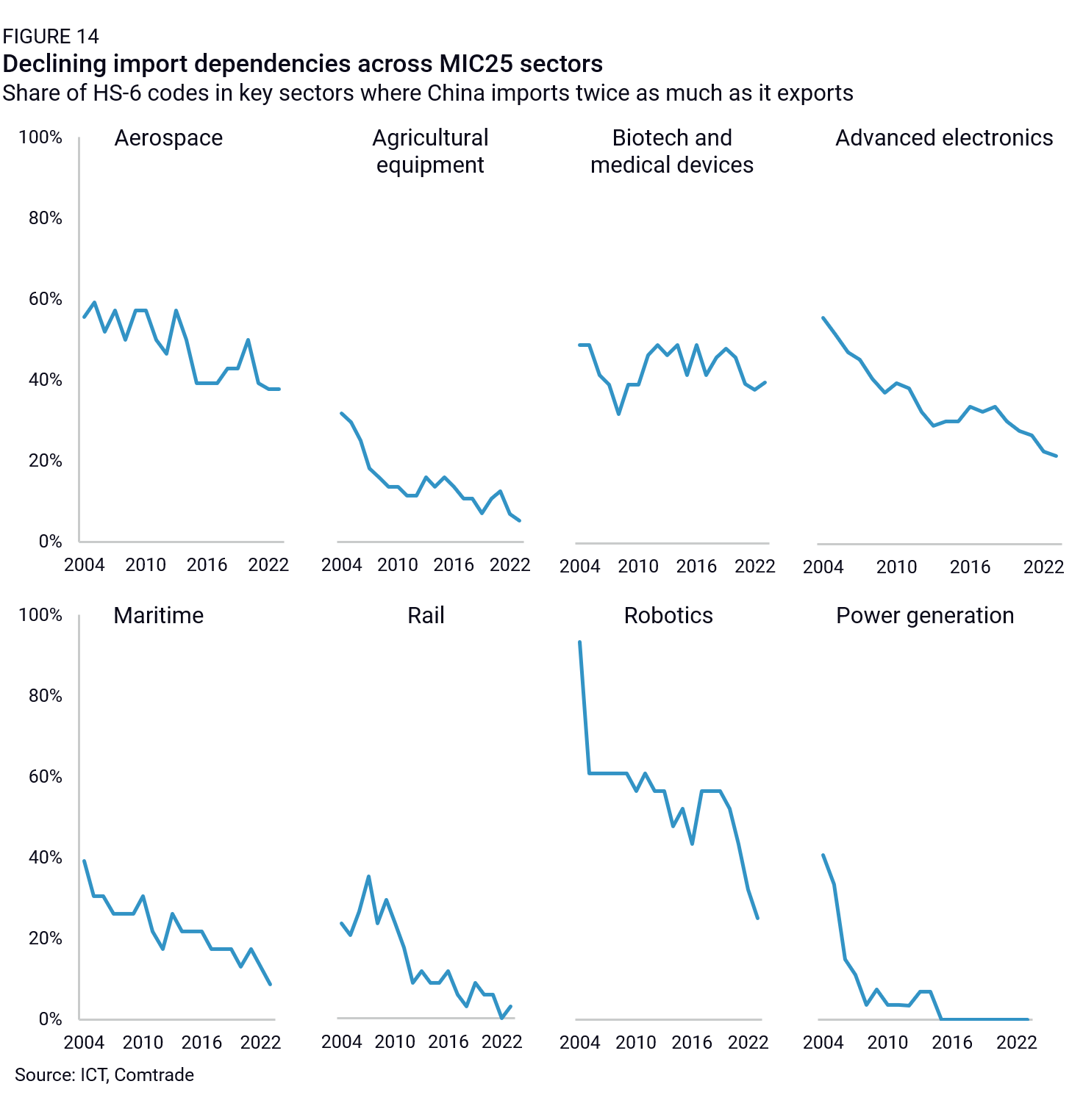

Aggregate data reflect China’s declining import dependencies. To assess this at an aggregate level, we use a proxy—specifically, the share of HS-6 codes in key sectors where China’s imports are double its exports, given that data on direct import demand is often unavailable.17 For a major exporting country like China, this proxy identifies areas where domestic production still lags behind imported goods.

According to this measure, China has made broad progress in reducing import dependencies (Figure 14). While in some sectors, the most significant gains were achieved before the launch of MIC25, import dependencies have continued to decline across most sectors since 2015. In sectors like rail and power generation, import dependencies have been virtually eliminated. For example, imports of rail bogies—a product China still relied on imports for in 2015—decreased from $70 million in 2015 to just $1.4 million in 2023.

However, progress has been slower in other areas. In the biotech and medical device sector, the dependency rate only slightly decreased from 39% in 2015 to 38% in 2023. Similarly, in aerospace, it declined marginally from 41% to 40% over the same period. Advanced electronics have seen moderate improvements, with the dependency share falling from 30% in 2015 to 22% in 2023.

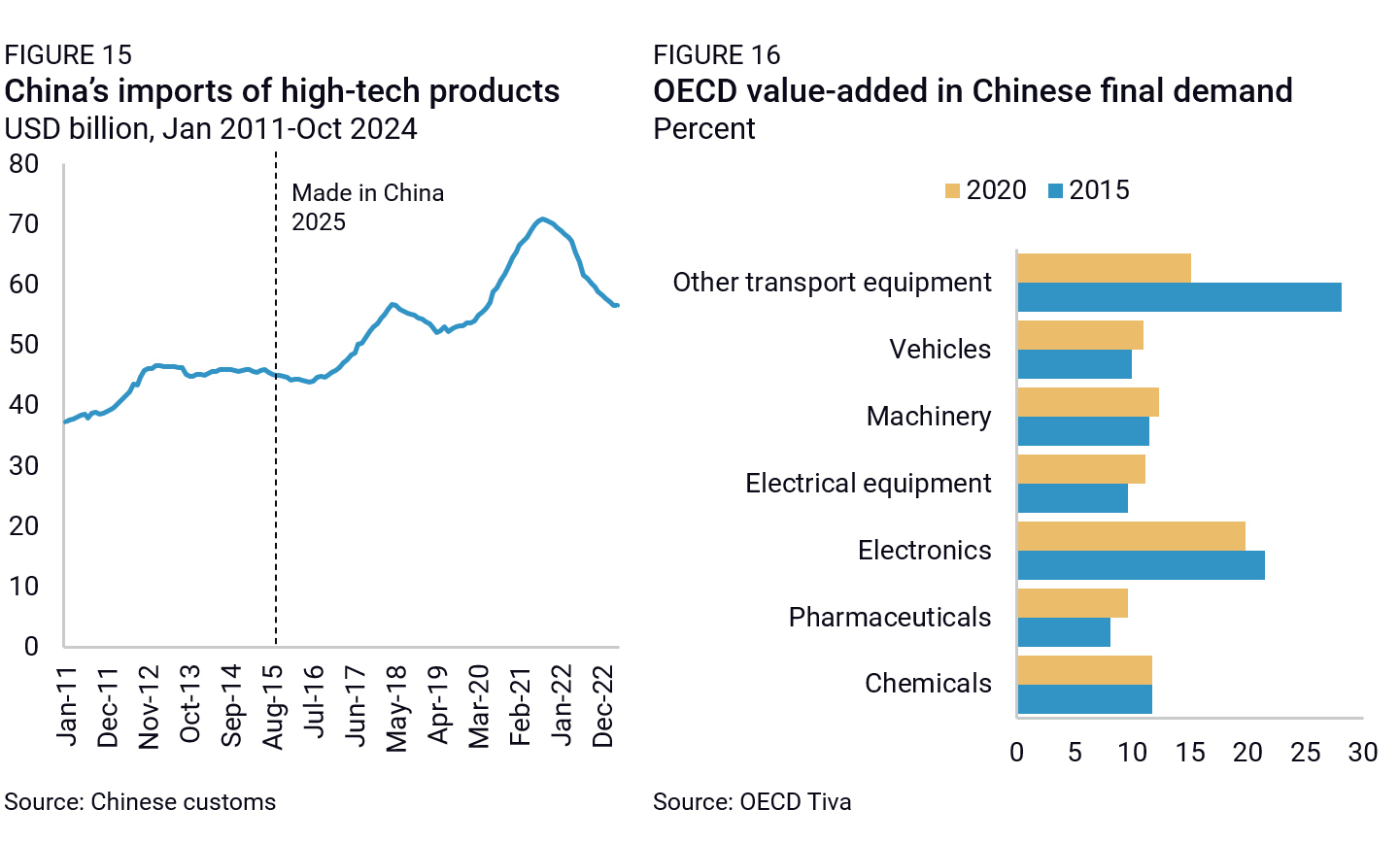

Despite China’s strides in reducing import dependencies, its drive for industrial upgrading has also led to an increased demand for technologically advanced products. Over the past decade, while high-tech exports rose significantly from approximately $650 billion in 2015 to around $850 billion in 2023, high-tech imports have kept pace, growing from $550 billion to $690 billion over the same period and limiting the growth of China’s high-tech trade surplus from $100 billion to $160 billion during the same period (Figure 15). Due to those growing imports, the share of value-added coming from the OECD and embodied in China’s final demand across major manufacturing sectors has increased from 2015 to 2020, the most recent data available, for most sectors except electronics and other transport equipment, which includes ships and airplanes (Figure 16).

Evaluation of MIC25 targets at the sectoral level

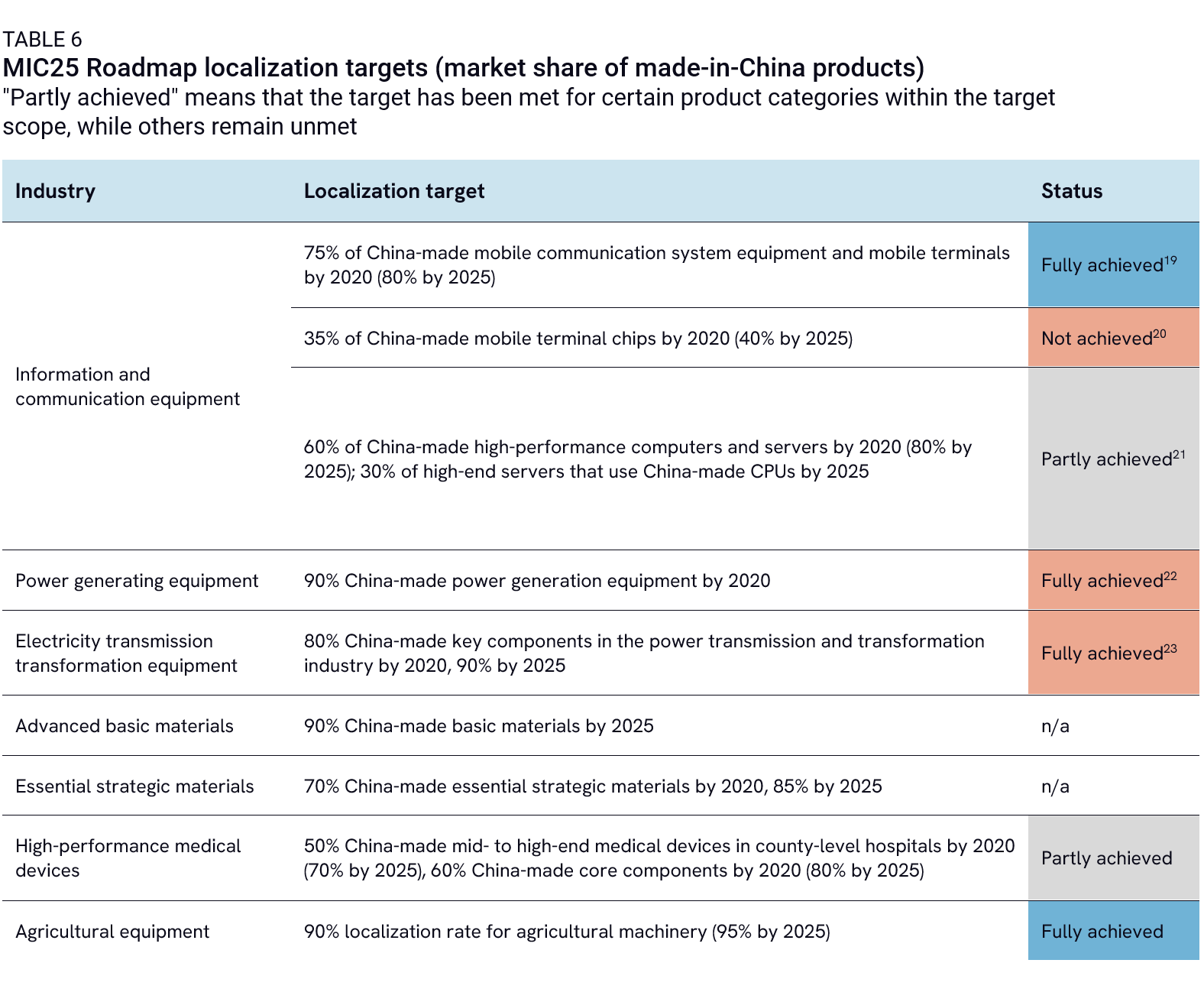

Sectoral achievements illustrate China’s overall progress in meeting its localization targets. China has successfully reached many of its “Made in China” goals in areas like mobile communication equipment—including optical transmission systems, optical switches, and core routers—as well as in power generation, transmission equipment, and agricultural machinery. Partial progress has been made in sectors like high-performance computing, where China remains reliant on imported CPUs, and in medical devices, where import vulnerabilities persist. In the advanced materials sector, however, the lack of sufficiently detailed trade data makes it difficult to accurately assess import dependencies (Table 6).

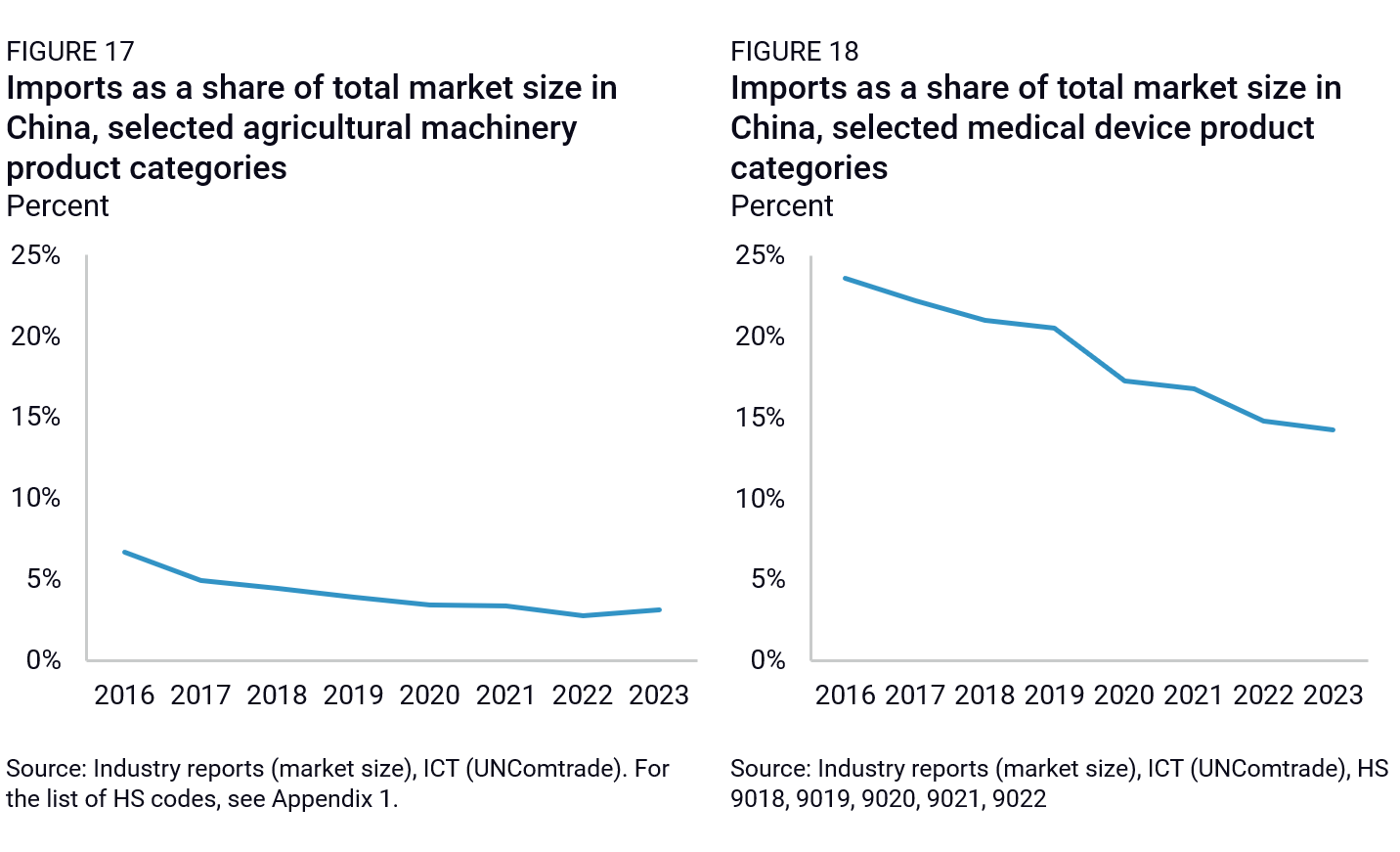

China set very high made-in-China targets (90% and 95% for 2020 and 2025, respectively) for the agricultural machinery sector. According to Chinese reports, while China had already reached a localization rate of 96% for tractors with 100 horsepower or less as of 2019, only 17% of tractors with 200 horsepower or more were domestically produced. In 2022, China still imported 90% of its harvesting products that exceed 250 horsepower and 90% of its core components of intelligent agricultural machinery control equipment. That proportion fell to 80% of imported high-end agricultural machinery in 2024. Overall, China was able to satisfy around 90% of domestic demand as of 2023, close to the goal it had set. A different set of data reveals further progress: the share of agricultural machinery imports relative to the total market size (based on industry reports) has decreased significantly, from 7% in 2016 to 3% in 2023 (Figure 17).

The localization targets for the medical device sector were somewhat less ambitious, reflecting the industry’s earlier stage of development in China. The MIC25 Roadmap set goals of achieving 70% domestically made mid- to high-end medical devices in county-level hospitals and 80% domestically made core components by 2025. While it is challenging to precisely determine whether these targets have been fully met, the available data indicates both substantial progress as localization pressures intensified, as well as ongoing vulnerabilities. Imports of selected medical device products as a share of the total market size in China decreased from 24% in 2015 to 14% in 2023 (Figure 18).

For a product like computed tomography (CT), although foreign firms roughly had 80% market share in China in 2022, imported products only accounted for about 40% of domestic demand. Absolute imports of CT products decreased by 45% in the past two years after reaching a peak in 2021 (the year Notification 551 declared that China’s government hospitals should be purchasing domestically made CT equipment rather than imports). Imports of ultrasonic scanning apparatus, also on the Notification 551 list, show a very similar pattern, with a 47% decline between 2021 and 2023, even as foreign firms still accounted for 75% of the domestic market in 2022. This pattern is consistent with the increased localization of foreign firms outlined above. However, China has ramped up its imports of other products, such as X-ray tubes (also used in CT equipment), pacemakers, and apparatus based on the use of alpha, beta, gamma, or other ionizing radiation. Overall, the reliance on imports is still high, though it is rapidly declining and may reach the Roadmap’s targets by 2025.

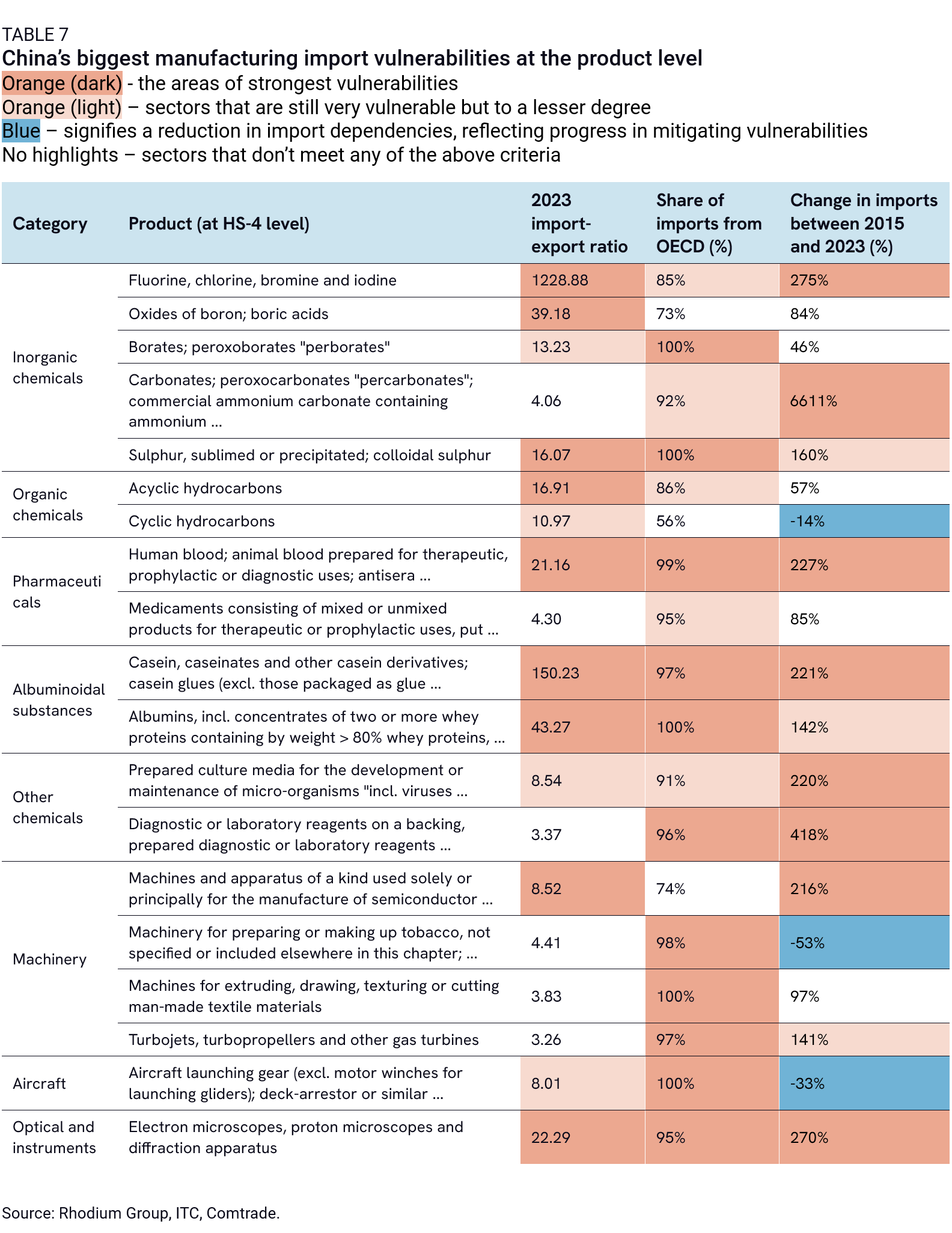

China’s most significant import dependencies on OECD countries continue to be in the chemicals and pharmaceutical sectors, as well as in high-end machinery and instruments (Table 7). In most of these products, Chinese imports have grown more than twofold since 2015. For example, China’s imports of semiconductor manufacturing equipment have more than tripled over that period. Dutch firm ASML remains the sole supplier of the industry’s most advanced EUV lithography machines and controls about 90% of the market for less advanced immersion deep ultraviolet machines, which are not produced in China. China also depends on imports for electron microscopes, dominated by foreign firms like Thermo Fisher, Zeiss, Hitachi, and JEOL, and where imports have almost quadrupled since 2015. Many kinds of inorganic and organic chemicals, including fluorines, oxides, and borates, also continue to be exported to China rather than produced locally.

Net assessment

China has had its strongest achievements in reducing import dependencies. This is not surprising: it is the first step in China’s multi-pronged industrial policy strategy, as outlined in Chapter 1. However, significant vulnerabilities persist, particularly in sectors that rely on specialized, high-tech components where domestic capabilities are still developing.

Looking ahead, it is uncertain if foreign firms will continue to play a major role in addressing these gaps. Geopolitical tensions have increasingly put foreign companies operating in critical sectors under scrutiny, in both their home country and China, making them more cautious about the risks associated with transferring sensitive technologies to China. This shift only heightens the urgency for China to reduce its reliance on foreign firms and build up its own technological capabilities. Indeed, Beijing has emphasized this priority repeatedly in recent years, underscoring the strategic importance of achieving self-sufficiency—frequently characterized in Chinese media as “breaking the foreign chokehold”—in key industries.

Chapter 3: Decreasing dependencies on foreign firms

In addition to reducing import dependencies, another key goal of MIC25 was to decrease reliance on foreign companies, even those with operations in China. Many of the Roadmap’s targets focused specifically on increasing the market share of products made in China by Chinese firms. This represents a narrower measure of self-sufficiency than localization targets, as it excludes products made by MNCs operating within China. For instance, a Philips Healthcare CT machine manufactured in China would contribute to the localization rate but not to the market share of Chinese firms. In contrast, a Mindray electrocardiograph produced domestically would count toward both localization and Chinese firm market share. This chapter evaluates China’s progress in meeting these Chinese company market share targets by drawing on domestic and international industry reports as well as relevant news sources.

Aggregate picture

In many products, Chinese firms have achieved significant successes, sometimes more than doubling their domestic market share in the past decade. For instance, in luminescent detection IVD, a crucial element in medical devices, the market share of domestic companies surged from 10% in 2015 to 25% by 2021. Similarly, carbon fiber, a vital component in the new materials industry, saw its localization rate climb from 18% to an impressive 47% during the same period. For fiber lasers, the localization rate has surged from 29% in 2017 to 65% in 2021. Notably, certain sectors have experienced an accelerated pace of localization over the past two years. For example, in China’s ocean engineering equipment and high-tech ships industry, certain higher-tech products such as marine monitoring system sensors only began to develop quickly in 2021 but achieved 70% localization by 2023.

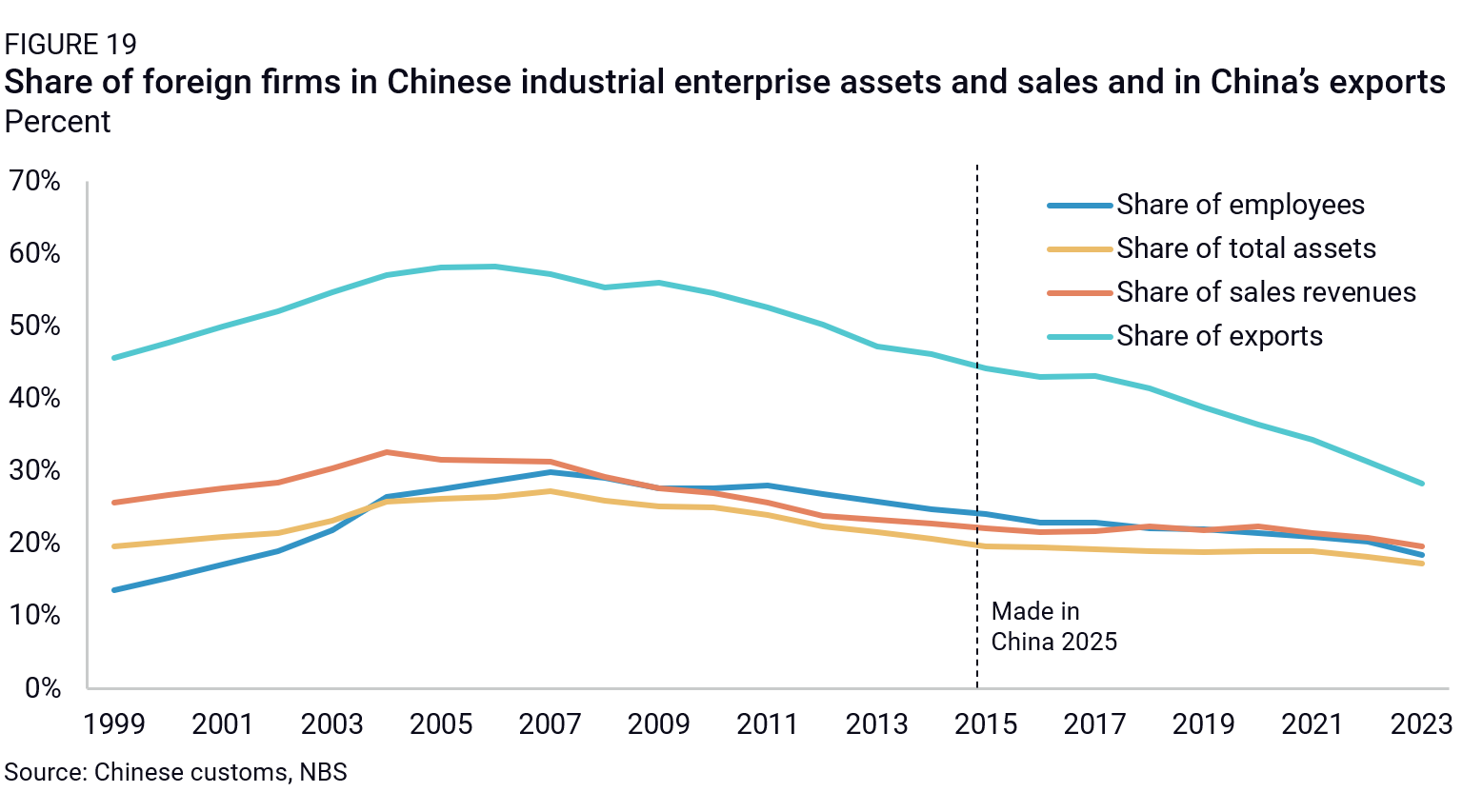

However, overall, China’s progress in achieving its market share targets—and its progress in reducing reliance on foreign companies more broadly—have been uneven and less striking than its progress in reducing import dependencies. This is not surprising: Foreign companies still account for 17% of industrial enterprise assets in China, 20% of industrial enterprise sales revenues, and 28% of exports, according to data from Chinese Customs and National Bureau of Statistics (Figure 19).18 The asset and sales data is likely overstated because it does not include very small enterprises and service industries, but it likely accurately reflects the importance of foreign companies in the manufacturing sector.

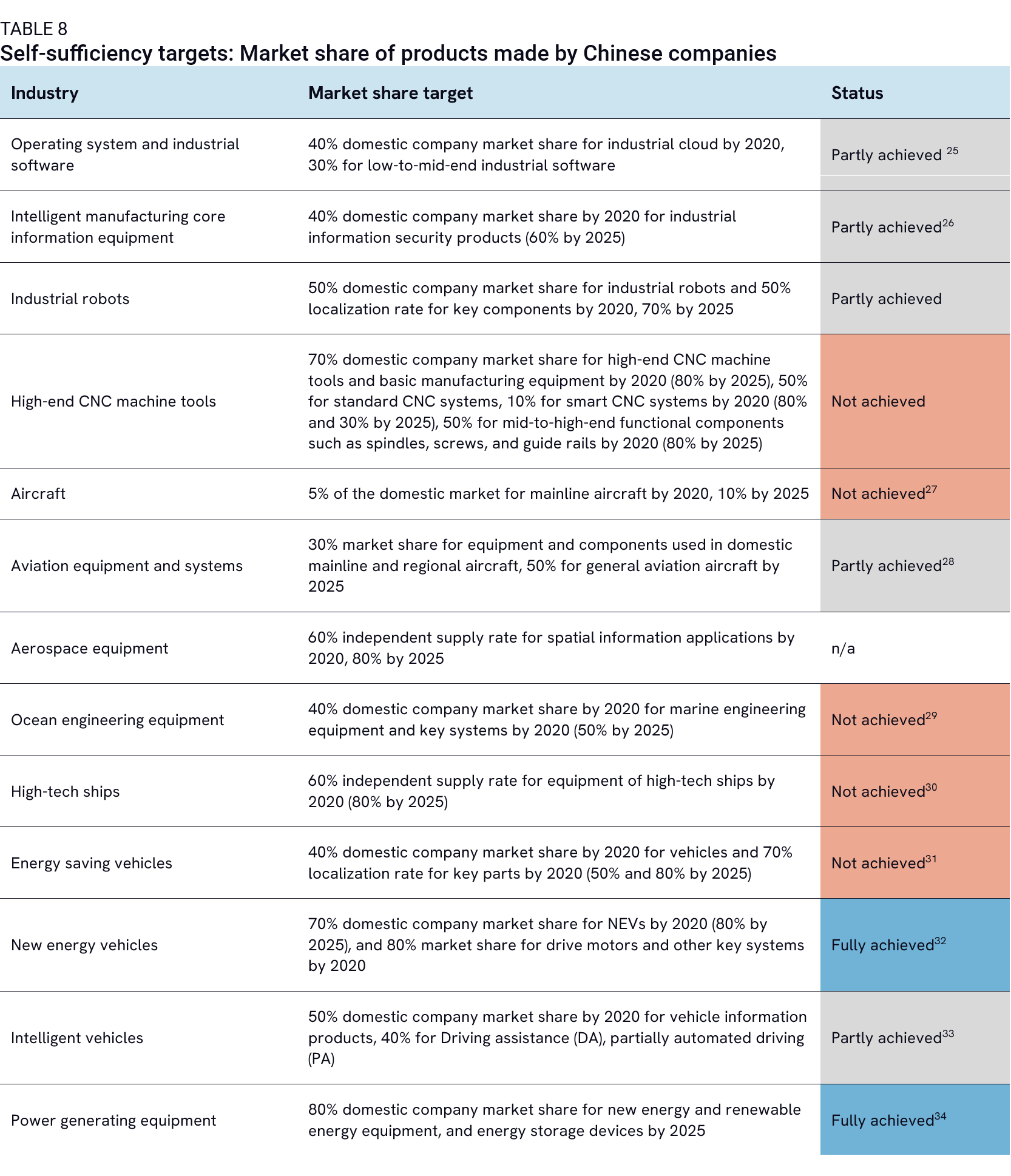

Overall, our assessment suggests that China has achieved some of its market share targets for domestic firms outlined in the Roadmap, particularly in sectors like industrial cloud—where stringent restrictions on foreign participation have given local players an advantage—as well as in new-energy vehicles and power generation equipment, where China has successfully leapfrogged foreign technology. However, in most areas, China has fallen short of its ambitious goals, particularly in sectors such as high-end machine tools, ocean engineering equipment, and commercial aircraft (Table 8).

This shortfall is partly due to the ambitious nature of the Roadmap’s targets but also highlights the challenges faced by domestic firms in catching up with global leaders. Nonetheless, even in industries where Chinese firms have not yet met their market share objectives, industry reports and interviews indicate that the situation is evolving rapidly, with local companies steadily gaining market share at a faster pace.

The momentum is likely to continue in the years to come. Faced with persistent vulnerabilities, Beijing has introduced a flurry of policies in recent years to more aggressively favor domestic firms. This includes, for example, the “Auditing Guidelines for Government Procurement of Imported Products” (Document 551) issued in 2021 as well as many local government procurement policies including “Buy China” clauses since then.19 The recent decline in inbound FDI has prompted renewed assurances to foreign firms that they would be included in procurement incentives as long as they localize their production. Regardless, requirements for the location of IP development, registration, and local content have only become more stringent in recent years. These policies will likely accelerate domestic industry development and reduce reliance on foreign firms in the years to come.

Strongest achievements

Power generation

China has had major success in power generation, and is now almost fully self-sufficient. That said, only a few improvements were made in the past decade, as China had already achieved basic self-sufficiency by 2015.

In civil nuclear power, China was reportedly already 85% self-sufficient by 2017, with the remaining share mainly consisting of general equipment. The country also already enjoyed a uranium enrichment capacity of 5,760 thousand SWU annually by 2017. A notable milestone since then was the development and commissioning of the Hualong One reactor, China’s first domestically designed and constructed third-generation nuclear reactor, which began commercial operations in 2021.

In the wind sector, most of China’s turbine parts were already produced by local companies in 2015, although Chinese manufacturers still relied on foreign suppliers for some important parts, such as megawatt-level speed increaser gearbox bearings, converters, and control systems. At present, though domestic companies have made progress in producing their own bearings, manufacturers still use foreign products for the most high-tech of these components(bearings and gearboxes).

Mixed achievements

Robotics and high-end CNC machine tools

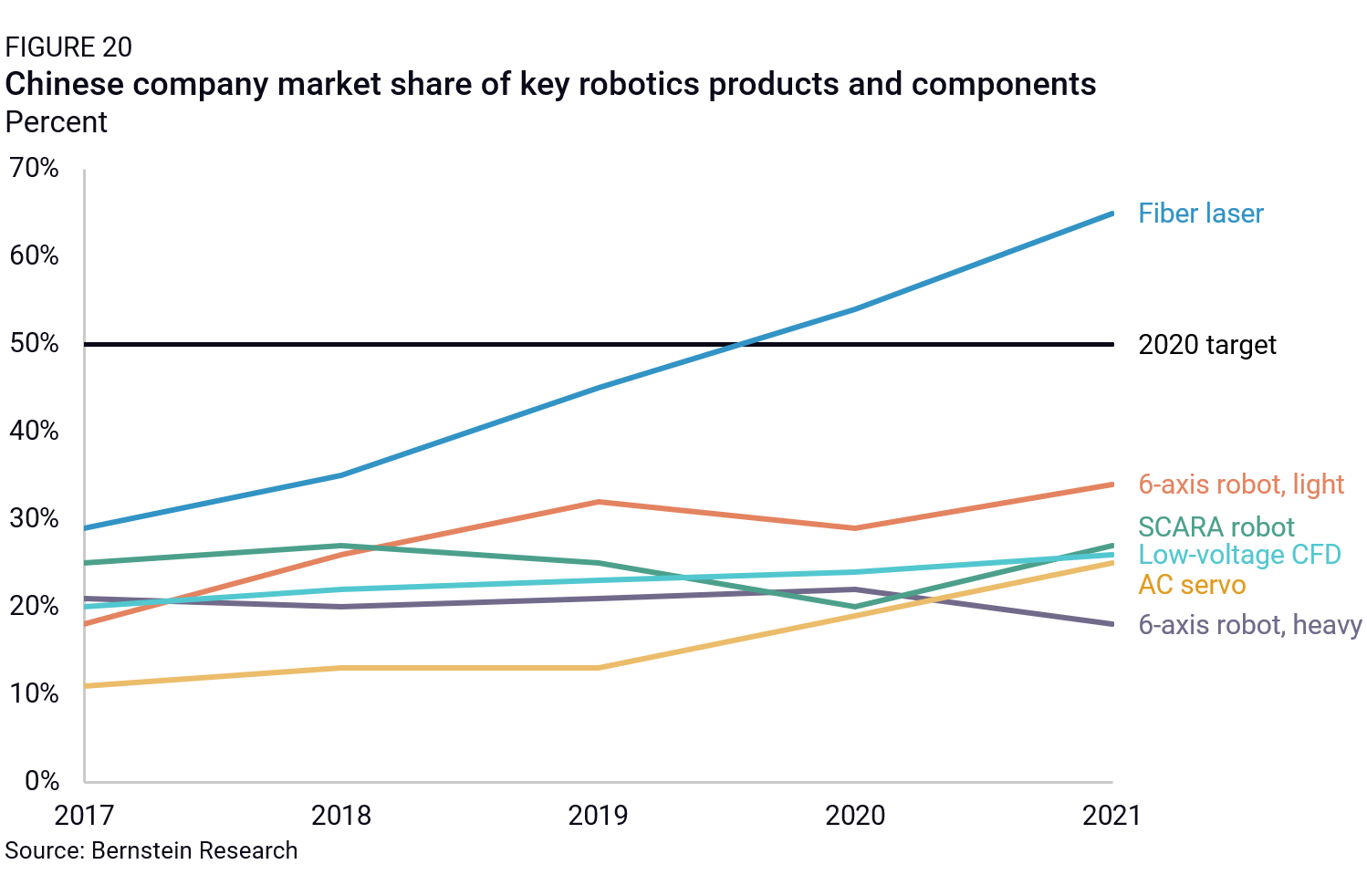

Most areas have seen mixed achievements in increasing domestic companies’ market share in China. Although Chinese companies already widely manufacture low-end products, they are still catching up with foreign players in high-end technologies. For example, the Roadmap outlined a goal of 50% domestic company market share by 2020 and 70% by 2025 in the industrial robot industry. However, Chinese companies’ share of the domestic market was only 18% for heavy 6-axis robots, 34% for light 6-axis robots, and 17% for SCARA robots in 2021 (Figure 20). 70% of China’s market for strain wave reducers (Chinese firm Leader Drive holds over 50% of the strain wave reducer market) and 65% for fiber lasers were captured by domestic brands in 2022.